IMARC Group, a leading market research company, has recently released a report titled "PCB Design Software Market Report by Component (PCB Design Software, PCB Design Services), Deployment Type (Cloud-based, On-premises), Industry (Transportation, Consumer Electronics, Telecommunications, Healthcare, Industrial Automation and Control, Education and Research, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global PCB design software market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

PCB Design Software Market Highlights:

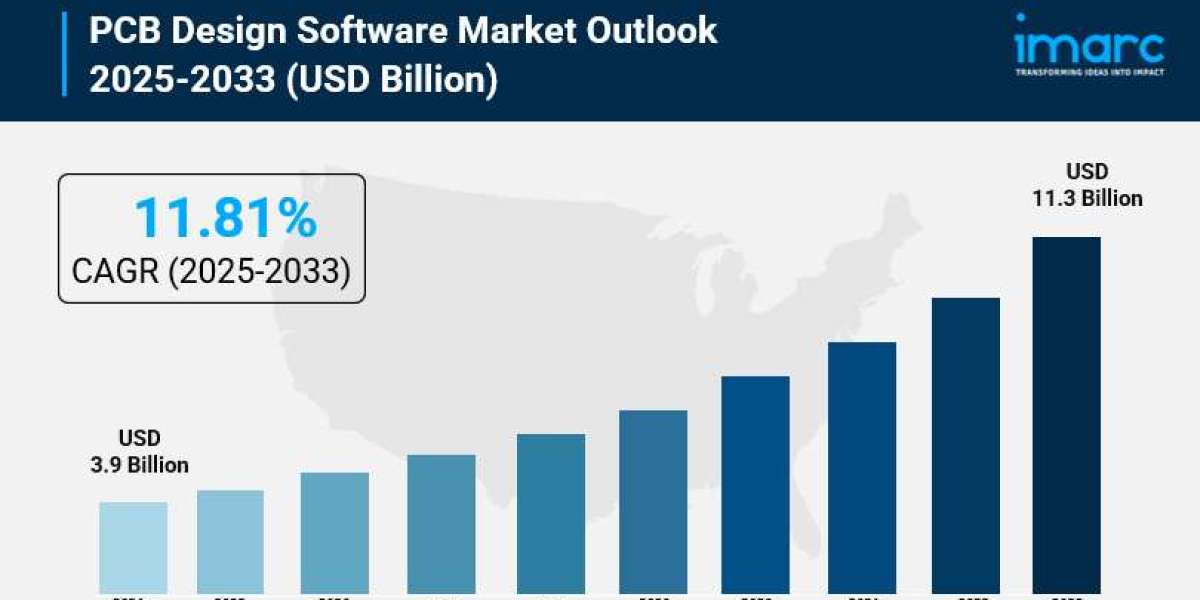

- PCB Design Software Market Size: Valued at USD 3.9 Billion in 2024.

- PCB Design Software Market Forecast: The market is expected to reach USD 11.3 billion by 2033, growing at an impressive rate of 11.81% annually.

- Market Growth: The PCB design software market is experiencing robust expansion fueled by the surge in advanced electronics development and the accelerating pace of digital transformation across industries.

- Technology Integration: Cutting-edge innovations like artificial intelligence, machine learning algorithms, and cloud-based design platforms are revolutionizing how engineers create and optimize circuit boards.

- Regional Leadership: North America dominates the market landscape, powered by significant investments in research and development activities and the presence of major technology companies driving innovation.

- Industry Demand: The telecommunications sector leads adoption, accounting for the largest share as 5G infrastructure rollout and network modernization projects create unprecedented demand for sophisticated PCB design solutions.

- Key Players: Industry leaders include Altium Limited, Ansys Inc., Autodesk Inc., Cadence Design Systems Inc., Novarm Limited, Shanghai Tsingyue Software Co. Ltd., WestDev Ltd., and Zuken Inc., which dominate the market with innovative solutions.

- Market Challenges: Balancing the growing complexity of electronic designs with the need for faster time-to-market and maintaining design integrity amid increasingly stringent regulatory requirements present ongoing challenges.

