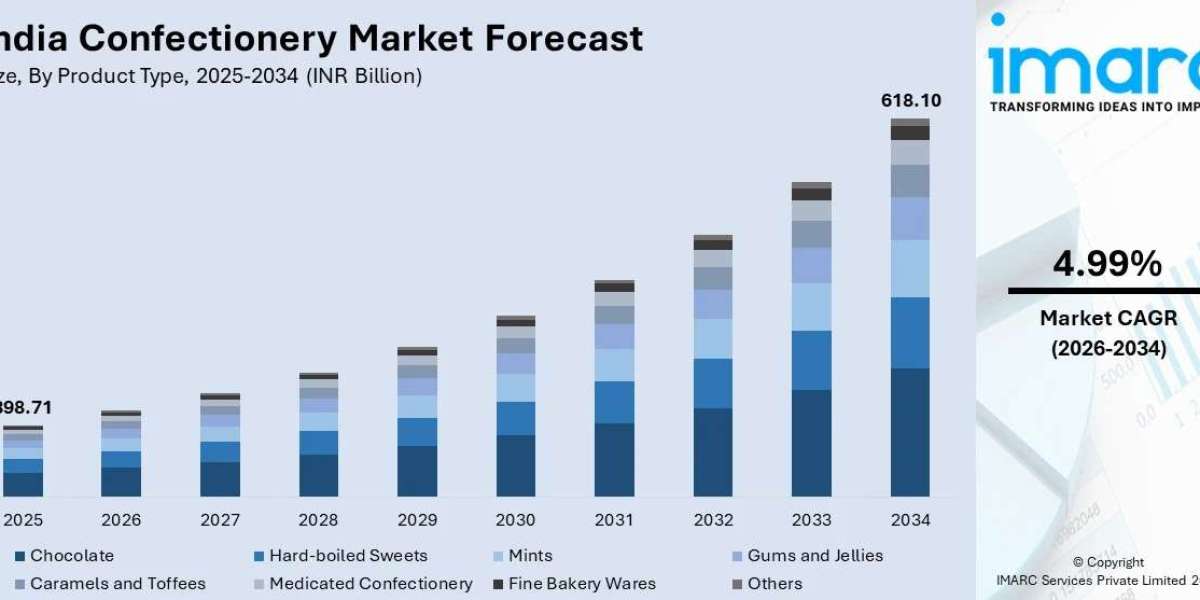

The India Confectionery Market size was valued at INR 398.71 Billion in 2025, projected to reach INR 618.10 Billion by 2034. It is expected to grow at a compound annual growth rate (CAGR) of 4.99% during the forecast period from 2026 to 2034. The growth is driven by rising urbanization, evolving consumer preferences for indulgent treats, increasing disposable incomes, cultural significance of sweets, and expansion of modern retail and e-commerce platforms. The report presents a thorough review featuring the India Confectionery Market outlook, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA CONFECTIONERY MARKET KEY TAKEAWAYS

- The India confectionery market size was valued at INR 398.71 Billion in 2025, growing at a CAGR of 4.99% from 2026 to 2034.

- Chocolate dominates with a market share of 36.5% in 2025, driven by consumer preference for premium treats and gifting culture during festivals.

- Adults lead the age group segment with 45.0% market share in 2025, aided by marketing methods tailored to adult consumers.

- Economy price point holds the largest segment with 49.6% share in 2025, reflecting price-sensitive consumers and wide availability in traditional retail.

- Supermarkets and hypermarkets dominate distribution channels with 42.3% share in 2025 due to extensive product ranges and organized retail growth.

- North India is the largest regional market with a 32.8% share in 2025, backed by high population density and strong festival traditions.

Sample Request Link: https://www.imarcgroup.com/india-confectionery-market/requestsample

MARKET TRENDS

Premiumization and Artisanal Offerings: Premium and artisanal confectionary items are rapidly gaining popularity among Indian consumers seeking distinctive flavor profiles and refined taste experiences. Artisanal chocolatiers incorporate traditional Indian spices—cardamom, jaggery, paan, and masala chai—into cocoa concoctions, innovating high-end desi-flavored bars such as cardamom-ghee-moong lentil chocolate and chili-infused dark variations. Startup chocolatiers use these culturally authentic flavors to satisfy local consumers desiring elegant yet culturally relevant chocolates.

Health-Conscious Confectionery Innovation: Growing health awareness prompts demand for sugar-free, low-calorie, and functional confectionery. Manufacturers have begun producing items with natural sweeteners like stevia and jaggery, reduced sugar content, and fortified ingredients offering health benefits. A notable example is Zydus Wellness's October 2024 launch of Sugar Free D'lite cookies in flavors like choco chip, yummy berries, and mocha hazelnut, designed for consumers prioritizing wellness without sacrificing indulgence.

