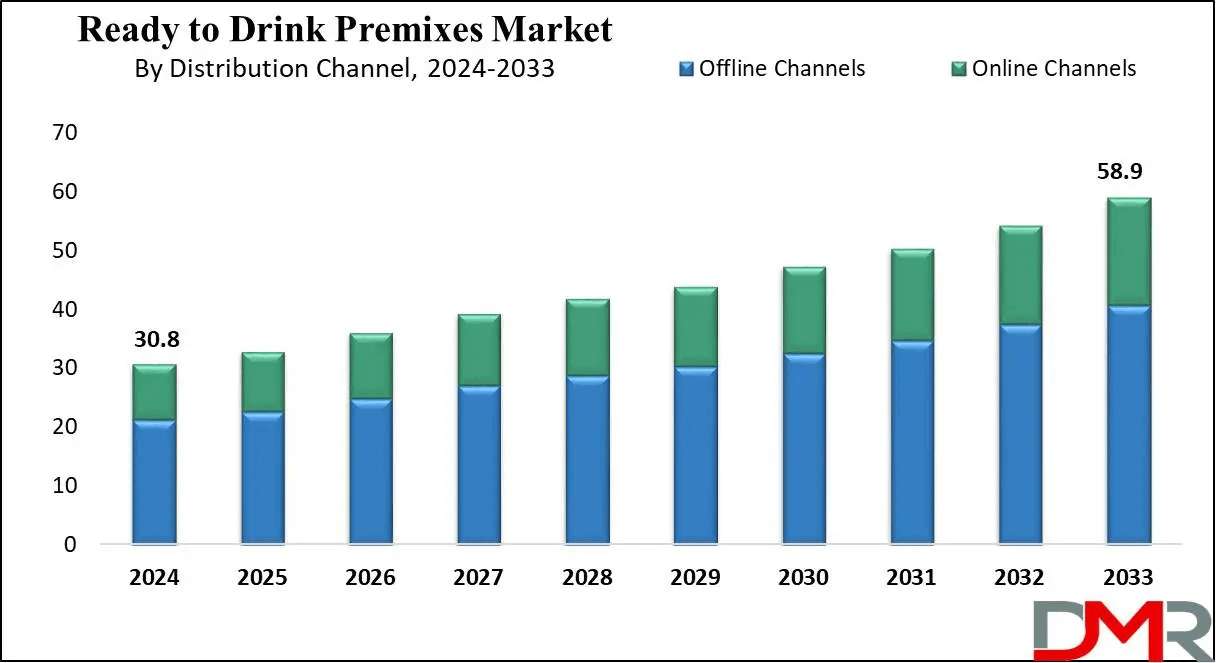

The global Ready to Drink Premixes Market is rapidly gaining traction, driven by evolving consumer lifestyles, increasing urbanization, and a growing preference for convenience-oriented beverages. Valued at USD 30.8 billion in 2024, the market is projected to reach an impressive USD 58.9 billion by 2033, expanding at a CAGR of 7.5% during the forecast period. Ready-to-drink (RTD) premixes include prepackaged alcoholic and non-alcoholic beverages that eliminate the need for preparation, offering an instant and consistent taste experience. These products cater to time-conscious consumers seeking ready-to-consume options without compromising on flavor or quality. The RTD trend has become especially prominent in younger demographics and urban populations, where lifestyle shifts, rising disposable incomes, and social drinking culture continue to drive demand across the globe.

Market Dynamics

The global ready-to-drink premixes market is being fueled by multiple factors that reflect changing consumption patterns. One of the key growth drivers is the increasing preference for convenient, on-the-go beverage options. With busy lifestyles and growing work commitments, consumers are gravitating toward premixed drinks that offer immediate consumption without any effort in preparation. This demand extends across alcoholic and non-alcoholic segments, encompassing cocktails, mocktails, tea, coffee, and functional beverages.

