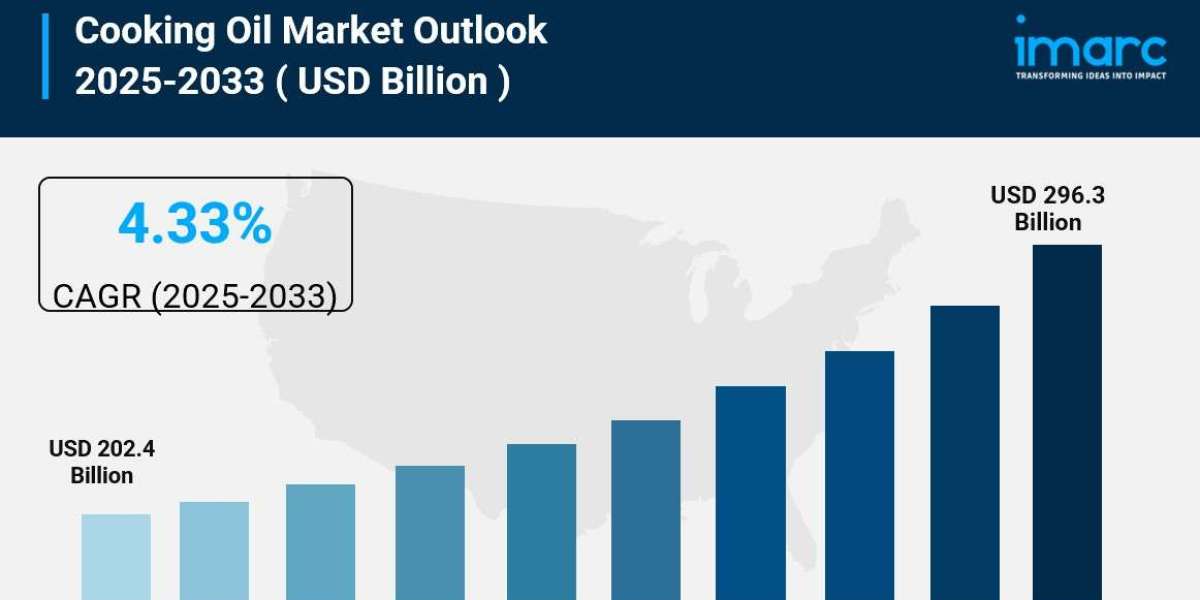

The global cooking oil market size was valued at USD 202.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 296.3 Billion by 2033, exhibiting a CAGR of 4.33% from 2025-2033. Asia Pacific currently dominates the market in 2024, while North America's United States holds 80.0% of the regional market share. The market is experiencing steady growth driven by rising awareness about health and wellness, changing individual preferences in dietary requirements, emphasis on sustainable sourcing practices and certifications, and the boom in home cooking trends.

Key Stats for Cooking Oil Market:

- Cooking Oil Market Value (2024): USD 202.4 Billion

- Cooking Oil Market Value (2033): USD 296.3 Billion

- Cooking Oil Market Forecast CAGR: 4.33%

- Leading Segment in Cooking Oil Market: Palm Oil (28.7% market share)

- Key Regions in Cooking Oil Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top Companies in Cooking Oil Market: ACH Food Companies Inc. (Associated British Foods plc), American Vegetable Oils Inc., Archer-Daniels-Midland Company, Bunge Limited, Cargill Incorporated, CJ CheilJedang Corp., Fuji oil Holding Inc., Indofood Agri Resources Ltd., J-Oils Mills Inc., Louis Dreyfus Company B.V., Marico Limited, Modi Naturals Ltd., Ottogi Co. Ltd., Wilmar International Limited.

Request Sample Report URL: https://www.imarcgroup.com/cooking-oil-market/requestsample

Why is the Cooking Oil Market Growing?

The cooking oil market is experiencing robust growth as consumers worldwide become increasingly health-conscious and embrace diverse culinary experiences. What's driving this expansion is a fundamental shift in how people approach food preparation, nutrition, and sustainable consumption.

Health and wellness trends represent the primary growth catalyst. The global health and wellness market reached USD 3,670.4 billion, reflecting widespread consumer interest in making healthier dietary choices. This awareness is driving demand away from saturated oils toward healthier alternatives rich in antioxidants and monounsaturated fats. Oils like olive, avocado, and coconut are gaining popularity due to their recognized health benefits, including omega-3 content that reduces inflammation and supports cardiovascular wellness.

The home cooking boom significantly propels market growth. More consumers are experimenting with diverse cuisines at home, creating demand for specialty and premium oils that complement different cooking styles and flavors. This trend has been amplified by lifestyle changes that prioritize home preparation over dining out, leading to increased variety in household oil pantries.

