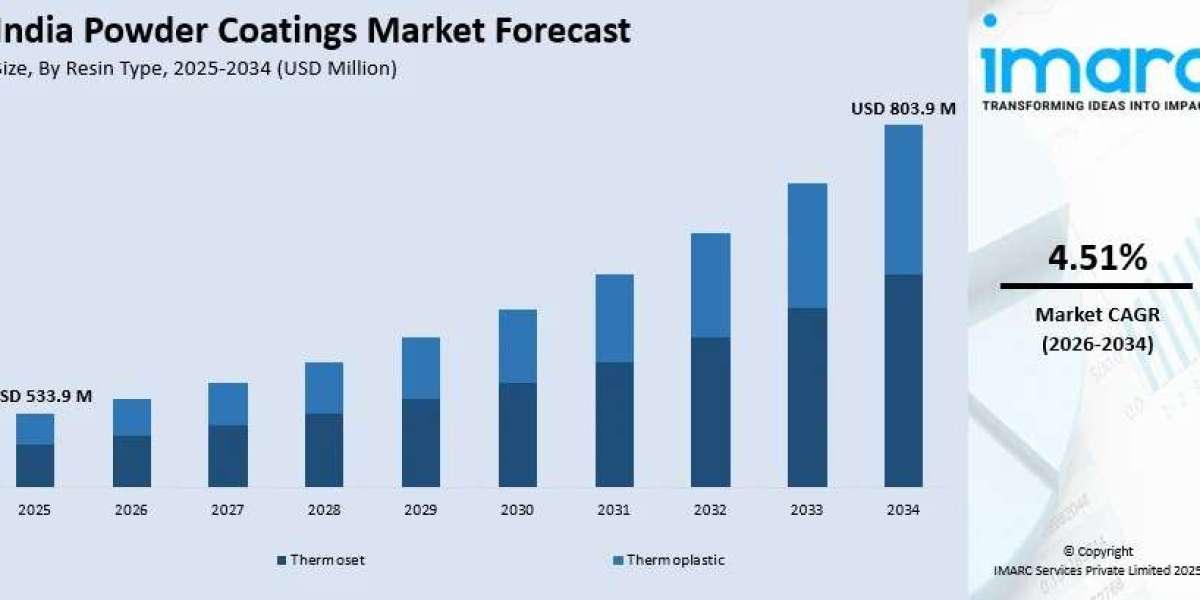

The India powder coatings market size was USD 533.9 Million in 2025 and is projected to reach USD 803.9 Million by 2034, exhibiting a CAGR of 4.51% during 2026-2034. Growth is driven by increasing demand from automotive, consumer durables, and construction sectors. The market benefits from shifts toward low-VOC, sustainable coatings and enhancements in durability and efficiency. Industrialization, infrastructure advancements, and regulatory compliance further bolster expansion across key industries. The report presents a thorough review featuring the India powder coatings market size, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA POWDER COATINGS MARKET KEY TAKEAWAYS

- Current Market Size: USD 533.9 Million in 2025

- CAGR: 4.51% (2026-2034)

- Forecast Period: 2026-2034

- The market is expanding due to rising demand from automotive, appliances, and infrastructure sectors.

- Transition to low-VOC and sustainable coatings is boosting adoption driven by environmental regulations.

- Technological advancements in resin formulations and application methods are widening applications.

- Urbanization and smart city projects create strong demand in architectural and construction segments.

- Market challenges include raw material price volatility and high entry costs due to specialized equipment.

Sample Request Link: https://www.imarcgroup.com/india-powder-coatings-market/requestsample

MARKET TRENDS

India's powder coatings market is undergoing a significant shift towards environmentally friendly coatings as industries move away from solvent-based products. Powder coatings, which contain no volatile organic compounds (VOCs), are favored by companies focused on sustainability and regulatory compliance. India ranked third on the U.S. Green Building Council’s 2024 LEED list, certifying 370 projects covering 8.5 million gross square meters, underscoring its commitment to green building practices. Advances in powder coating formulations, including low-temperature curing and high-durability variants, expand their applicability, supporting energy reduction goals and propelling market growth.

The consumer durables and automotive sectors are key drivers of powder coatings demand due to the materials' durability, corrosion resistance, and aesthetic versatility. In appliances such as refrigerators and air conditioners, powder coatings improve surface protection and finishing options. Automotive applications include wheels, chassis, and engine parts that benefit from heat and impact resistance. India’s rising middle-class population, accounting for 31% in 2024, fuels demand for premium coatings. The trend toward powder coatings replacing traditional liquid paints highlights manufacturers’ pursuit of durable, cost-effective solutions.