In addition, there is a rising inclination toward premium and craft-quality ready-to-drink beverages. Consumers are seeking unique flavors, natural ingredients, and lower-calorie options, driving manufacturers to innovate within product categories. Health-conscious consumers are particularly favoring low-sugar and organic variants of RTD drinks. The inclusion of functional ingredients such as vitamins, herbal extracts, and adaptogens in RTD beverages further enhances their appeal, bridging the gap between indulgence and wellness.

The increasing popularity of RTD alcoholic beverages, including cocktails, spirits, and flavored malt drinks, has significantly contributed to market expansion. These products provide a consistent, bar-quality experience without the need for mixology skills, making them especially popular in social gatherings, parties, and outdoor events. Furthermore, manufacturers are leveraging sleek packaging designs, sustainable materials, and convenient can or bottle formats to attract environmentally conscious consumers.

Market Restraints

Despite strong growth prospects, the ready-to-drink premixes market faces challenges such as regulatory restrictions on alcohol-based beverages in certain regions. Varying taxation and labeling requirements across countries can impact international trade and distribution. Additionally, high competition from substitute products like energy drinks, fresh juices, and powdered mixes may slow down market penetration in specific demographics. Concerns about artificial additives, preservatives, and sugar content in some RTD products also lead to cautious adoption among health-focused consumers. To overcome these barriers, companies are increasingly focusing on clean-label products and natural formulations to gain consumer trust.

Opportunities in the Market

The future of the RTD premixes market is highly promising, with innovation playing a central role. The emergence of low- and no-alcohol beverages presents a major growth opportunity, aligning with the global moderation trend. Consumers are showing growing interest in beverages that offer taste and sociability without the downsides of alcohol consumption. This shift has prompted many brands to launch low-alcohol and alcohol-free cocktails, wines, and spirits.

Moreover, sustainability is becoming a key differentiator in the market. Brands that adopt eco-friendly packaging and promote responsible sourcing are likely to gain a competitive advantage. The rise of online sales and direct-to-consumer (DTC) distribution channels has also expanded the reach of RTD products. E-commerce platforms, subscription models, and home delivery services are making it easier for consumers to explore a wide variety of RTD beverages, supporting steady sales growth.

Market Segmentation

The global ready-to-drink premixes market can be segmented by product type, packaging, distribution channel, and region.

By product type, the market includes RTD alcoholic beverages and RTD non-alcoholic beverages. Alcoholic RTD beverages, such as cocktails, spirits, and beer-based drinks, dominate the market due to increasing social drinking trends and premiumization in the beverage industry. Non-alcoholic variants, including iced tea, coffee, fruit juices, and mocktails, are also witnessing strong demand, particularly among health-conscious consumers and younger audiences.

By packaging, the market is categorized into cans, bottles, and others. Cans are the preferred choice for RTD products due to their lightweight, recyclable nature, and portability. However, glass bottles are gaining popularity in the premium RTD segment, as they convey quality and sophistication.

By distribution channel, the market includes supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets remain the dominant sales channel due to extensive product variety and easy accessibility. Online retail, however, is growing rapidly as consumers increasingly turn to e-commerce platforms for convenient doorstep delivery and exclusive product offerings.

Market Trends

One of the prominent trends in the global RTD premixes market is the rise of health-oriented beverages. Manufacturers are introducing low-calorie, plant-based, and sugar-free RTD products to cater to wellness-focused consumers. Another emerging trend is the blending of flavors inspired by global cuisines, creating exotic and fusion drinks that cater to adventurous taste preferences. Additionally, premiumization remains a key strategy, as consumers are willing to pay more for artisanal and high-quality beverages.

Technology and automation are also reshaping the production and packaging processes. Advanced filling systems, smart labeling, and digital marketing are enhancing the efficiency of operations while improving consumer engagement. The integration of AI-driven analytics in consumer insights is allowing brands to tailor their offerings more effectively to regional tastes.

