IMARC Group, a leading market research company, has recently releases a report titled “Canned Alcoholic Beverages Market Report by Product (Wine, RTD Cocktails, Hard Seltzers), Distribution Channel (On-trade, Liquor Stores, Online Stores, and Others), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global canned alcoholic beverages market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Canned Alcoholic Beverages Market Highlights:

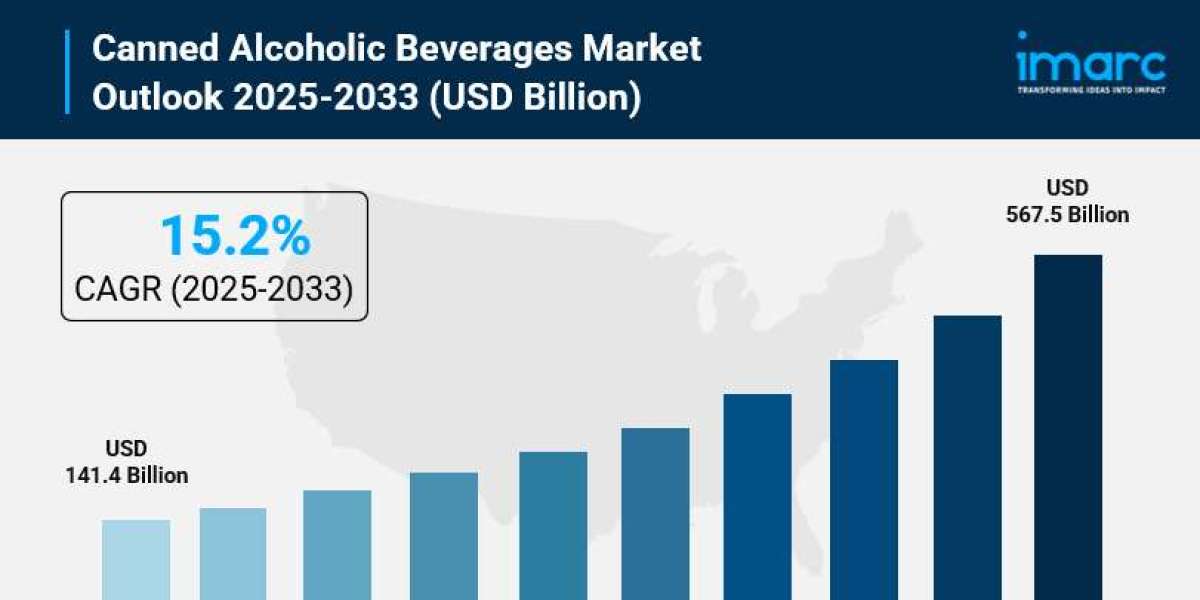

- Canned Alcoholic Beverages Market Size: Valued at USD 141.4 Billion in 2024.

- Canned Alcoholic Beverages Market Forecast: The market is expected to reach USD 567.5 billion by 2033, growing at an impressive rate of 15.2% annually.

- Market Growth: The canned alcoholic beverages market is experiencing exceptional growth as consumers increasingly prioritize convenience, portability, and ready-to-drink options that fit their fast-paced lifestyles.

- Product Innovation: Wine, RTD cocktails, and hard seltzers are driving market diversification, with RTD cocktails commanding 45% of industry share and attracting consumers seeking sophisticated, bar-quality experiences at home.

- Regional Leadership: North America dominates the global market, powered by strong consumer demand for hard seltzers, premium canned cocktails, and health-conscious beverage choices among millennials and Gen Z demographics.

- Health-Conscious Shift: Growing wellness trends are reshaping product development, with manufacturers launching lower-calorie, lower-alcohol, and natural ingredient formulations to meet evolving consumer preferences.

- Key Players: Major industry leaders include Anheuser-Busch InBev, Diageo, Constellation Brands, Bacardi Limited, and Suntory Holdings, who are investing heavily in flavor innovation and sustainable packaging solutions.

- Market Challenges: Regulatory complexities across different markets and the need for continuous product innovation to maintain consumer interest present ongoing strategic considerations.