Dietary preference shifts create sustained demand for plant-based oils. The popularity of ketogenic diets, plant-based eating, and gluten-free lifestyles drives consumption of specific oil types that align with these nutritional approaches. Two in five consumers actively make healthy food and beverage choices to maintain wellness, while an equal percentage aims for balanced diets.

Urbanization and rising disposable incomes, particularly in developing nations, accelerate adoption of branded and quality cooking oils. As middle-class populations expand, consumers increasingly seek packaged, quality-assured oils over traditional bulk alternatives. This trend is especially pronounced in Asia Pacific, where urbanization continues transforming food consumption patterns.

Sustainability emphasis shapes purchasing decisions across demographics. The clean-label ingredients market reached USD 52.9 billion globally, reflecting consumer preference for products with transparent sourcing, production processes, and environmental impact information. Companies respond by obtaining certifications like RSPO (Roundtable on Sustainable Palm Oil) and implementing traceability measures.

Innovation in oil processing techniques enhances market appeal. Cold-pressing, chemical-free extraction, and fortification with vitamins and minerals cater to health-conscious segments. These technological advances improve oil quality, nutritional profiles, and shelf life while meeting premium product demands.

The expanding food service industry contributes steady growth through commercial kitchen requirements. Restaurants, chain operations, and food delivery services consume large volumes of cooking oils, particularly affordable, functional varieties like soybean and palm oils that perform well in high-temperature applications.

AI Impact on the Cooking Oil Market:

Artificial intelligence is revolutionizing the cooking oil industry by optimizing production processes, enhancing quality control, and enabling personalized consumer experiences that drive market growth and innovation.

Smart farming technologies powered by AI optimize crop yields and oil quality at the source. Dabeeo initiated an AI farm monitoring project for palm oil farms in Indonesia spanning 765 square kilometers, using AI analysis and ultra-high-resolution satellite imagery to reduce monitoring workloads while improving agricultural efficiency. These systems analyze soil conditions, weather patterns, and plant health to optimize growing conditions and predict harvest timing.

AI-driven quality control systems ensure consistent product standards across production batches. Machine learning algorithms analyze oil composition, color, flavor profiles, and contamination risks in real-time, enabling immediate adjustments to maintain quality specifications. Computer vision systems inspect packaging integrity, labeling accuracy, and product consistency before distribution.

Precision blending technologies use AI to create optimal oil combinations that meet specific nutritional, functional, and flavor requirements. Advanced algorithms analyze fatty acid compositions, temperature tolerance, and nutritional profiles to develop blended oils that balance taste, health benefits, and cost-effectiveness for different market segments.

Smart supply chain management optimizes inventory, distribution, and pricing strategies through predictive analytics. AI systems analyze market demand patterns, seasonal variations, commodity price fluctuations, and consumer behavior to optimize procurement, production scheduling, and distribution networks while minimizing waste and costs.

Personalized nutrition platforms leverage AI to recommend optimal cooking oils based on individual health profiles, dietary restrictions, and culinary preferences. These systems analyze user data including health conditions, cooking habits, and nutritional goals to suggest specific oil types and usage patterns that support individual wellness objectives.

Consumer insights powered by AI help manufacturers understand evolving preferences and market trends. Machine learning algorithms analyze social media sentiment, purchasing patterns, and demographic data to identify emerging demand for specific oil types, packaging formats, and sustainability features, enabling proactive product development.

Automated extraction and refining processes use AI to optimize temperature, pressure, and chemical parameters during oil production. These intelligent systems maximize yield while preserving nutritional content and flavor characteristics, reducing energy consumption and production costs while improving product quality.

Segmental Analysis:

Analysis by Type:

- Palm Oil

- Soy Oil

- Sunflower Oil

- Peanut Oil

- Olive Oil

- Rapeseed Oil

- Others

Palm oil represents the leading segment with 28.7% market share due to its widespread use in food products, cost-effectiveness compared to other oils, high productivity per hectare making it efficient for large-scale production, and desirable functional properties including high melting point and stability at high temperatures.

Analysis by Distribution Channel:

- Hypermarket and Supermarket

- Independent Retail Stores

- Business to Business

- Online Sales Channel

Hypermarkets and supermarkets lead with 45.7% market share by offering extensive oil selections ranging from traditional vegetable oils to premium varieties, providing convenient one-stop shopping experiences, competitive pricing through promotions, and enabling easy brand and price comparisons.

Analysis by End User:

- Residential

- Food Services

- Food Processing

- Others

Residential dominates with 69.8% market share driven by growing diversity in cooking techniques, increasing variety in household oil pantries to accommodate different culinary requirements, and rising consumer willingness to invest in diversified oil selections for both traditional and modern cooking innovations.

