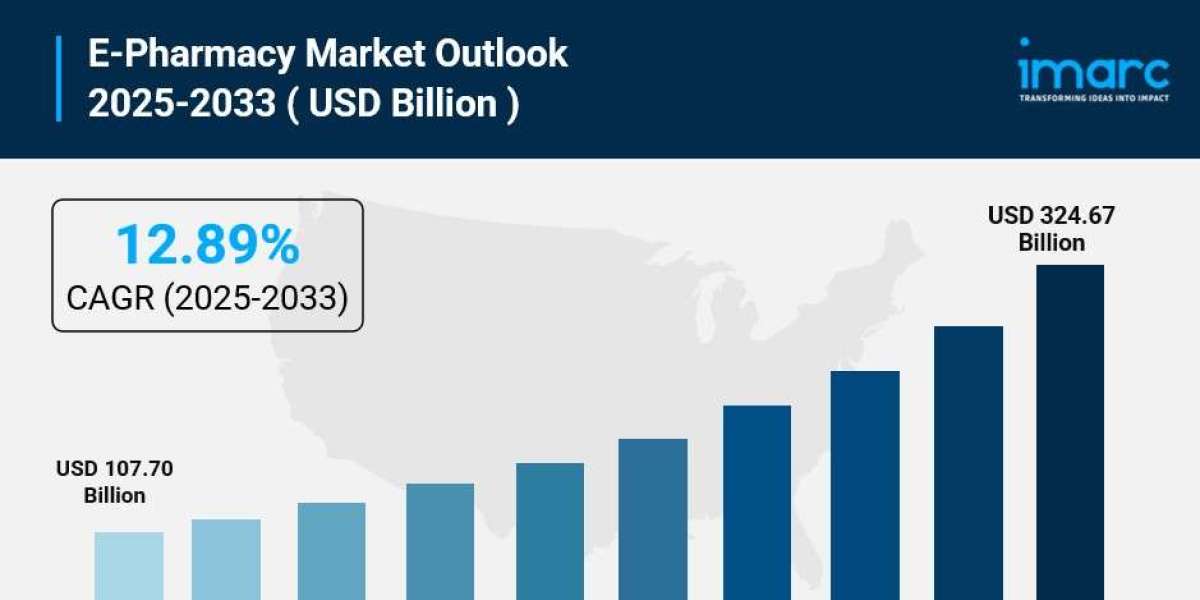

The global e-pharmacy market size was valued at USD 107.70 Billion in 2024. It is projected to reach USD 324.67 Billion by 2033, exhibiting a CAGR of 12.89% during the forecast period of 2025-2033. The market growth is driven by rising internet penetration, advancements in secure payment technologies, and the expansion of online retail, with North America currently leading the market with a 40.7% share.

The male grooming products market share is growing steadily, driven by the rising focus on personal hygiene, style consciousness, and the increasing availability of specialized products for men. Consumers are shifting toward premium, organic, and multifunctional grooming solutions encompassing skincare, haircare, beard care, and fragrances. The expansion of e-commerce and the influence of digital marketing have significantly boosted global accessibility and product visibility. Furthermore, changing lifestyle patterns, urbanization, and greater acceptance of male grooming routines across all age groups are contributing to market expansion. As brands innovate with eco-friendly formulations and personalized solutions, the male grooming products market share is expected to continue its upward trajectory in the coming years.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

E-Pharmacy Market Key Takeaways

- Current Market Size (2024): USD 107.70 Billion

- CAGR (2025-2033): 12.89%

- Forecast Period: 2025-2033

- North America dominated the market with more than 40.7% share in 2024.

- The rising adoption of mobile applications and digital platforms enhances consumer engagement and retention.

- Artificial Intelligence (AI) and Machine Learning (ML) tools are increasingly used for personalized recommendations and inventory optimization.

- Contactless services and same-day prescription deliveries (e.g., Amazon's expansion plans) are boosting the market growth.

- The increasing internet penetration and smartphone usage globally, expected to reach 6 billion users by 2027, supports market expansion.