Request for a sample copy of the report: https://www.imarcgroup.com/canned-alcoholic-beverages-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Changing Consumer Lifestyles and At-Home Entertainment:

Socializing and entertaining evolved in the modern world. Canned alcohol opportunities evolved too. More and more consumers favor entertaining at home rather than going out, and they look for convenient, premium products that require little labor when they prepare for social occasions. Canned alcohol fits right in with this trend. Canned beers and wines are easy to store in a refrigerator, easy to serve, and pre-measured, so whether you're having a barbecue in the backyard, or hosting a dinner party where cocktails are being served, you know exactly what you're going to get. Younger consumers want convenient and relatively inexpensive options. These consumers want different flavors without buying whole bottles, and they follow the growing trend of consuming spirits at home, so variety packs and samplers have risen in popularity because these allow consumers to try different types of spirits.

- The Craft Beverage Revolution Goes Mainstream:

Speakers stressed that craft breweries and distilleries, while once the outliers, were fast becoming the norm for canned alcoholic beverages at present. Canned craft producers showed consumers that cans can deliver a better quality and unique and interesting flavor experience, and products can be taken on the go. The craft beer trend has since been replicated with canned wines, premium cocktails and craft hard seltzers, which are often flavored with elderflower, hibiscus and exotic fruits. Craft, especially, can create strong local followings, with their fans often following them into other beverage categories, leading to success outside their core market. For instance, Dirty Water was launched as a session hard seltzer in August 2024 and achieved penetration into the competitive New York City market via influencer partnerships. The craft approach has been described as stressing authenticity, transparency and storytelling with the goal of appealing to consumers overwhelmed by the quantity of mass-produced products. The efforts of smaller companies to grow and form distribution relationships with major retailers may increase participation and interest in the market.

- Health and Wellness Meets Alcoholic Beverages:

Today, people are looking into a guilt-free way to drink alcohol and, obviously, the industry is responding with new products that fall in line with health trends. Demand exploded. Millennials and Gen Z drive this because they consider their consumption. This has been seen in hard seltzers' popularity. These drinks offer more health-conscious choices, for example 100 calories per can, compared to the 150-200 calories of other mixed alcoholic cocktails and beers. Consumers perceive ingredient lists then scrutinize them. They want more products including natural flavors plus real fruit juice without artificial ingredients. Many grocery food brands now provide nutritional information on packaging. Some brands even add additional functional ingredients, such as vitamins or electrolytes, to promote the products for use by active people. Citrus flavors, which comprise 34.8% of the hard seltzer category, are sometimes used because they have a fresh, light and healthy profile. Instead, it is an entire cultural shift that may be changing the way younger generations think about drinking on a wider level.

- Sustainability Driving Packaging Innovation:

The demand for more sustainable products is seeing growth across all product categories, and canned alcoholic beverages are included in this. Aluminum cans can be recycled indefinitely without any loss of quality, and are at a higher recycling rate than glass bottles (around 70% globally). Outside of their recyclability, cans have logistics advantages, as they weigh less than glass and therefore require less fuel to transport, resulting in lower carbon emissions. Cans also better protect beverages from the damaging effects of light and oxygen than many other types of beverage container, reducing spoilage and wastage. Many large manufacturers use recycled aluminum and produce cans in a carbon neutral fashion. Canned alcoholic beverages have a niche marketing appeal to the environmentally conscious, especially to younger buyers who consider environmental impact an important influence on their purchasing behavior. This has helped them gain more shelf space, as well as mind-share, as they communicate their environmental impact to consumers.

Canned Alcoholic Beverages Market Report Segmentation:

Breakup by Product:

- Wine (Still, Fortified, Low-Alcohol, Sparkling)

- RTD Cocktails (Malt-Based, Spirit-Based, Wine-Based)

- Hard Seltzers (Malt-Based, Spirit-Based, Wine-Based)

RTD cocktails lead the market with 45% share, capturing consumers who want sophisticated, mixologist-quality drinks without the effort or expense of making cocktails from scratch.

Breakup by Distribution Channel:

- On-Trade

- Liquor Stores

- Online Stores

- Others

Liquor stores dominate distribution, offering consumers the convenience of browsing extensive selections with knowledgeable staff assistance, promotional bundles, and increasingly, home delivery services.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the largest market share, driven by massive consumer appetite for hard seltzers and innovative RTD cocktails.

Who are the key players operating in the industry?

The report covers the major market players including:

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Bacardi Limited

- Brown–Forman Corporation

- Constellation Brands Inc.

- Diageo plc

- E. & J. Gallo Winery

- Sula Vineyards

- Suntory Holdings Limited

- Union Wine Company

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=12872&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

![Tadalafil | vidalista 40mg [20%OFF]](https://www.flexsocialbox.com/upload/photos/2024/01/LQciprsI9vJ34rqLa5iY_06_5d0d5db09448325c7d4b86efa8e17fbd_image.jpg)