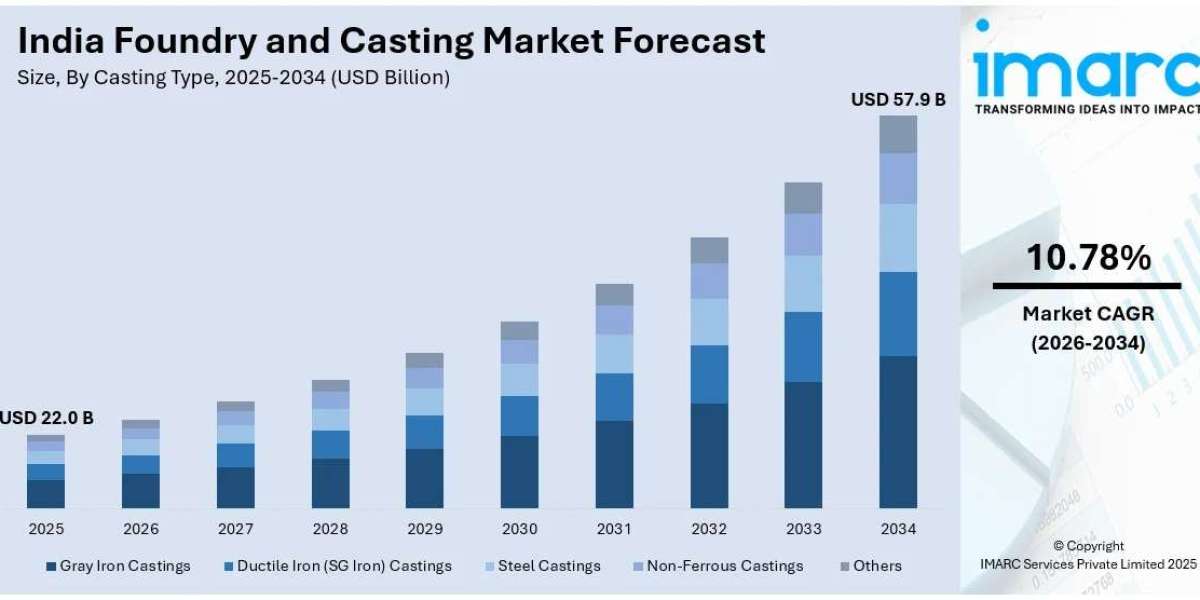

The India Foundry and Casting Market reached a size of USD 22.0 Billion in 2025. It is projected to grow to USD 57.9 Billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 10.78% during 2026-2034. This growth is driven by increased infrastructure development, automotive industry expansion including shift to electric vehicles, government policies like "Make in India," and advancements in manufacturing technologies enhancing production efficiency and export potential. The report presents a thorough review featuring the India Foundry and Casting Market size, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA FOUNDRY AND CASTING MARKET KEY TAKEAWAYS

- Current Market Size: USD 22.0 Billion in 2025

- CAGR: 10.78% during 2026-2034

- Forecast Period: 2026-2034

- Technological innovation including automation, CAD/CAM, 3D printing, and advanced melting and molding technologies are significantly improving casting quality and efficiency.

- The automotive and construction sectors are key growth drivers, with rising vehicle production and infrastructure projects fueling demand.

- Government initiatives such as the National Infrastructure Pipeline (NIP) and Pradhan Mantri Awas Yojana (PMAY) stimulate the construction sector, augmenting foundational market demand.

- India produces approximately 12 million MT of castings annually, with projected growth to USD 25 Billion by 2025 driven primarily by automotive and construction needs.

- Lost Foam Casting accounts for about 30% of die-cast components, catering to the automotive industry's focus on lighter, fuel-efficient vehicles.

Sample Request Link: https://www.imarcgroup.com/india-foundry-casting-market/requestsample

MARKET TRENDS

The Indian foundry and casting market is undergoing rapid technological transformation. Automation, simulation tools, and sophisticated robotics are being adopted. Computer-aided design (CAD) and computer-aided manufacturing (CAM) systems reduce defects and improve casting accuracy. The incorporation of 3D printing technology in pattern and mold production speeds up product development. Advanced melting and molding technologies save material and increase efficiency, boosting quality and production speed, positioning Indian foundries competitively in global markets.

