The private equity market is witnessing robust growth as investors seek alternative investment opportunities offering higher returns compared to traditional financial instruments. Private equity involves investment in private companies or buyouts of public companies to restructure, expand, or improve operational efficiency before eventual exit through mergers, acquisitions, or IPOs. The market is driven by the increasing availability of capital from institutional investors, high-net-worth individuals, and sovereign wealth funds, along with growing interest in venture capital and growth equity. Additionally, private equity firms are increasingly focusing on value creation through strategic management, digital transformation, and operational optimization of portfolio companies. Rising competition among firms and strategic acquisitions are influencing the Private Equity Market Share, highlighting shifts in regional dominance, sectoral investments, and emerging players shaping the global investment landscape.

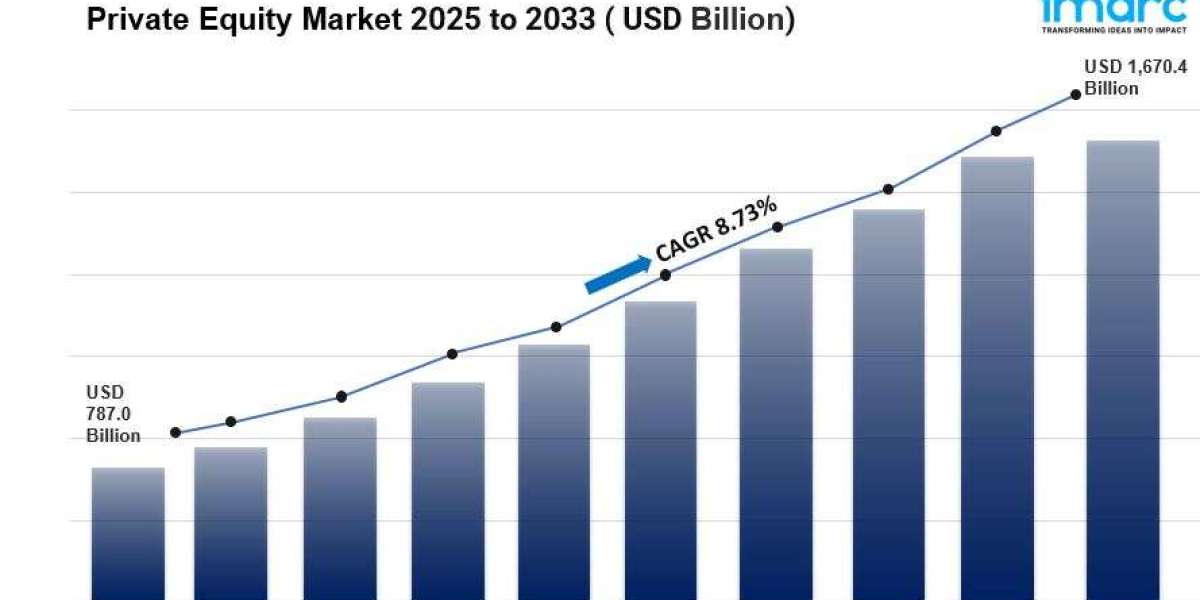

The global private equity market size was valued at USD 787 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,670.43 Billion by 2033, exhibiting a CAGR of 8.73% from 2025-2033. North America currently dominates the market, holding a market share of over 33.8% in 2024. The growth of the North American region is driven by a robust financial ecosystem, significant investor activity, technological advancements, and a focus on innovation across industries like technology and healthcare.

How the private equity market works:

The private equity market operates by pooling capital from investors to acquire ownership stakes in private companies or take public companies private. These investors, known as limited partners (LPs), typically include pension funds, endowments, wealthy individuals, and institutional investors. The funds are managed by private equity firms, or general partners (GPs), who identify, invest in, and actively manage target companies to enhance their value over time.

Private equity firms use a combination of equity and debt—known as leveraged buyouts (LBOs)—to acquire businesses with strong growth potential or operational inefficiencies. Once acquired, they work closely with management teams to improve profitability, optimize operations, expand into new markets, and drive innovation. The goal is to increase the company’s valuation before eventually exiting the investment through a sale, merger, or initial public offering (IPO).

Returns generated from these exits are distributed among investors after deducting management and performance fees. Unlike public markets, private equity investments are long-term and illiquid, often requiring a holding period of five to ten years. Overall, the private equity market plays a critical role in global finance by driving business transformation, fostering innovation, and supporting economic growth through strategic investment and active management.