Regional Analysis

North America is projected to dominate the global ready-to-drink premixes market, holding a 37.2% share in 2024. The region’s leadership is driven by a strong consumer base with a pronounced preference for convenience products and premium beverages. The United States and Canada, in particular, are key contributors to this growth, supported by an established retail infrastructure, high disposable incomes, and evolving social consumption trends. The growing demand for flavored alcoholic beverages and non-alcoholic mocktails has further strengthened North America’s position in the market.

Europe is another major region in the global RTD premixes market, driven by strong demand for alcoholic premixes and the growing popularity of low-ABV (alcohol by volume) beverages. Countries such as the United Kingdom, Germany, and Italy are witnessing an increased preference for ready-to-consume drinks that align with social and leisure activities. Meanwhile, Asia Pacific is emerging as the fastest-growing market due to rapid urbanization, rising middle-class populations, and expanding retail networks. Countries like Japan, China, and India are seeing heightened demand for both health-oriented and indulgent RTD beverages.

Latin America and the Middle East & Africa regions also present untapped opportunities, supported by the growing young population and increasing acceptance of ready-to-drink products as part of modern lifestyles.

Download a Complimentary PDF Sample Report: https://dimensionmarketresearch.com/report/ready-to-drink-premixes-market/request-sample/

Competitive Landscape

The competitive landscape of the global RTD premixes market is characterized by the presence of established beverage manufacturers and emerging craft brands competing to capture market share. Leading companies are investing in innovation, product diversification, and sustainable packaging to differentiate themselves. Collaborations and partnerships with retailers and distribution channels are common strategies used to enhance product visibility and availability.

Brand storytelling, packaging aesthetics, and flavor innovation have become essential marketing tools in the RTD segment. Manufacturers are focusing on expanding their portfolios to include premium and health-focused offerings. The rise of local and regional brands is also reshaping competition, as smaller companies introduce culturally inspired flavors and niche products that resonate with specific markets.

Future Outlook

The future of the global ready-to-drink premixes market looks promising, with sustained growth expected over the next decade. Increasing consumer inclination toward convenience, combined with the trend of premiumization, will continue to drive innovation. The integration of functional ingredients, natural flavors, and sustainable packaging will play a pivotal role in shaping consumer preferences.

Technological advancements in beverage processing and packaging will enhance production efficiency, while digital marketing and data analytics will help companies target niche audiences more effectively. The continuous evolution of online sales channels will further boost accessibility and brand visibility.

As the global consumer landscape continues to evolve, the ready-to-drink premixes market is poised to thrive at the intersection of convenience, flavor innovation, and health-conscious consumption.

FAQs

What is driving the growth of the global ready-to-drink premixes market?

The market is primarily driven by rising consumer demand for convenience, premium beverage options, and innovative flavors that cater to busy lifestyles.

Which region holds the largest share of the ready-to-drink premixes market?

North America dominates the market with a 37.2% share in 2024, driven by high consumer spending, an established retail sector, and strong demand for both alcoholic and non-alcoholic RTD beverages.

What types of products are included in the RTD premixes market?

The market includes both alcoholic beverages such as cocktails and spirits, and non-alcoholic drinks like coffee, tea, and mocktails, available in cans and bottles.

What are the major trends shaping the RTD premixes industry?

Key trends include health-focused beverages, sustainability in packaging, flavor innovation, and the growing influence of e-commerce sales channels.

What is the projected market size of the RTD premixes industry by 2033?

The market is expected to reach USD 58.9 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Summary of Key Insights

The global ready-to-drink premixes market, valued at USD 30.8 billion in 2024, is projected to double by 2033, driven by strong demand for convenience, health-conscious beverages, and innovative flavors. North America leads the market, while Asia Pacific is emerging as the fastest-growing region. The industry’s future lies in functional ingredients, sustainable packaging, and expanding digital sales channels, making it one of the most dynamic segments in the global beverage industry.

Purchase the report for comprehensive details: https://dimensionmarketresearch.com/checkout/ready-to-drink-premixes-market/