IMARC Group has recently released a new research study titled “Mexico Calcium Chloride Market Size, Share, Trends and Forecast by Product Type, Application, Raw Material, Grade, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

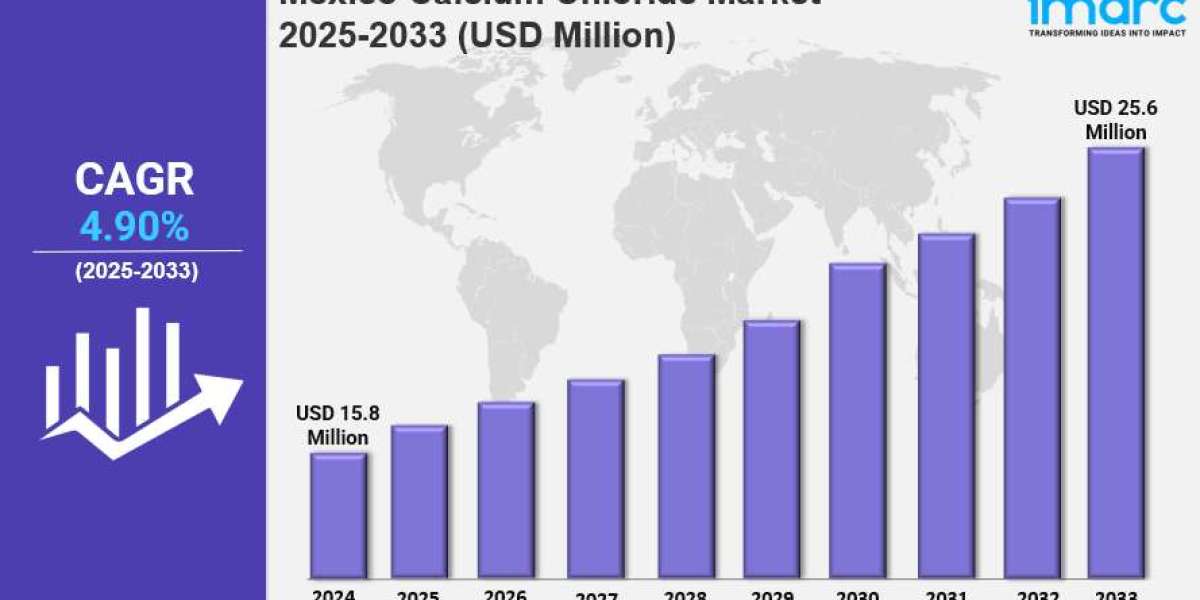

The Mexico calcium chloride market reached a size of USD 15.8 Million in 2024 and is projected to grow to USD 25.6 Million by 2033, reflecting a CAGR of 4.90% for the forecast period 2025–2033. The market growth is driven by rising investments in oil and gas exploration and production, expansion in infrastructure and construction projects, and increasing demand for dust suppression in semi-arid regions.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Calcium Chloride Market Key Takeaways

- Current Market Size: USD 15.8 Million in 2024

- CAGR: 4.90% during 2025-2033

- Forecast Period: 2025-2033

- Growing exploration and production activities in Mexico's oil and gas sector are increasing demand for calcium chloride in drilling fluids and wellbore stabilization.

- Significant infrastructure development supported by both private and government investments is boosting calcium chloride use as a concrete accelerator.

- Calcium chloride's hygroscopic properties make it effective for dust control and road stabilization in Mexico's arid and semi-arid regions.

- Mexico's real estate market is expected to reach USD 237.1 Billion by 2033, supporting growth in construction applications.

- Although de-icing applications are limited geographically, they contribute to stable base demand in higher altitudes and cold snaps.

