IMARC Group, a leading market research company, has recently released a report titled "Decorative Laminates Market Size, Share, Trends, and Forecast by Product Type, Application, End-Use, Texture, Pricing, Sector, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global decorative laminates market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Decorative Laminates Market Highlights:

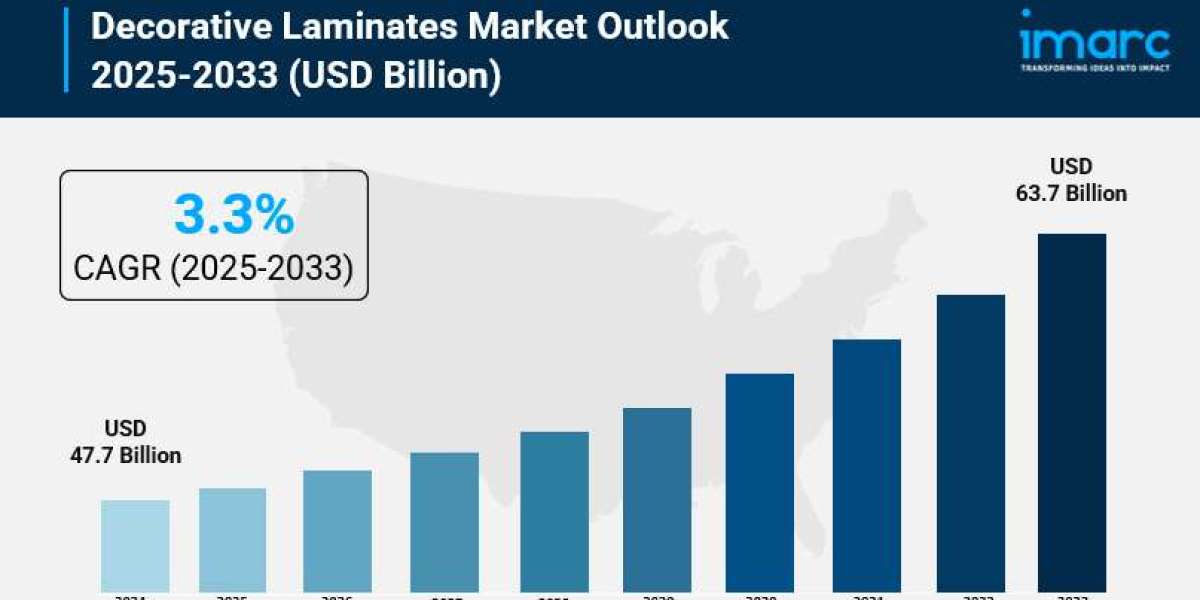

- Decorative Laminates Market Size: Valued at USD 47.7 Billion in 2024.

- Decorative Laminates Market Forecast: The market is expected to reach USD 63.7 Billion by 2033, exhibiting a growth rate of 3.3% during 2025-2033.

- Market Growth: The decorative laminates market is experiencing steady expansion driven by rising urbanization, booming construction activities, and increasing consumer demand for cost-effective yet stylish interior solutions.

- Technology Integration: Advanced manufacturing technologies like digital printing and precision texturing are revolutionizing laminate production, enabling incredibly realistic wood, stone, and metal finishes.

- Regional Leadership: Asia-Pacific dominates the market with over 45.1% share, propelled by rapid urbanization and massive construction projects across China, India, and Southeast Asian nations.

- Sustainability Focus: Growing environmental awareness is pushing manufacturers to develop eco-friendly laminates made from recycled materials and low-VOC processes.

- Key Players: Industry leaders include Greenlam Industries Limited, Formica Corporation, Wilsonart LLC, Century Plyboards (I) Limited, and Merino Industries Limited, which drive innovation with cutting-edge designs and sustainable solutions.

- Market Challenges: The need for continuous innovation to meet evolving design preferences and regulatory compliance for sustainable manufacturing present ongoing challenges.

Claim Your Free “Decorative Laminates Market” Insights Sample PDF: https://www.imarcgroup.com/decorative-laminates-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Surging Demand for Aesthetic and Functional Interiors:

The interior design industry is experiencing quite outstanding growth all around the world because it does create massive opportunities for decorative laminate manufacturers. Globally, interior design services generated USD 150.7 Billion in 2020, and the sector's projections show USD 255.4 Billion by 2027. Annual increases are expected for interior design in developing markets such as India reaching USD 67.4 Billion in 2032. Consumer priorities are shifting now in a fundamental way. This shift is reflected by explosive growth. Homeowners, businesses, and hospitality operators are no longer satisfied by basic functionality. They want instead spaces that make a statement. Decorative laminates have emerged as just about the perfect solution, for the reason that they offer up an exhaustive range of the colors, of the designs, and of the textures that are able to transform ordinary interiors into advanced, into modern environments. These materials are particularly attractive since they can mimic expensive materials like natural wood, marble, also granite inexpensively. Retail stores along with upscale hotels, among other businesses, are increasingly turning to decorative laminates. They act thus to make cheap memorable customer adventures.