Claim Your Free “PCB Design Software Market” Insights Sample PDF: https://www.imarcgroup.com/pcb-design-software-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Consumer Electronics and IoT Devices:

The electronics industry is witnessing an unprecedented boom, with smart devices becoming integral to daily life. The global consumer electronics sector continues to expand rapidly, with smartphones, tablets, wearable technology, and IoT-enabled devices flooding markets worldwide. This explosion in connected devices is creating massive demand for sophisticated PCB design tools that can handle increasingly complex circuit layouts. Modern consumers expect sleeker, more powerful devices with enhanced functionality packed into smaller form factors. This miniaturization trend is pushing design teams to adopt advanced software solutions that can optimize component placement, ensure signal integrity, and manage thermal considerations—all while reducing the physical footprint of circuit boards. Engineers are now designing PCBs with thousands of connections and multiple layers, requiring software that can visualize, simulate, and validate designs before production, dramatically reducing costly errors and accelerating product launches.

- Revolutionary Integration of AI and Automation Technologies:

The PCB design landscape is undergoing a fundamental transformation through artificial intelligence and machine learning integration. Leading software providers are embedding intelligent automation features that can predict potential design flaws, suggest optimal routing paths, and automatically adjust layouts for better performance. These smart tools analyze vast amounts of design data to identify patterns and recommend improvements that would take human engineers hours or days to discover. AI-powered design verification can now scan circuits for potential electromagnetic interference issues, signal integrity problems, and manufacturing constraints in real-time. Cloud-based platforms are enabling collaborative design environments where teams distributed across different continents can work simultaneously on the same project, with version control and automatic synchronization ensuring everyone stays aligned. This shift toward intelligent, cloud-enabled design tools is dramatically accelerating development cycles and allowing companies to bring products to market faster than ever before.

- Massive Infrastructure Investments in 5G and Telecommunications:

The global rollout of 5G networks represents one of the most significant infrastructure projects in recent history, creating enormous demand for advanced PCB design capabilities. Telecommunications companies worldwide are investing billions in upgrading their networks to support next-generation connectivity. These 5G systems require highly specialized PCBs capable of handling ultra-high frequency signals with minimal loss and interference. The complexity of radio frequency design for 5G equipment demands software tools with sophisticated simulation capabilities that can model electromagnetic behavior accurately before physical prototyping. Network equipment manufacturers are racing to develop base stations, small cells, and edge computing hardware that can support the massive data throughput and low latency promises of 5G technology. This telecommunications revolution is driving software vendors to develop specialized features for RF design, high-speed digital signal processing, and thermal management—all critical considerations for equipment that must operate reliably in diverse environmental conditions while handling unprecedented data volumes.

- Growing Automotive Electronics and Electric Vehicle Revolution:

The automotive industry's transformation into a technology-driven sector is creating explosive demand for PCB design software. Modern vehicles contain dozens of electronic control units managing everything from engine performance to advanced driver assistance systems. Electric vehicles add another layer of complexity, requiring sophisticated power management boards, battery monitoring systems, and charging infrastructure electronics. Automotive electronics must meet stringent reliability standards and operate flawlessly in harsh conditions—extreme temperatures, vibration, and electromagnetic noise. This demanding environment requires design software with comprehensive simulation and validation tools that can verify circuit behavior under all possible operating conditions. The push toward autonomous driving technology is amplifying these requirements, as self-driving systems depend on multiple sensors, processors, and communication modules that must integrate seamlessly and respond instantaneously. Automotive manufacturers and their suppliers are investing heavily in advanced PCB design tools that can ensure functional safety compliance while accelerating the development of increasingly complex electronic systems.

PCB Design Software Market Report Segmentation:

Breakup by Component:

- PCB Design Software

- PCB Design Services

PCB design software dominates the market, representing the largest segment as organizations prioritize in-house design capabilities and seek comprehensive tools that provide end-to-end solutions from schematic capture through manufacturing output.

Breakup by Deployment Type:

- Cloud-based

- On-premises

On-premises deployment accounts for the largest market share, as companies prioritize data security, maintain complete control over their intellectual property, and integrate design tools with existing enterprise infrastructure and workflows.

Breakup by Industry:

- Transportation

- Consumer Electronics

- Telecommunications

- Healthcare

- Industrial Automation and Control

- Education and Research

- Others

Telecommunications leads with the largest segment share, driven by massive investments in 5G infrastructure development, network equipment modernization, and the continuous evolution of communication technologies requiring cutting-edge PCB design capabilities.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America commands the largest regional market share, propelled by extensive research and development investments, the presence of leading technology companies and software vendors, and rapid adoption of advanced design methodologies across multiple high-tech industries.

Who are the key players operating in the industry?

The report covers the major market players including:

- Altium Limited

- Ansys Inc.

- Autodesk Inc.

- Cadence Design Systems Inc.

- Novarm Limited

- Shanghai Tsingyue Software Co. Ltd.

- WestDev Ltd.

- Zuken Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=8257&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302