Global Rail Transportation Market outlook (2025–2032)

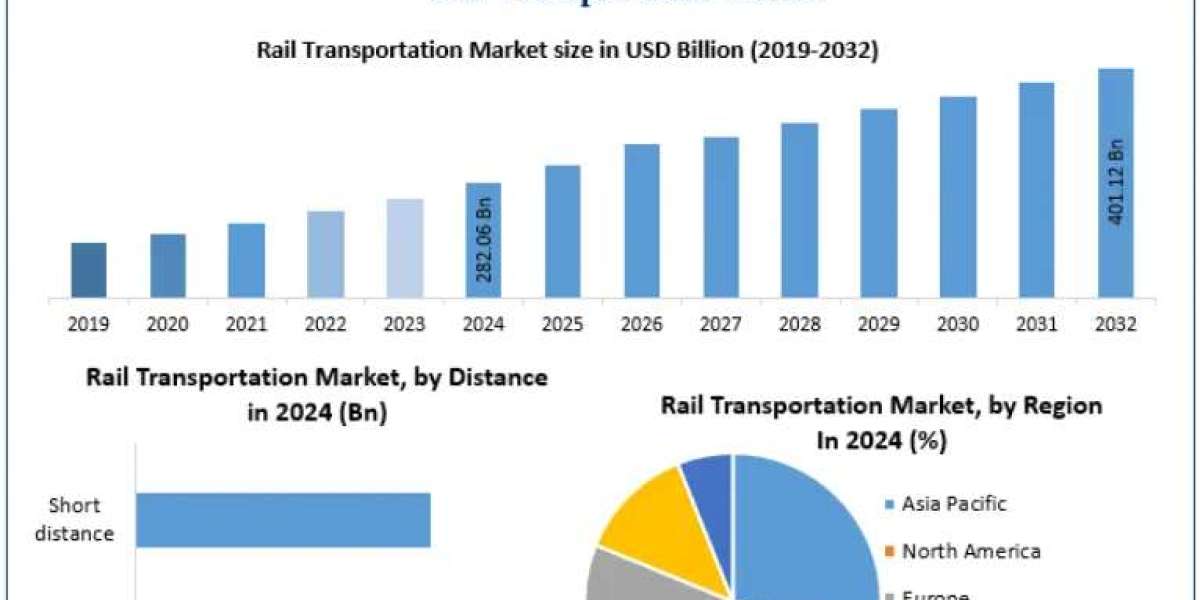

The Rail Transportation Market was valued at USD 282.06 billion in 2024 and is projected to reach USD 401.12 billion by 2032, growing at a compound annual growth rate (CAGR) of 4.5 percent. This growth is driven by increasing investments in rail infrastructure, rising environmental concerns, and the need for efficient, high-capacity transport systems for both passengers and freight.

Infrastructure investment fueling technological advancement

Rail operators and governments across the globe are making significant investments in both new and existing railway networks. These efforts are aimed at enhancing service efficiency, safety, and capacity while reducing environmental impact. Rail is widely recognized as the most eco-friendly land transportation mode, using far less energy and emitting less carbon dioxide per tonne-kilometer than road or air transport. As a result, rail is increasingly seen as a future-proof solution to mobility and climate challenges.

Europe is a prime example of how infrastructure investment is supporting this trend. The European Green Deal allocates €87.5 billion to rail infrastructure upgrades as part of a broader effort to reduce transport emissions. Similarly, in the United States, the Infrastructure Investment and Jobs Act (IIJA) provides $66 billion for new rail corridors, modernized tracks, and safety improvements. Africa’s "Agenda 2063" includes the development of a continent-wide high-speed train network, reinforcing rail’s strategic role in sustainable development.

For in-depth information on this study, visit the following link:https://www.maximizemarketresearch.com/request-sample/113747/

Modal shift goals to reduce carbon emissions

As governments strive to meet climate targets, they are promoting a shift in freight transport from road to rail. The European Union, for instance, aims to double the share of freight carried by rail by 2030. Achieving this would reduce annual CO2 emissions by 290 million tonnes and would require rail freight volumes to increase by approximately 6 percent per year in ton-kilometers. This modal shift aligns with both environmental objectives and the desire to reduce road congestion.

Opportunities in rolling stock and digitalization

Modernization of rolling stock presents a major growth opportunity for the rail market. Global rolling stock investments are forecasted to grow at 6 percent annually, supporting upgrades in speed, safety, and capacity. New trains enhance customer experience through amenities like digital connectivity, onboard services, and optimized interiors. These upgrades not only improve operational efficiency but also attract new passengers, especially in high-density urban and intercity corridors.

