Managing money in 2025 feels completely different from how it did just a few years ago. I’ve watched countless individuals transform from spreadsheet warriors drowning in transaction data to confident decision-makers backed by AI-powered insights. The change? AI personal finance tools that actually understand your spending patterns, predict your needs, and guide you toward financial stability.

The AI-powered personal finance management market is expected to reach $2.37 billion by 2029, growing at nearly 10% annually, and for good reason. These aren’t your grandfather’s budgeting apps; they’re sophisticated systems that learn, adapt, and evolve with your financial journey.

What Is AI Personal Finance?

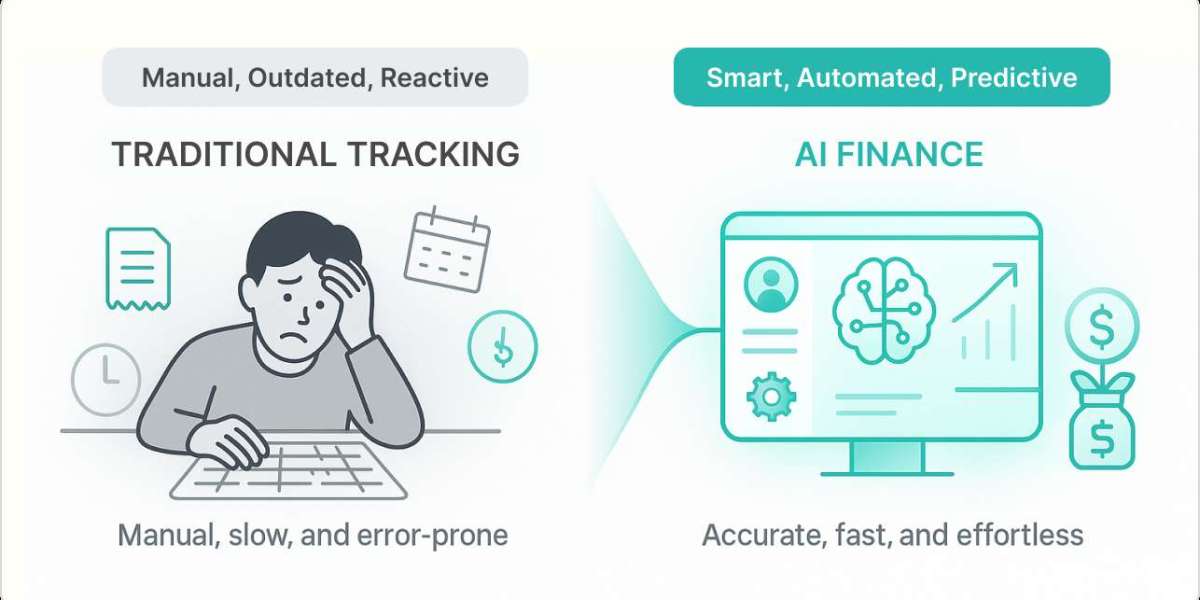

AI personal finance refers to intelligent financial management systems that leverage machine learning algorithms, predictive analytics, and natural language processing to automate budgeting, optimize spending, and provide personalized financial guidance. Unlike traditional finance trackers that simply categorize transactions, AI-powered personal finance assistants analyze patterns, predict future expenses, and offer actionable recommendations tailored to your unique financial situation.

Why AI-Powered Personal Finance Tools Are Changing the Game

The shift from manual tracking to AI-driven insights represents more than convenience; it’s a fundamental reimagining of how we interact with money.

Real-Time Budget Tracking That Actually Works

In America, 84% of people exceed their monthly budget, with 44% using credit cards to cover overspending. The problem isn’t discipline; it’s visibility. Traditional finance trackers show you what happened last week. AI personal finance apps show you what’s happening right now and what’s likely to happen tomorrow.

Real-time budget tracking tools for state-level agencies and individuals alike now process transactions as they occur, categorizing spending automatically and flagging unusual patterns before they become problems. When your AI-powered personal finance assistant notices you’re about to exceed your dining budget, it alerts you before you make that reservation, not three days later when it’s too late.

Personalization That Goes Beyond Basic Categories

AI personal finance apps use machine learning algorithms to learn from spending habits continuously and offer increasingly precise and relevant recommendations. Your coffee habit doesn’t just get lumped into “dining out.” The system recognizes it as a daily pattern, calculates its annual impact ($1,825 for that $5 daily latte), and suggests realistic alternatives.

Predictive Intelligence for Smarter Decisions

AI’s predictive capabilities forecast future financial scenarios by analyzing spending patterns, regular payments, and seasonal expenditures to predict future financial health. This transforms budgeting from reactive damage control to proactive financial planning.

The Best AI Personal Finance Apps Transforming Money Management

YNAB (You Need A Budget): This zero-based budgeting platform has integrated AI to analyze spending patterns and suggest realistic budget adjustments. Users report that YNAB is the first budgeting app that not only helped them understand spending but also changed their financial habits.