With the momentum around Industry 4.0, Indian foundries have embraced data analytics and predictive maintenance, streamlining processes and minimizing downtime. The July 2024 acquisition by SMG Group of Hunter Foundry Machinery Corporation—a leading player in matchplate moulding machines and sand casting technology—exemplifies the technology upgrade trend. These advancements contribute to superior quality, operational efficiency, and enhanced competitiveness.

Growth continues with increasing application of Lost Foam Casting (LFC), which is utilized for 30% of die-cast components, aligning closely with the automotive industry's push towards lighter and more fuel-efficient vehicles. The sector's technology adoption ensures it can meet evolving market demands while reducing time-to-market and product wastage.

MARKET GROWTH FACTORS

The expansion of the automotive and construction industries drives growth in the Indian foundry and casting market. Rising vehicle production, notably due to growing consumer demand and increasing adoption of electric vehicles (EVs), has amplified the need for high-quality cast components such as engine blocks, transmission housings, and brake parts. Concurrently, expanding infrastructure projects like highways, railways, airports, and housing fuel demand for structural and machinery castings.

Government initiatives such as the National Infrastructure Pipeline (NIP) and Pradhan Mantri Awas Yojana (PMAY) directly stimulate construction activities, enhancing demand for castings. The robust industrialization, urbanization, and rising investment in renewable energy projects further bolster the demand across multiple sectors, ensuring sustained market growth over the forecast period.

Contribution to volume and value is significant, with India producing about 12 million MT of castings annually. The forecasted market value is USD 25 Billion by 2025, indicative of strong demand primarily from automotive and construction domains. This robust growth trajectory is supported by a growing manufacturing base and enabling government policies such as "Make in India" that facilitate technology adoption and export expansion.

MARKET SEGMENTATION

Casting Type Insights:

- Gray Iron Castings

- Ductile Iron (SG Iron) Castings

- Steel Castings

- Non-Ferrous Castings

- Others

These segments encompass diverse metals used in casting, each tailored for specific industrial applications, with detailed market breakdowns and trend analysis provided in the report.

Manufacturing Process Insights:

- Sand Casting

- Investment Casting

- Die Casting

- Centrifugal Casting

- Others

The report details market size and trends for various manufacturing technologies, reflecting their application scopes and growth dynamics.

End Use Industry Insights:

- Automotive

- Railways

- Agriculture and Tractor Industry

- Machine Tools and Engineering

- Construction and Infrastructure

- Aerospace and Defense

- Power and Electrical Equipment

- Sanitary and Pipe Fittings

The market analysis covers a comprehensive range of industries that utilize castings, each contributing varying levels of demand and development.

Regional Insights:

- North India

- South India

- East India

- West India

Regional segmentation analysis explores market differences and growth opportunities across India's major geographical areas.

REGIONAL INSIGHTS

The report provides comprehensive analysis across major Indian regions—North, South, East, and West India. However, it does not explicitly state the dominant region or specific market shares or CAGR values by region in the source. Hence, no exact regional dominance statistics can be reported.

Summary: Not provided in source.

RECENT DEVELOPMENTS & NEWS

In July 2024, Meson Valves India Limited acquired a majority stake in Milindpra Castings Private Limited for ₹70,330, strengthening its presence in the metal casting sector. In December 2024, JS Auto Cast Foundry, a Bharat Forge subsidiary, announced a ₹67.5 crore investment to expand its Perundurai unit near Erode, Tamil Nadu. This expansion will increase grey and SG iron casting production capacity by over 60%, from 72,000 tonnes to 116,000 tonnes, aimed at meeting rising market demand and strengthening competitive positioning.

KEY PLAYERS

- Meson Valves India Limited

- Milindpra Castings Private Limited

- JS Auto Cast Foundry (subsidiary of Bharat Forge)

- SMG Group

- Hunter Foundry Machinery Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302