Technological innovation fuels market growth as new resin systems like polyurethane, polyester-epoxy hybrids, and thermoplastic powders meet specific industry demands with enhanced resistance to UV, corrosion, moisture, and heat. Equipment advancements in electrostatic spray and fluidized bed technology increase efficiency and finish quality while reducing overspray. Investment in low-bake and ultra-thin film coatings improves energy conservation and substrate compatibility. Post-pandemic antimicrobial powder coatings open new applications in healthcare and public infrastructure, creating differentiation opportunities in a competitive marketplace.

MARKET GROWTH FACTORS

The powder coatings market growth is primarily driven by expanding demand from automotive, appliances, and infrastructure industries that value powder coatings for durability and economic efficiency. The growing consumer awareness of environmentally conscious products advances the uptake of low-VOC and sustainable coating solutions. Government policies such as India’s “Make in India” initiative further stimulate domestic manufacturing, increasing industrial coatings consumption across multiple sectors.

Urbanization and rapid development of smart city projects present substantial growth opportunities by increasing the demand for powder coatings in architectural and construction applications. Additionally, the growing presence of consumer appliances in rural and semi-urban regions expands market penetration. Customization trends are encouraging manufacturers to offer a wider range of textures, colors, and specialty coatings, leveraging rising foreign investments and collaborative ventures to introduce advanced powder coating products.

Despite the positive outlook, challenges remain from raw material price fluctuations that increase manufacturing costs and pressure profit margins. Limited awareness of powder coating benefits among smaller industries curtails broader adoption. The high capital cost of specialized curing equipment restricts entry for smaller users. Competition from established players and low-cost alternatives pose additional barriers to market growth.

MARKET SEGMENTATION

Resin Type Insights:

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Thermoplastic

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

Descriptive: The resin type segmentation covers thermoset resins such as epoxy, polyester, epoxy polyester hybrid, and acrylic, which are commonly used for their chemical and mechanical properties. Thermoplastic types include PVC, nylon, polyolefin, and PVDF, catering to applications requiring flexibility and heat resistance.

Coating Method Insights:

- Electrostatic Spray

- Fluidized Bed

Descriptive: The coating methods include electrostatic spray, which provides precise application through charged powder particles, and fluidized bed, which involves dipping components into a bed of fluidized powder.

Application Insights:

- Consumer Goods

- Appliances

- Automotive

- Architectural

- Agriculture, Construction and Earthmoving Equipment (ACE)

- General Industries

- Others

Descriptive: Powder coatings are applied across diverse industries from consumer goods and appliances to automotive and agricultural construction equipment, supporting various durability and aesthetic requirements.

Regional Insights:

- North India

- South India

- East India

- West India

Descriptive: The market is geographically segmented into North, South, East, and West India, reflecting regional demand variations tied to industrial and infrastructure growth.

REGIONAL INSIGHTS

The report segments the market into North India, South India, East India, and West India. However, no specific dominant region or exact market share data has been provided in the source. Therefore, regional dominance and associated statistics are not explicitly indicated.

RECENT DEVELOPMENTS & NEWS

In August 2025, PPG and Asian Paints extended their joint venture agreements in India for 15 years, until 2041, to continue serving multiple coatings sectors including powder coatings. July 2025 saw JSW Paints acquire a 74.76% stake in Akzo Nobel India for approximately USD 1.64 Billion, excluding AkzoNobel’s powder coatings business. In the same month, AkzoNobel launched energy-efficient Interpon 600 and 610 Low-E powder coatings in India and China, curing at 150 °C, reducing energy consumption by 20% and curing time by 25%. AkzoNobel also unveiled the Interpon D2525 stone-effect powder coating in April 2023, providing aluminium with a natural stone look and sustainability benefits.

In February 2025, Akzo Nobel India approved the acquisition of its powder coatings business by its parent company, including its International Research Centre and intellectual property rights related to decorative paints for INR 2,073 Crore and INR 70 Crore respectively. February 2024 saw Arkema invest in India's powder coatings sector to expand low-VOC and lower-carbon solutions at its Navi Mumbai facility.

KEY PLAYERS

- PPG

- Asian Paints

- JSW Paints

- Akzo Nobel India

- Arkema

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302