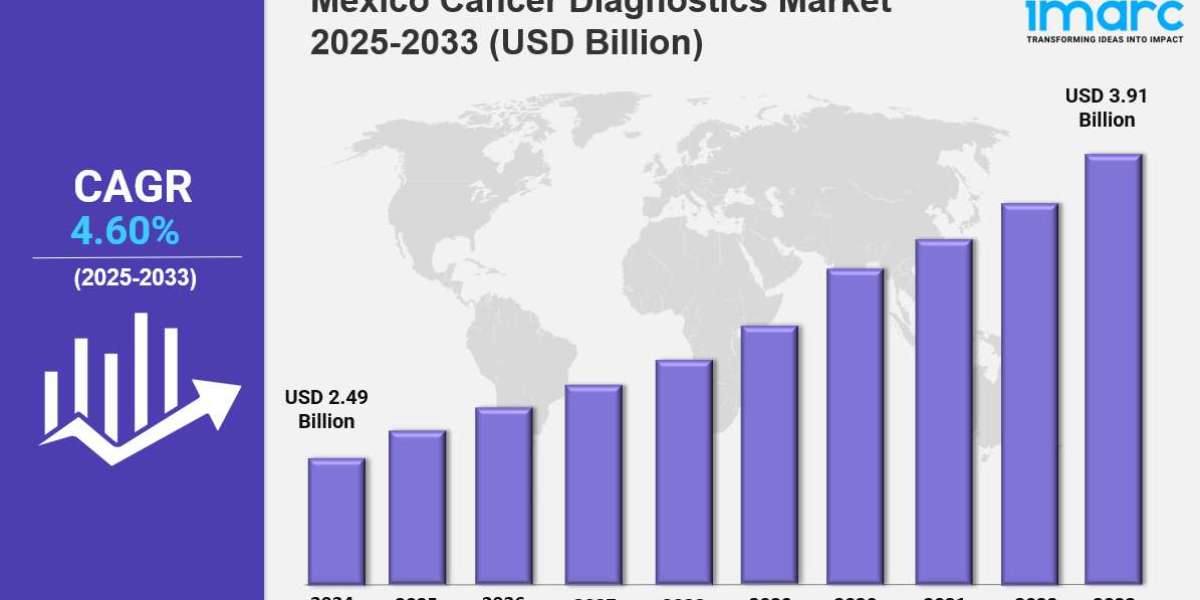

The Mexico cancer diagnostics market size reached USD 2.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.91 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The Mexico cancer diagnostics market is growing due to rising cancer prevalence, increased awareness, and demand for early detection. Growth is driven by advanced diagnostic technologies, government initiatives, and expanding healthcare infrastructure, making the industry more dynamic, accessible, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising cancer prevalence and early detection awareness

✔️ Increasing adoption of advanced imaging and biomarker-based diagnostic tools

✔️ Expanding government initiatives and investment in healthcare infrastructure and screening programs

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-cancer-diagnostics-market/requestsample

Mexico Cancer Diagnostics Market Trends and Drivers:

The Mexico Cancer Diagnostics Market is expanding rapidly as cancer rates continue to climb nationwide. Factors such as an aging population, high smoking prevalence, processed food consumption, and persistent environmental risks are intensifying the country’s cancer burden. Breast, prostate, and cervical cancers remain the most commonly diagnosed, placing significant pressure on healthcare systems in both urban and rural areas.

As part of the rising Mexico Cancer Diagnostics Market Demand, early detection has become a public health priority. However, diagnostic access is uneven. While advanced hospitals in Mexico City and Guadalajara benefit from modern imaging and lab technologies, many rural clinics still rely on outdated equipment, limiting timely diagnosis.

Government Plans and International Partnerships

The 2023 National Cancer Plan aimed to address infrastructure gaps, but slow implementation and funding limitations have reduced its impact. To bridge these challenges, international firms like Roche and Siemens have introduced genomic testing and liquid biopsy technologies to select regions. These innovations helped boost screening rates for lung and HPV-related cancers by 20% in 2024. Still, over 60% of cancers in Mexico are diagnosed at late stages, underscoring the urgent need for earlier, more affordable diagnostics—a key driver of the growing Mexico Cancer Diagnostics Market Size.

Urban centers are adopting advanced solutions such as AI-driven platforms (e.g., MedAI-MX) that streamline radiology workflows. Private labs are also leading in technologies like PET-MRI scanners and ctDNA testing. In contrast, public hospitals often depend on pilot programs or international aid, with affordability remaining a major issue. Comprehensive genetic testing can cost over $1,000, making it inaccessible for many families. This affordability challenge is shaping the demand for locally produced, low-cost diagnostic alternatives and influencing the Mexico Cancer Diagnostics Market Outlook.

To modernize cancer care, the Mexican government announced a $500 million Health Infrastructure Fund (2023–2028), though bureaucratic delays have slowed progress. Meanwhile, private investment in diagnostic startups surged 35% in 2024, reflecting strong confidence in the market. Local production of immunoassay reagents and diagnostic materials is also increasing, reducing reliance on imports, though supply chain risks remain.

Patient advocacy groups are pressing for reforms to make biomarker testing more affordable, while startups are developing rapid, lower-cost diagnostic kits. However, many face regulatory hurdles under COFEPRIS, delaying commercialization.

Regulatory Reforms and Market Outlook

Encouraging regulatory changes in 2024 have started to fast-track approvals for early-stage cancer diagnostics, supported by collaborations with the Pan American Health Organization (PAHO). Despite progress, rising equipment costs—exacerbated by peso depreciation—pose ongoing challenges for hospitals upgrading their systems.

Global players like Abbott and BD are investing in local manufacturing and workforce training to strengthen Mexico’s diagnostic capacity. Private providers such as Laboratorio Polanco and Chopo are also gaining market share by offering faster, higher-quality diagnostic services, particularly in urban centers.

Future Trends in Mexico Cancer Diagnostics Market

Looking ahead, the Mexico Cancer Diagnostics Market Growth will be driven by:

- Wider adoption of non-invasive methods such as liquid biopsies for breast and colorectal cancers

- Expanding AI- and cloud-based diagnostic platforms in urban hospitals

- Rising investment in locally manufactured, cost-effective testing solutions

- Strong demand for sustainable, accessible, and accurate cancer detection tools

Although challenges remain—particularly affordability and rural access—the overall Mexico Cancer Diagnostics Market Forecast remains positive. With government initiatives, private investment, and technological innovation converging, Mexico is moving toward a more efficient, inclusive, and resilient cancer diagnostics ecosystem.

Mexico Cancer Diagnostics Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

- Consumables

- Antibodies

- Kits and Reagents

- Probes

- Others

- Instruments

- Pathology-based Instruments

- Imaging Instruments

- Biopsy Instruments

Breakup by Technology:

- IVD Testing

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Next-generation Sequencing (NGS)

- Microarrays

- Flow Cytometry

- Immunoassays

- Others

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Mammography

- Ultrasound

- Biopsy Technique

Breakup by Application:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Melanoma

- Others

Breakup by End User:

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145