Digital Transformation and E-commerce Expansion: The Indian confectionery market is experiencing significant digital transformation spurred by e-commerce and rapid commerce platforms that shift distribution and purchasing patterns. Online and quick commerce platforms enhance product accessibility in urban and semi-urban areas, especially during peak holiday seasons. Brands deploy digital marketing, influencer collaborations, and social media engagement to reach broader customer segments. E-commerce confectionery sales show strong momentum in metropolitan areas driven by consumer preference for convenient online shopping.

MARKET GROWTH FACTORS

Rising Disposable Incomes and Evolving Lifestyles: Growth is fueled by India's expanding middle class and increasing disposable incomes, which boost discretionary spending on indulgent, high-end foods. Urbanization exposes consumers to sophisticated and international confectionery brands, widening consumer expenditure on these treats. Young urban professionals seek convenience and quality, preferring distinctive confectionery options. The metropolitan expansion further supports consumption across all product categories owing to growing purchasing power and the demand for ready-to-eat indulgences.

Cultural Significance of Gifting and Festive Celebrations: Traditional gifting during festivals such as Diwali, Eid, Raksha Bandhan, and weddings generates significant seasonal confectionery demand. Gifting hampers containing chocolates, traditional sweets, and sugar confectionery witness substantial sales spikes during festival periods, underscoring the cultural importance of sweets. Approximately 70% of India's confectionery sales occur around festivals. The rising trend of chocolates replacing traditional mithai in gifting reflects consumer shifts towards contemporary confectionery. Manufacturers capitalize on this by launching limited editions and festive packaging.

Expansion of Modern Retail and E-commerce Platforms: The growth of modern retail outlets—supermarkets, hypermarkets, and convenience stores—enhances confectionery product accessibility in urban and semi-urban locales. These outlets provide wide selections, attractive promotions, and improved shopping experiences that encourage impulse buying. The surge in e-commerce and fast commerce platforms revolutionizes distribution by connecting companies directly to previously untapped consumers, favored particularly by younger demographics for doorstep delivery and competitive pricing, notably during festival seasons.

MARKET SEGMENTATION

- Product Type:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Chocolate holds the largest share at 36.5% in 2025, led by growing consumer preference for premium treats and gifting culture during festivals. Urbanization and exposure to Western culture have boosted popularity among younger consumers. Manufacturer innovation includes exotic flavors and health-oriented variants.

- Age Group:

- Children

- Adult

- Geriatric

Adults lead with a 45.0% share in 2025, driven by diverse consumption occasions and health-conscious buying habits. Marketing targets nostalgic and sophisticated tastes. Adults exhibit strong purchasing power for premium products and convenience.

- Price Point:

- Economy

- Mid-range

- Luxury

Economy pricing dominates with 49.6% share in 2025, indicative of price-sensitive Indian consumers and the prevalence of affordable products in traditional stores. The segment's resilience is supported by small pack sizes and value packs for various economic strata.

- Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead with 42.3% share in 2025, benefiting from extensive product ranges, promotional offers, and organized retail growth in urban and tier-I cities. Enhanced logistics and cold-chain infrastructure maintain product quality.

- Region:

- North India

- West and Central India

- South India

- East India

North India accounts for the largest share at 32.8% in 2025, driven by high population density, metropolitan hubs like Delhi NCR, and traditional sweet consumption during festivals and weddings. Retail and e-commerce expansion also bolster the region.

REGIONAL INSIGHTS

North India is the dominant region with a 32.8% market share in 2025. This is supported by dense populations, strong urban centers like Delhi NCR, and traditions involving sweet consumption for festivals, weddings, and religious activities. The region benefits from heightened acceptance of foreign brands, organized retail growth, improved distribution networks, and cold-chain infrastructure, aiding access in urban and semi-urban zones.

RECENT DEVELOPMENTS & NEWS

In January 2025, South Korea-based Lotte Wellfood, formerly Lotte Confectionery, announced plans to launch 'Pepero'—a biscuit stick with chocolate coating—in India. This product, popular in Korea, will be manufactured at Lotte's Haryana facility, marking the first production outside Korea. In September 2024, Annapurna Swadisht acquired Madhur Confectioners Private Limited (MCPL), a confectionery manufacturer specializing in lollipops and flavored sweets. This acquisition bolsters Annapurna Swadisht's presence and expands its product portfolio in the Indian confectionery market.

KEY PLAYERS

- Candico India Ltd

- Parle Products Pvt. Ltd

- Haldiram Foods International Pvt. Ltd

- Lotte India Corporation Ltd

- MTR Foods Pvt. Ltd

- Flury’s Swiss Confectionery Pvt Ltd

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302