IMARC Group, a leading market research company, has recently releases a report titled “Blood Preparation Market Report by Product (Whole Blood, Blood Components, Blood Derivatives), Antithrombotic and Anticoagulants Type (Platelet Aggregation Inhibitors, Fibrinolytics, Anticoagulants), Antithrombotic and Anticoagulants Application (Thrombocytosis, Pulmonary Embolism, Renal Impairment, Angina Blood Vessel Complications, and Others), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global blood preparation market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Blood Preparation Market Highlights:

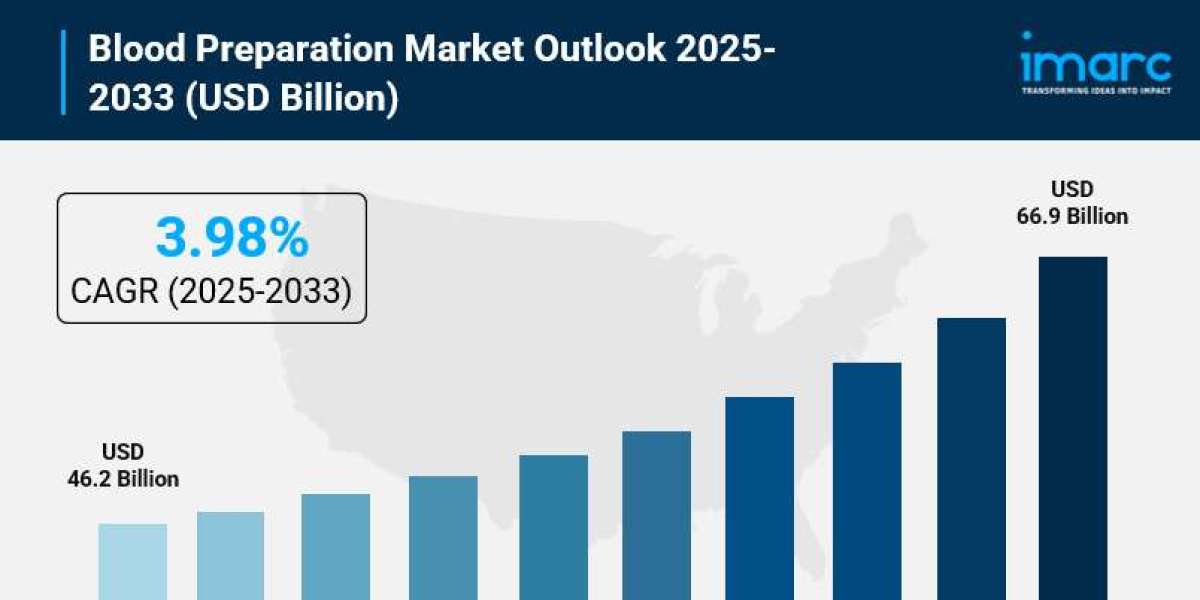

- Blood Preparation Market Size: Valued at USD 46.2 Billion in 2024.

- Blood Preparation Market Forecast: The market is expected to reach USD 66.9 Billion by 2033, growing at an impressive rate of 3.98% annually.

- Market Growth: The blood preparation market is experiencing steady expansion driven by the rising burden of chronic diseases and increasing healthcare infrastructure investments worldwide.

- Technology Integration: Automation technologies are transforming blood processing operations, improving accuracy while reducing manual errors in critical procedures like centrifugation, expression, and sealing.

- Regional Leadership: North America leads the market, supported by advanced healthcare infrastructure, substantial healthcare spending, and a well-established network of blood donation centers.

- Healthcare Infrastructure: Government initiatives across major economies are strengthening blood bank facilities, improving safety protocols, and promoting voluntary blood donation programs.

- Key Players: Industry leaders include Baxter International Inc., Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Pfizer Inc., and Sanofi S.A., which dominate the market with innovative blood preparation solutions.

- Market Challenges: Maintaining adequate blood supply levels and ensuring consistent donor participation remain ongoing challenges for the industry.