Key Components and Strategies of the Private Equity Market

The private equity market functions through several key components and strategic approaches that drive successful investments and value creation.

Key Components:

- Limited Partners (LPs): Institutional investors, pension funds, and high-net-worth individuals who provide the capital for private equity funds.

- General Partners (GPs): Private equity firms that manage the fund, identify investment opportunities, and execute value creation strategies.

- Portfolio Companies: Businesses acquired by private equity firms, typically with strong potential for growth or operational improvement.

- Investment Structures: Common structures include leveraged buyouts (LBOs), growth capital, venture capital, and distressed asset investments.

- Exit Strategies: The process of realizing returns, often through initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales.

Key Strategies:

- Operational Improvement: Enhancing efficiency, cutting costs, and optimizing management performance.

- Financial Engineering: Utilizing leverage to amplify returns while maintaining risk control.

- Market Expansion: Entering new markets or product segments to increase revenue streams.

- Buy-and-Build Approach: Acquiring smaller firms to strengthen market position and achieve economies of scale.

- Digital Transformation: Leveraging technology to modernize operations and improve profitability.

Request to Get the Sample Report: https://www.imarcgroup.com/private-equity-market/requestsample

Factors Affecting the Growth of the Private Equity Industry:

Increased Focus on ESG Investments

The private equity market is undergoing a significant transformation with a growing emphasis on Environmental, Social, and Governance (ESG) investments. This shift is driven by heightened awareness of sustainability and responsible investing practices. Institutional investors, including pension funds and endowments, are increasingly integrating ESG criteria into their investment decisions, encouraging private equity firms to realign their strategies accordingly. Incorporating ESG factors into the investment process enhances risk management while unlocking opportunities for long-term value creation. Firms are now prioritizing companies with robust ESG frameworks, as such businesses tend to demonstrate stronger resilience, efficiency, and growth potential. Moreover, the rising focus on ethical governance and social responsibility is attracting a new generation of socially conscious investors seeking both financial returns and positive societal impact. Looking ahead, ESG integration will continue to shape deal sourcing, due diligence, and exit strategies across the private equity landscape.

Technological Transformation and Digitalization

Rapid advances in technology are redefining how private equity firms operate and invest. Increasing reliance on data analytics, artificial intelligence (AI), and machine learning is enhancing decision-making, improving due diligence, and enabling firms to identify promising opportunities with greater precision. At the portfolio level, companies are embracing digital transformation to optimize operations, enhance customer experience, and drive profitability. This digital wave is particularly evident in sectors such as healthcare, fintech, and e-commerce, where innovation is crucial for maintaining competitiveness. As we move toward 2025, the integration of digital technologies across private equity operations will accelerate, leading to more efficient fund management, data-driven investment evaluation, and improved performance outcomes. Firms that adopt advanced digital tools will be best positioned to capture emerging opportunities and sustain long-term growth.

Growing Interest in Emerging Markets

As mature markets become increasingly saturated, private equity firms are turning their focus toward emerging economies to capture new growth avenues. Regions such as Southeast Asia, Africa, and Latin America are witnessing rapid industrialization, urbanization, and rising consumer spending—creating fertile ground for investment. High-growth sectors like technology, renewable energy, and infrastructure are particularly attractive for generating strong returns. The pursuit of portfolio diversification and higher yields continues to draw global investors toward these dynamic markets. However, challenges such as regulatory uncertainty, political risk, and local market complexities demand adaptive strategies and strong regional partnerships. Looking ahead, firms that build local expertise and adopt flexible investment models will be well-positioned to navigate these markets successfully and unlock substantial long-term value.

Private Equity Market Report Segmentation:

By Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout holds the majority of the market share because buyout funds focus on acquiring and restructuring underperforming companies, providing opportunities for significant value creation and high returns.

Regional Insights:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

North America's dominance in the market is attributed to its mature financial ecosystem, robust economic growth, and a high concentration of institutional investors and private equity firms.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

Key Companies:

- AHAM Asset Management Berhad

- Allens

- Apollo Global Management, Inc.

- Bain and Co. Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc.

- CVC Capital Partners

- Ernst and Young Global Ltd.

- HSBC Holdings Plc

- Morgan Stanley

- The Carlyle Group

- Warburg Pincus LLC

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) (+1-201971-6302)

United States: +1-201971-6302