Analysis of Cooking Oil Market by Regions

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Asia Pacific leads the market due to fast urbanization, expanding middle class populations in countries like China, India, Indonesia, and Vietnam, changing dietary habits leading to increased fried and processed food consumption, and the region's dominance in palm oil production providing cost-effective supply.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=8447&flag=C

What are the Drivers, Restraints, and Key Trends of the Cooking Oil Market?

Market Drivers:

The cooking oil market benefits from multiple powerful growth catalysts operating across consumer, industrial, and technological domains. Health consciousness represents the primary driver as consumers increasingly understand connections between cooking oil choices and cardiovascular health, inflammation, and overall wellness.

Demographic shifts including urbanization and rising middle-class populations create sustained demand for branded, quality-assured oils. As disposable incomes increase, particularly in developing markets, consumers upgrade from basic oils to premium, health-focused alternatives that offer superior nutritional profiles.

Culinary diversity expansion drives demand for specialty oils suited to specific cooking techniques and flavor profiles. Home cooking trends encourage experimentation with international cuisines, creating markets for olive oil, avocado oil, coconut oil, and other specialty varieties previously limited to commercial kitchens.

Market Restraints:

Despite positive growth trends, the market faces several challenges that could impact expansion. Price volatility in raw materials affects production costs and consumer affordability, particularly for premium oil varieties that require specific agricultural conditions and processing methods.

Sustainability concerns regarding palm oil production create regulatory and consumer pressure that may impact market dynamics. Environmental challenges including deforestation and labor practices in oil palm cultivation generate negative publicity that affects purchasing decisions.

Health misinformation and conflicting nutritional guidance can create consumer confusion about optimal oil choices, potentially slowing adoption of healthier alternatives or creating market uncertainty around specific oil types.

Market Key Trends:

Several transformative trends are reshaping the cooking oil landscape toward healthier, more sustainable, and technologically advanced solutions. Fortification with vitamins, minerals, and functional ingredients transforms cooking oils into wellness products that provide nutritional benefits beyond basic cooking needs.

Sustainable sourcing certification becomes increasingly important as consumers demand transparency about environmental and social impacts. Companies invest in traceability systems, environmental certifications, and ethical sourcing practices to meet growing sustainability expectations.

E-commerce adoption accelerates as consumers seek convenient access to specialty oils, bulk purchasing options, and subscription-based delivery services. Direct-to-consumer models enable brands to build stronger relationships while providing detailed product information and usage guidance.

Premium product development focuses on cold-pressed, organic, and minimally processed oils that preserve nutritional content and flavor characteristics. These products command higher margins while meeting consumer preferences for natural, additive-free food products.

Leading Players of Cooking Oil Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Cooking Oil landscape include:

- ACH Food Companies Inc. (Associated British Foods plc)

- American Vegetable Oils Inc.

- Archer-Daniels-Midland Company

- Bunge Limited

- Cargill Incorporated

- CJ CheilJedang Corp.

- Fuji oil Holding Inc.

- Indofood Agri Resources Ltd.

- J-Oils Mills Inc.

- Louis Dreyfus Company B.V.

- Marico Limited

- Modi Naturals Ltd.

- Ottogi Co. Ltd.

- Wilmar International Limited

These leading providers are expanding their footprint through innovative product development including health-oriented organic, cold-pressed, and fortified oil varieties, strategic partnerships and acquisitions to penetrate new markets, and enhanced e-commerce presence to capture direct-to-consumer opportunities across residential, food service, and industrial applications.

Key Developments in Cooking Oil Market:

- June 2023: Scientists at the Institute of Natural Sciences and Mathematics developed vegetable oil blends with health-benefiting properties, creating ideal oil blends with balanced compositions of polyunsaturated fatty acids that address consumer demands for functional nutrition through cooking oils.

- October 2023: KTC Edibles launched Planet Palm, a new sustainable portfolio representing their biggest UK palm segment brand, featuring certified sustainable and responsibly sourced palm oil with complete traceability from plantations, reflecting industry shift toward transparency and environmental responsibility.

- May 2024: Dabeeo initiated an AI-powered farm monitoring project for Indonesian palm oil farms covering 765 square kilometers, partnering with Tunas Sawa Erma Group to use satellite imagery and AI analysis for efficient farm monitoring, demonstrating technology integration in agricultural production.

- June 2023: 3F Oil Palm commenced oil palm plantation operations in Assam's Lakhimpur district under government partnership, planning to expand across 20,000 hectares within five years through centrally sponsored schemes, highlighting government support for domestic oil production capacity expansion.

- Market Innovation Trend: Companies focus on developing fortified cooking oils enriched with omega-3 fatty acids, vitamins, and minerals, while implementing cold-pressing and chemical-free extraction techniques to preserve nutritional content and appeal to health-conscious consumers seeking premium oil products.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302