- Explosive Growth in Construction and Real Estate:

About phenomenal growth, the construction sector is experiencing it, especially in developing regions. These regions see rapid urbanization as well as infrastructure development. In 2025, the construction sector alone in India is predicted toward a USD 1.4 Trillion worth. From 2024 until 2032, the sector of building construction should grow each year at 5.13%. Real estate should hit USD 8,654 Billion by the year of 2032. These aren't mere figures; they show millions of new homes, offices, stores, plus hotels now built across the globe. Due to each of these projects requiring modern and durable and aesthetic interior solutions, a massive demand exists for decorative laminates. From 2024 to 2032, Argentina's construction sector should grow at 3.50%. This growth will expand further into the market for these versatile materials. Renovation as well as refurbishment activities are in fact contributing a lot to the market demand. This demand is being driven also by new construction. Property owners seek current materials for interior upgrades because decorative laminates offer value, style, and durability.

- Revolutionary Manufacturing Technologies:

Technology is completely transforming what's possible in decorative laminate production. Now manufacturers are able to produce laminates having astonishingly realistic textures also detailed designs which perfectly mimic granite, marble, as well as natural wood because digital printing transformed the industry. In 2024, the global digital printing market reached USD 30.5 Billion so these capabilities saw wide adoption. That adoption reflected upon this market value. For architects and for interior designers and for consumers there exists dramatically expanded design possibilities as a result of these technological breakthroughs. The functional properties of laminates have improved in a large way because of the advances in manufacturing, and not just aesthetics. Newer items withstand scratches, stains, heat, and moisture better so they suit tough uses such as kitchen counters plus busy office desks. For example, in December of 2024, SkyDecor Laminates Pvt. Ltd. launched a total of two revolutionary product lines: 'Design Master 1 MM+ Decorative Laminates' that featured a total of over 300 unique designs, and 'Acrylish , Volume 2' with 111 high-gloss designs that were created by use of 100% virgin PMMA for more improved surface stability with scratch resistance. Technology allows for these innovations so manufacturers deliver products joining great looks with impressive strength.

- Growing Emphasis on Sustainable and Eco-Friendly Solutions

Ecological awareness alters consumer preferences also manufacturer actions within the decorative laminates sector. In 2022, around 90% of European consumers did particularly consider the sustainability of such products. For French consumers, there was an even higher awareness at 91%, most especially when they regarded household items. This is not just a trend now, but it is also something more. It does represent a shift that is fundamental in the evaluation by consumers of materials for interiors. Since manufacturers employ low-VOC processes minimizing environmental impact, eco-friendly laminates made from recycled materials are being developed. The United States market exemplifies this shift since established producers use cutting-edge technology so they can provide revolutionary laminates with improved strength, aesthetics, and environmental sustainability. In 2024, the Formica Corporation expanded their DecoMetal Laminates line by five additional designs, which showed manufacturers lead as they balanced innovation aesthetically and took responsibility environmentally. This transition is in fact being accelerated because of strict environmental regulations. Developed markets particularly feel these regulations. Companies investing in sustainable practices meet regulatory requirements they also position themselves to capture the growing segment of environmentally conscious consumers who will prioritize green building materials.

Decorative Laminates Market Report Segmentation:

Breakup by Product Type:

- High Pressure Laminates

- Low Pressure Laminates

Low pressure laminates dominate with 80.5% market share, remaining the preferred choice due to their cost-effectiveness, ease of installation, and wide availability. These laminates require less intensive production compared to high pressure alternatives, making them more economical for a broader range of applications including home and commercial furniture, cabinetry, and interior design.

Breakup by Application:

- Furniture and Cabinets

- Flooring

- Wall Panels

- Others

Furniture and cabinets lead with 53.2% market share, reflecting the enormous demand for visually beautiful, long-lasting, and cost-effective surface materials in the furniture industry. Decorative laminates are highly versatile, offering a wide variety of colors, patterns, and textures that beautify furniture and cabinets while providing excellent scratch, stain, and moisture resistance.

Breakup by End Use:

- Non-Residential

- Residential

- Transportation

Non-residential leads with 56.4% market share, encompassing commercial, retail, hospitality, and healthcare sectors. These spaces require high-quality interior materials that are durable, aesthetically pleasing, and capable of creating attractive yet functional environments. Increasing commercial construction and renovation projects are driving rising demand in non-residential applications.

Breakup by Texture:

- Matte/Suede

- Glossy

Matte/suede textures dominate with 65.6% market share, driven by their contemporary look and practical benefits. These textures provide a subtle, understated finish aligned with modern design trends, offering a non-glossy, smooth surface that minimizes glare and fingerprints while being easy to clean and maintain.

Breakup by Pricing:

- Premium

- Mass

Mass products lead with 71.8% market share, driven by affordability and wide accessibility. These laminates offer cost-effective solutions for consumers and businesses seeking quality surface materials without premium costs, catering to a broad audience with varied aesthetic preferences and budget constraints.

Breakup by Sector:

- Organised

- Unorganised

Organised sector dominates with 80.2% market share, driven by consistent quality, reliability, and adherence to industry standards. These laminates are produced by established manufacturers with advanced facilities, ensuring high-quality products that meet consumer expectations with superior durability and better after-sales service.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Abet Laminati S.p.A

- AICA Laminates India Pvt. Ltd.

- Airolam decorative laminates

- Archidply Industries Ltd

- Century Plyboards (I) Limited

- Formica Corporation

- FunderMax Gmbh

- Greenlam Industries Limited

- Merino Industries Limited

- OMNOVA North America Inc. (SURTECO GmbH)

- Stylam Industries Limited

- Wilsonart LL

Request Customization: https://www.imarcgroup.com/request?type=report&id=2196&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302