Operators are also embracing digital technologies to improve scheduling, capacity planning, and safety. Innovations such as moving-block signaling and fully automated train operations are being pioneered by European firms like Siemens, Alstom, and Thales. These technologies boost line capacity and offer greater flexibility, further reinforcing rail as a competitive mode of transport.

Market dynamics driven by affordability and convenience

A recent global survey across nine countries indicates that price, safety, reliability, and convenience remain the most important factors influencing passenger decisions. While sustainability is often cited as a desirable attribute, only a small portion of consumers are willing to pay a premium for it. For long-distance passengers, convenience aspects such as fewer transfers and reduced travel time are even more important than price.

Given this landscape, rail service providers are focusing on the core values of reliability, safety, and speed. By enhancing these features and maintaining competitive pricing, the sector aims to increase ridership and expand its share of total transportation.

Segment analysis highlights passenger dominance

The market is segmented by type into passenger and freight rail. In 2024, passenger rail transport accounted for the largest market share. Operators are looking to expand their networks and improve passenger experience by integrating services like onboard digital access, pet transport, concierge luggage handling, and flexible ticketing systems. Trains are increasingly viewed as multifunctional spaces rather than just modes of travel.

There is also a growing trend towards Mobility-as-a-Service (MaaS) models, where rail is integrated with other transportation modes, such as e-bikes, ride-sharing, and buses. This seamless connectivity, facilitated by mobile apps and unified ticketing, is expected to drive adoption.

In Europe, the merger of Eurostar and Thalys under Project Greenspeed is set to expand international connections and improve cross-border travel via the Channel Tunnel. This model of integrated rail networks is being replicated in other parts of the world to provide a more comprehensive and efficient travel experience.

Long-distance travel holds strong market potential

Based on distance, the Rail Transportation Market is divided into short-distance and long-distance segments. The long-distance segment is projected to dominate during the forecast period. In regions like the United States and the United Kingdom, long-distance travel is essential for connecting urban and rural areas, and trains offer a viable alternative to air and car travel, particularly in densely populated or congested corridors.

In the US, trains account for approximately 1 percent of long-distance travel, but government-backed investments and corridor upgrades are expected to increase this share. In Europe, high-speed rail services such as those between France, Germany, and the UK have already displaced short-haul flights on certain routes, thanks to faster boarding, city-center access, and reduced security wait times.

To access more details regarding this research, visit the following webpage:https://www.maximizemarketresearch.com/request-sample/113747/

Europe leads regional growth with strong infrastructure and innovation

Europe led the global Rail Transportation Market in 2024 with a 45 percent share. The continent’s robust infrastructure, advanced OEM ecosystem, and strong regulatory support make it a global leader in rail technology and implementation. Passenger kilometers have grown by more than 10 percent in the past five years, and national policies are actively promoting rail over short-haul flights and private vehicle use.

European companies also dominate the global train control and traffic management sector, contributing to innovations like automated operations and real-time traffic optimization. With over 60 percent of this market based in Europe, the region is well-positioned to lead the digital transformation of rail networks worldwide.

Outside of Europe, Asia Pacific is a rapidly emerging market, particularly in countries like China, India, and Japan, where rail remains a backbone of both passenger and freight transport. The integration of high-speed rail and urban metro systems is expanding access and efficiency.

Key players driving market expansion

The Rail Transportation Market features a mix of national operators, private logistics firms, and multinational technology providers. These organizations are investing in digital transformation, sustainable rolling stock, and cross-border integration to meet evolving mobility needs.

1. Amtrak (US)

2. CSX Corporation (US)

3. R. J. Corman Railroad Group, LLC (US)

4. Patriot Rail Company (US)

5. Professional Transportation, Inc. (US)

6. Union Pacific Railroad Company (US)

7. BNSF Railway (US)

8. Canadian National Railway Company (Canada)

9. DB Cargo (Germany)

10. DHL International GmbH (Germany)

11. Deutsche Bahn AG (Germany)

12. Thales Group (France)

13. LFP Perthus (Spain)

14. PKP Group (Poland)

15. Baltic Rail AS (Estonia)

16. Delhi Metro Rail Corporation (India)

17. Indian Railway (India)

18. Nippon Express Co. Ltd. (Japan)

19. Keretapi Tanah Melayu Berhad (Malaysia)

20. Toll Holdings Ltd. (Australia)

21. Arkas Logistics (Turkey)

Conclusion

The global Rail Transportation Market is on a strong growth trajectory through 2032, driven by investments in infrastructure, rolling stock modernization, and environmental priorities. With governments and operators aligning on the need for cleaner, faster, and more efficient transportation, rail is positioned as a cornerstone of the future mobility ecosystem. While challenges like cost sensitivity and modal competition remain, the long-term outlook remains positive as rail continues to evolve into a smarter and more sustainable transport solution.