Monarch Money: Starting at $14.99 per month, Monarch Money uses AI to clean up transaction categories, surface spending patterns, and generate easy-to-understand summaries. It’s particularly powerful for couples managing joint finances.

PocketGuard: The standout feature is the “In My Pocket” calculation, showing exactly how much you can safely spend after accounting for bills and savings goals. PocketGuard connects to over 18,000 financial institutions and syncs transactions in real-time.

Wealthfront: Wealthfront manages over $80 billion in assets using AI to build portfolios across 17 global asset classes, delivering an average annual return of 8.61% for moderate-risk profiles.

How AI Personal Finance Apps Actually Work

Automated Transaction Categorization

Modern personal finance apps automatically sort transactions into specific categories using AI algorithms, analyzing merchant data, transaction patterns, and historical behavior. The system learns that “Target” might be groceries one week and household supplies the next, categorizing accordingly.

Intelligent Expense Forecasting

Advanced AI can forecast future expenses by analyzing patterns, allowing users to budget for upcoming bills and avoid overdrafts. If you typically spend $120 on groceries every Sunday, the system predicts that expense and factors it into your available balance calculations.

Smart Savings Optimization

AI discovers savings by searching for improved offers on services, identifying unwanted subscriptions, and suggesting more favorable financial products. These platforms spot optimization opportunities you’d never find manually.

Real-World Impact: AI Personal Finance Success Stories

Over 75% of banking executives agree that artificial intelligence significantly enhances traditional financial services. Consider the financial services provider that partnered with our team at SR Analytics. By unifying fragmented data across multiple bank accounts and payment apps into a single AI-powered dashboard, users gained predictive insights that dramatically improved personal finance management.

Financial firms report that 46% of customers experienced better satisfaction after integrating AI into their services. The improvement comes from relevance; advice that actually applies to your situation, at the moment you need it.

Getting Started with AI Personal Finance

Based on my experience helping organizations implement these systems, here’s what works:

Connect all accounts first: Link checking, savings, credit cards, and investment accounts before worrying about advanced features. You can’t optimize what you can’t see.

Start with 8–10 major budget categories: Let the AI suggest refinements based on your actual spending patterns rather than creating dozens of categories upfront.

Review transactions weekly for 30 days: This training period dramatically improves categorization accuracy and helps you understand your financial patterns.

Enable strategic alerts: Focus on budget thresholds, unusual transactions, and upcoming bills, not every single purchase.

The transformation of personal finance mirrors broader trends in AI-driven data analytics services across industries. The same predictive analytics principles that help businesses forecast demand now empower individuals to predict cash flow and optimize spending.

Overcoming Common Challenges

Privacy concerns: Choose platforms with bank-level encryption and read-only access. The best apps never have permission to move money; only to observe transactions.

Integration limitations: Some smaller financial institutions struggle with API connections. Manual CSV imports work as a backup, though you lose real-time updates.

Learning curve: Give the system 30 days to reach optimal performance. The AI needs transaction data to identify patterns, and you need time to understand its recommendations.

Future Trends in AI Personal Finance

OpenAI’s recent acquisition of the AI-powered personal finance app Roi signals growing interest in personalized consumer AI. The World Economic Forum predicts that financial inclusion will be about enabling seamless interaction with the full spectrum of financial services within a single integrated experience.

Voice-activated financial assistants will move beyond simple balance checks to complex transaction processing and investment advice. The integration of AI for personal finance with broader financial ecosystems will provide truly holistic financial pictures.

“AI personal finance tools aren’t just about managing money; they’re about transforming your relationship with financial decisions through data-driven confidence,” says financial technology analyst Sarah Chen from Fintech Innovation Labs.

Making AI Work for Your Organization

For financial services firms or state agencies requiring robust budget tracking, successful implementations require clear data governance and strong integration strategies. Our work with financial services organizations reveals that winners share common traits: clean data, smart algorithms, and actionable insights.

Whether you need business intelligence consulting to build custom dashboards or data engineering services to unify fragmented financial data, the foundation remains consistent.

Conclusion: Your Financial Future Starts Now

AI personal finance represents a democratization of financial expertise. Tools once available only to wealthy individuals with personal advisors are now accessible to anyone with a smartphone.

A 2025 report estimates the global market for AI in fintech will reach $61.3 billion by 2030, with personal finance apps driving much of the growth. This isn’t hype; it’s a fundamental shift in how we relate to money.

The best finance tracker isn’t the one with the most features; it’s the one you’ll actually use consistently. Real-time budget tracking tools and AI-powered personal finance assistants work only when integrated into daily financial life. Start small, stay consistent, and let the technology amplify your financial decision-making.

Ready to transform your financial data into strategic insights? Whether you’re an individual optimizing personal finances or an organization seeking enterprise-grade financial analytics, contact our analytics experts to discuss how AI can revolutionize your approach to money management.

Schedule Your Free Financial Analytics Consultation | Explore Our Data Analytics Services