IMARC Group has recently released a new research study titled “Mexico Encryption Software Market Size, Share, Trends and Forecast by Component, Deployment Model, Organization Size, Function, Industry Vertical, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

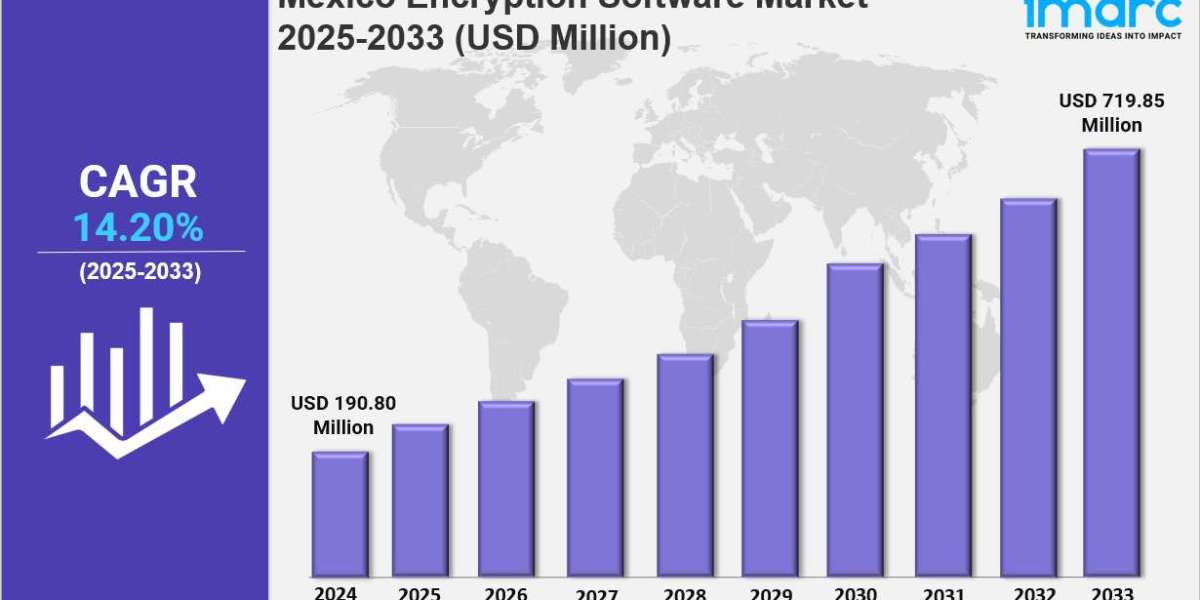

The Mexico encryption software market size reached USD 190.80 Million in 2024. It is expected to grow at a CAGR of 14.20% during the forecast period of 2025-2033 to reach USD 719.85 Million by 2033. This growth is driven by increased demand from both public and private sectors, accelerated adoption of digital governance, next-generation technologies like IoT and AI, and rising cybersecurity concerns. Encryption software is vital for securing sensitive information and ensuring privacy in Mexico's expanding digital ecosystem.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Encryption Software Market Key Takeaways

- Current Market Size: USD 190.80 Million in 2024

- CAGR: 14.20%

- Forecast Period: 2025-2033

- Accelerated adoption of cloud-based encryption solutions is a significant market trend, with increased integration into hybrid and multi-cloud environments.

- The public sector is increasingly enforcing encryption for digital infrastructure, strengthening citizen data protection and cybersecurity.

- Rising use of IoT, AI, and big data analytics fuels demand for embedded and real-time data encryption.

- Digital government initiatives and cybersecurity service providers contribute to growing encryption software utilization.

- The market sees substantial growth driven by regulatory focus on data protection and the shift towards secure cloud architectures.

Sample Request Link: https://www.imarcgroup.com/mexico-encryption-software-market/requestsample

To get more information on this market, Request Sample

To get more information on this market, Request Sample

Mexico Encryption Software Market Growth Factors

The Mexico encryption software market is propelled by growing demand across both public and private sectors, largely influenced by the expansion of digital governance and the rising adoption of next-generation technologies such as the Internet of Things (IoT) and artificial intelligence (AI). These technologies necessitate robust encryption for securing sensitive data, maintaining privacy, and countering cyberattacks, which is crucial to Mexico's role in the global cybersecurity landscape.

Cloud-based encryption solutions are increasingly adopted as businesses move towards digital transformation. Mexico's inclination to cloud infrastructures facilitates scalability, cost efficiency, and support for remote working models. Vendors emphasize providing encryption products that seamlessly integrate with cloud services to maintain data confidentiality in hybrid and multi-cloud setups. The regulatory focus on data protection further compels companies to embrace end-to-end encryption for sensitive cloud-stored data, significantly bolstering demand for cloud encryption software products.

The public sector in Mexico is progressively enforcing encryption software use to safeguard digital infrastructure and citizen information. Government initiatives including e-governance platforms, public record systems, and inter-agency communications rely on encryption to prevent unauthorized access and ensure confidentiality. Legislative changes focused on data privacy, along with national cybersecurity campaigns, have normalized the use of file, folder, and communication encryption across federal and state platforms. This institutional demand fuels the market, supported by emerging cybersecurity service providers addressing breach detection, digital forensics, and threat simulations.

Mexico Encryption Software Market Segmentation

Component Insights:

- Software

- Services

Software includes the application solutions for encryption while services cover support and consulting related to implementation and management.

Deployment Model Insights:

- On-premises

- Cloud-based

On-premises deployment involves local infrastructure installations, whereas cloud-based deployment focuses on encryption in cloud environments.

Organization Size Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises typically have extensive infrastructure requiring robust encryption solutions; SMEs adopt scalable and cost-effective encryption.

Function Insights:

- Disk Encryption

- Communication Encryption

- File and Folder Encryption

- Cloud Encryption

Functions include securing data at rest (disk), in communication channels, specific files and folders, and cloud-based data.

Industry Vertical Insights:

- BFSI

- Aerospace and Defense

- IT and Telecom

- Media and Entertainment

- Government and Public

- Retail

- Healthcare

- Others

These verticals represent the sectors adopting encryption software tailored to industry-specific security needs.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The market is segmented regionally to analyze demand across distinct geographical zones in Mexico.

Regional Insights

The report highlights Northern Mexico, Central Mexico, Southern Mexico, and Others as key regional markets.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=34295&flag=C

Recent Developments & News

In July 2024, GMO GlobalSign partnered with Seguridad America to expand its customer base in Mexico, aiming to provide localized support for GlobalSign's Public Key Infrastructure (PKI) products. This collaboration enhances cybersecurity solutions for Mexican companies amid growing cyber threats and the rising demand to comply with federal regulations. Additionally, in October 2023, Accenture acquired MNEMO Mexico, a managed cybersecurity services firm with 229 professionals and a 24/7 security operations center in Mexico City, boosting Accenture's cybersecurity presence in Latin America.

Key Players

- GMO GlobalSign

- Seguridad America

- Accenture

- MNEMO Mexico

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302