Request Your Free “E-Pharmacy Market” Insights Sample PDF: https://www.imarcgroup.com/e-pharmacy-market/requestsample

Market Growth Factors

The increasing internet penetration and evolving digital consumer behavior are significant growth drivers for the e-pharmacy market. The proliferation of smartphones, affordable fast internet services, and digital inclusion programs have facilitated accessibility worldwide. The number of smartphone users is anticipated to reach 6 billion by 2027, enabling wide adoption of e-pharmacies. This environment allows consumers to acquire knowledge easily and interact socially, transforming traditional shopping into digital purchasing models. The rise of online marketplaces also fosters digital entrepreneurship by enabling cross-border offerings and fueling industry growth.

Emerging technological advancements, especially in secure payment gateways, are positively impacting the e-pharmacy sector. The implementation of encryption technologies with anti-fraud algorithms enhances digital transaction security, fostering consumer confidence. Biometric authentication methods, such as fingerprints and facial recognition, reduce password vulnerabilities and cyber attack risks. Such technologies minimize data breaches and fraudulent activities, further encouraging digital purchases. In 2023 alone, more than 8 billion records were breached globally, which underscores the importance of these security measures for market expansion.

The significant expansion of online retail reshapes access to pharmaceutical products, benefiting the e-pharmacy market. Online platforms provide convenience, accessibility, and affordability, especially critical for chronic disease patients who require regular medication. Consumers have access to comprehensive product information, reviews, and expert advice, improving healthcare experiences. E-pharmacies also offer account management and refill reminders, strengthening patient adherence. Examples include India's online pharmacy market projected to grow about eightfold since 2019, with major conglomerates like Reliance, Amazon, and Tata entering the sector.

Market Segmentation

Analysis by Drug Type:

- Over the Counter (OTC) Drugs: Largest component, driven by demand for accessible, non-prescription medications for minor ailments and wellness.

- Prescription Drugs: Not elaborated separately in the source.

Analysis by Product Type:

- Skin Care: Market leader in 2024, driven by growing awareness of skin health and personalized regimens.

- Dental

- Cold and Flu

- Vitamins

- Weight Loss

- Others

Skin care products benefit from online availability, natural and organic preferences, and telemedicine integration.

Analysis by Platform:

- App-Based: Holds 63.8% market share in 2024, favored for ease of use, personalized recommendations, and mobile technology integration.

- Web-Based

Analysis by Payment Method:

- Cash on Delivery (COD): Retains significance in regions with limited online payment adoption, offering trust and convenience.

- Online Payment: Increasingly adopted due to seamless transactions, discounts, loyalty programs, and security.

Regional Insights

North America holds the largest market share of over 40.7% in 2024. The region benefits from widespread high-speed internet access, mature regulatory frameworks ensuring medicine safety, and high smartphone penetration fostering digital healthcare adoption. Personalized medication management and telemedicine integration enhance the user experience, supporting market growth. For instance, the US digital health market is expected to grow at 17.30% CAGR from 2024 to 2032, further promoting online medicine delivery services.

Recent Developments & News

- November 2024: Apollo 24/7 launched a 19-minute delivery service for medical supplies in Delhi and Noida, competing with quick commerce platforms.

- November 2024: The Online Order and Home Delivery of Medicines (OnHOME) Alliance was launched in Brussels, urging EU policymakers to facilitate online prescription drug access.

- May 2024: Bond Vet launched BondRx, an online pharmacy offering home delivery services in operational regions.

Key Players

- CVS Health Corporation

- DocMorris (Zur Rose Group AG)

- Express Scripts Holding Company (Cigna Healthcare)

- Giant Eagle Inc.

- Lloyds Pharmacy Limited

- Optumrx Inc. (Unitedhealth Group Incorporated)

- Rowland Pharmacy

- The Kroger Co.

- Walgreen Co. (Walgreens Boots Alliance Inc.)

- Walmart Inc.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to Analyst: https://www.imarcgroup.com/request?type=report&id=3854&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302