Market Overview:

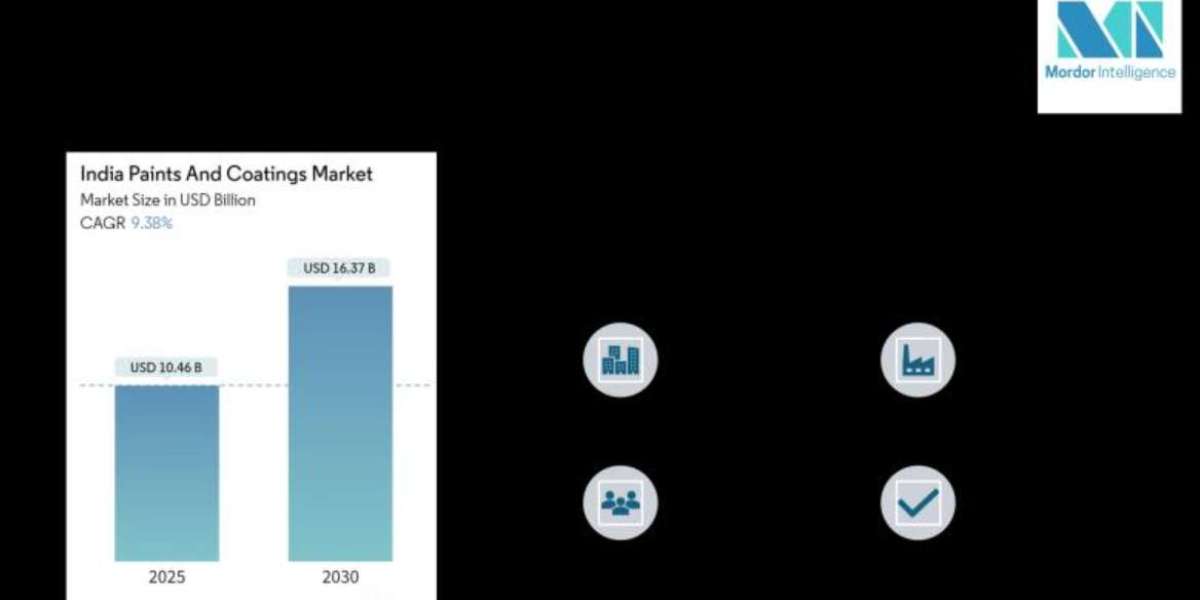

India paints and coatings market is gearing up for notable expansion in the coming years. Recent analysis estimates that the market will be valued at USD 10.46 billion in 2025, rising to USD 16.37 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 9.38% over that period. This growth is being fueled by surging demand from construction and real estate developments, along with intensifying competition as new players enter the field.

Browse Full Report Details @ https://www.mordorintelligence.com/industry-reports/india-paints-and-coatings-market?utm_source=flexsocialbox

India paints and coatings market Top Key Trends:

Construction and Real Estate Fuelling Demand

The expanding infrastructure and real estate sectors are pushing up demand for paints and coatings substantially. Rising urbanisation and increased housing and commercial construction are central to this trend

Raw Material Price Volatility

Fluctuating prices of raw materials have created cost pressures for manufacturers, occasionally slowing down growth despite sustained demand

New Player Disruptions and Intensifying Competition

The entry of Grasim Industries' Birla Opus into the market in early 2024 has shifted the landscape. Within months, it captured approximately 7% market share, competing aggressively with established companies through deep discounts, dealer incentives, and proximity investments

Regulatory Scrutiny and Antitrust Actions Loom

In mid‐2025, the Competition Commission of India launched an antitrust probe into Asian Paints-India's leading paint manufacturer-with its 52% market share under scrutiny for alleged anti‐competitive practices

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/india-paints-and-coatings-market?utm_source=flexsocialbox

India paints and coatings Market Segmentation

By End-Use / Sector

Construction & Real Estate: Continues to be the backbone of demand, powering growth across both decorative and protective coatings.

Automotive and Industrial Applications: These verticals contribute regularly, although they were not explicitly quantified in the primary report.

By Product Type (Broad Observations)

Decorative Paints: Likely a major share given construction-driven demand.

Industrial Coatings: Gaining relevance, especially as industrial output and infrastructure expand, but specific figures for India were limited in the main source.

By Geography / Market Share

The national market is seeing significant shifts, with Asian Paints holding about 52%, Birla Opus gaining around 7%, and others like Berger Paints, Kansai Nerolac, Indigo Paints, and Akzo Nobel India competing for remaining share

Explore Our Full Library of Chemicals & Materials Research Industry Reports: https://www.mordorintelligence.com/market-analysis/chemicals-materials?utm_source=flexsocialbox

Top Key Players:

The India paints and coatings market features both longstanding incumbents and rising challengers:

Asian Paints remains the stable market leader, with approximately 52% share. Its scale and distribution footprint have historically set the industry standard

Birla Opus (Grasim Industries): Entered the sector in February 2024 and swiftly captured about 7% share, thanks to aggressive expansion tactics including dealer incentives, aggressive pricing, and strategic plant locations

Other Notable Players:

Berger Paints

Kansai Nerolac

Indigo Paints

Akzo Nobel India

Explore more about the India Paints and Coatings Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/india-paints-and-coatings-market?utm_source=flexsocialbox

Conclusion:

The expanding construction and real estate sectors remain the foundational drivers of demand, even as rising raw material costs and supply pressures challenge margins. Competitive intensity has noticeably increased with Birla Opus making a rapid market entry, while legacy players like Asian Paints adjust to heightened market pressures.