Request for a sample copy of the report: https://www.imarcgroup.com/blood-preparation-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Rising Wave of Chronic Diseases Creating Unprecedented Demand:

Healthcare systems worldwide are grappling with an explosion of chronic conditions that require regular blood-based treatments. Right now, approximately 129 million people in the United States alone are living with at least one major chronic disease. These conditions—ranging from cardiovascular disorders and cancer to diabetes—often lead to complications like anemia, clotting disorders, and compromised immune systems. The result? A massive surge in demand for blood transfusions, platelet replacement therapy, and plasma treatments. To put this in perspective, U.S. hospitals transfused 10,764,000 units of red blood cells in 2021 alone, according to the National Blood Collection and Utilization Survey. What's more, our aging population is accelerating this trend, as older individuals face higher risks of chronic illnesses and their related complications, pushing hospitals and blood centers to expand their preparation capabilities significantly.

- Government Initiatives Reshaping Blood Supply Infrastructure:

Governments around the world are taking blood supply security seriously, rolling out comprehensive initiatives that are fundamentally changing how blood products are collected, processed, and distributed. Take India as a prime example—the Government of India is currently supporting 1,131 blood banks across public and charitable sectors, providing everything from manpower and blood bags to testing kits and funding for voluntary blood donation camps. But it's not just about quantity; it's about quality and coordination too. India's e-RaktKosh system represents a major leap forward—this integrated blood bank management information system connects all blood banks into a single network, enabling real-time monitoring and coordination. These kinds of systematic improvements are building trust among healthcare providers and patients alike, creating a more reliable and safer blood supply chain that can respond quickly to emergencies and routine needs.

- Growing Public Awareness Fueling Blood Donation Momentum:

There's a noticeable shift happening in public attitudes toward blood donation, driven by increasingly effective awareness campaigns. In the United States, about 6.8 million people donate blood each year, contributing to the collection of 13.6 million units of whole blood and red blood cells. Public health campaigns led by governments, NGOs, and healthcare organizations are successfully communicating the life-saving impact of blood donation. While only about 3% of eligible Americans currently donate blood annually, targeted educational initiatives are working to expand that percentage. Both developed and developing nations are establishing more structured and organized blood donation systems, ensuring steady, reliable supplies. During emergencies, natural disasters, and health crises, these robust systems prove their worth, with communities responding to calls for increased donations when the need spikes.

- Automation Technologies Revolutionizing Blood Processing:

The blood preparation industry is experiencing a technological transformation that's improving both efficiency and safety. Modern blood processing facilities are adopting automation technologies that handle repetitive, precision-critical tasks—weighing, balancing, centrifugation, expression, and sealing—with minimal human intervention. This shift isn't just about speed; it's about consistency and accuracy. Automated systems dramatically reduce the risk of human error in processes where precision is absolutely critical. These technologies enable blood centers to process larger volumes while maintaining stringent quality standards, which is essential as demand continues to climb. The integration of smart technologies also provides better tracking and quality control throughout the entire blood preparation workflow, from collection through final distribution to hospitals and clinics.

Blood Preparation Market Report Segmentation:

Breakup by Product:

- Whole Blood (Red Cells, Granulocytes, Plasma, and Platelets)

- Blood Components (Whole Blood Components, Packed Red Cells, Leukocyte Reduced Red Blood Cells, Frozen Plasma, Platelet Concentrate, and Cryoprecipitate)

- Blood Derivatives

Whole blood dominates the market, reflecting its versatile use across surgeries, trauma care, and emergency transfusions where all blood components are needed simultaneously.

Breakup by Antithrombotic and Anticoagulants Type:

- Platelet Aggregation Inhibitors (Glycoprotein Inhibitors, COX Inhibitors, ADP Antagonists, and Others)

- Fibrinolytics (Tissue Plasminogen Activator (TPA), Streptokinase, and Urokinase)

- Anticoagulants (Heparins, Vitamin K Antagonists, Direct Thrombin Inhibitors, and Direct Factor Xa Inhibitors)

Anticoagulants command the largest share, driven by their critical role in preventing blood clots and managing conditions like deep vein thrombosis, pulmonary embolism, and atrial fibrillation.

Breakup by Antithrombotic and Anticoagulants Application:

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina Blood Vessel Complications

- Others

Thrombocytosis leads with the largest market share, as this condition's prevalence—characterized by elevated platelet counts that can cause dangerous clotting—requires ongoing anticoagulant management.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Baxter International Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company Limited

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- LEO Pharma A/S

- Pfizer Inc.

- Portola Pharmaceuticals Inc. (Alexion Pharmaceuticals Inc.)

- Sanofi S.A.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4552&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302