Sample Request Link: https://www.imarcgroup.com/mexico-calcium-chloride-market/requestsample

Mexico Calcium Chloride Market Growth Factors

Mexico Calcium Chloride Market growth is being driven by the country’s increasing investments in oil and gas exploration and production, which are boosting demand for calcium chloride in drilling and well completion applications. The chemical plays a vital role in drilling fluids, completion fluids, and cementing by stabilizing shale formations, improving wellbore stability, and maintaining hydrostatic pressure. Developments in offshore reserves in the Gulf of Mexico and regulatory reforms such as energy sector liberalization, along with international company participation, are stimulating demand. For instance, Talos Energy Inc.'s 2024 success with the EW 953 well and involvement in the Sebastian prospect exemplify ongoing oil industry modernization boosting market prospects.

The construction sector is another key factor driving calcium chloride demand in Mexico. Both private and government investments are propelling growth in infrastructure, housing, and commercial buildings. Calcium chloride is widely used as a concrete accelerator, particularly valuable under low-temperature conditions prevalent in northern Mexico, enhancing curing time, compressive strength, and resistance to cracking. This industry expansion aligns with projections that Mexico’s real estate market will reach USD 237.1 Billion by 2033, underpinning sustained calcium chloride consumption.

Calcium chloride's efficacy in dust control and road stabilization further supports market expansion, especially in semi-arid and arid northern regions with many unpaved rural and industrial roads. Its hygroscopic nature helps absorb moisture to suppress dust, improving air quality, visibility, and operational efficiency in mining and quarrying, where it is also used for road stabilization. While de-icing demand is limited, niche applications during cold snaps and higher altitudes add to the steady base demand alongside dust control requirements.

To get more information on this market, Request Sample

Mexico Calcium Chloride Market Segmentation

Breakup by Product Type:

- Liquid: Calcium chloride in liquid form, widely used for various industrial and construction applications due to ease of handling.

- Hydrated Solid: Solid calcium chloride containing water of crystallization, used in multiple sectors for its moisture control and de-icing properties.

- Anhydrous Solid: Water-free solid calcium chloride, preferred where moisture sensitivity is critical.

Breakup by Applications:

- De-Icing: Use in melting ice on roads, though limited due to Mexico’s climate.

- Dust Control and Road Stabilization: Used extensively on unpaved roads to improve air quality and road conditions.

- Drilling Fluids: Applied in oil and gas for drilling and cementing operations.

- Construction: Acts as a concrete accelerator and strength enhancer.

- Industrial Processing: Utilized in various manufacturing and processing activities.

- Others: Additional miscellaneous applications.

Breakup by Raw Material:

- Natural Brine: Calcium chloride derived from natural brine sources.

- Solvay Process (by-Product): Obtained as a by-product from the Solvay process.

- Limestone and HCL: Produced using limestone and hydrochloric acid.

- Others: Miscellaneous raw material sources.

- Grade:

- Food Grade: Suitable for applications requiring food safety standards.

- Industrial Grade: Used for industrial purposes without food safety requirements.

Breakup by Region:

Northern Mexico emerges as a dominant region for calcium chloride demand, driven by its colder climate conditions necessitating concrete accelerants and extensive rural road networks requiring dust suppression. The report segments the market regionally into northern Mexico, central Mexico, southern Mexico, and others, but specific market share and CAGR by region are not provided in the source.

Mexico’s expanding infrastructure, oil and gas activities, and mining industries localized primarily in the northern region underscore this dominance.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32423&flag=C

Recent Developments & News

In 2024, Talos Energy Inc. announced that its Ewing Bank 953 well ("EW 953 well") successfully encountered commercial amounts of oil and natural gas. Talos also signed an agreement to join the Sebastian prospect, currently drilling in the Mississippi Canyon Block 387 of the U.S. Gulf of Mexico. These developments reflect renewed activity and investments in Mexico’s offshore oil and gas sector, boosting calcium chloride demand.

Competitive Landscape

The market research report includes a comprehensive analysis of the competitive landscape, covering market structure, key player positioning, winning strategies, and company evaluations. Detailed profiles of major companies have also been provided.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302