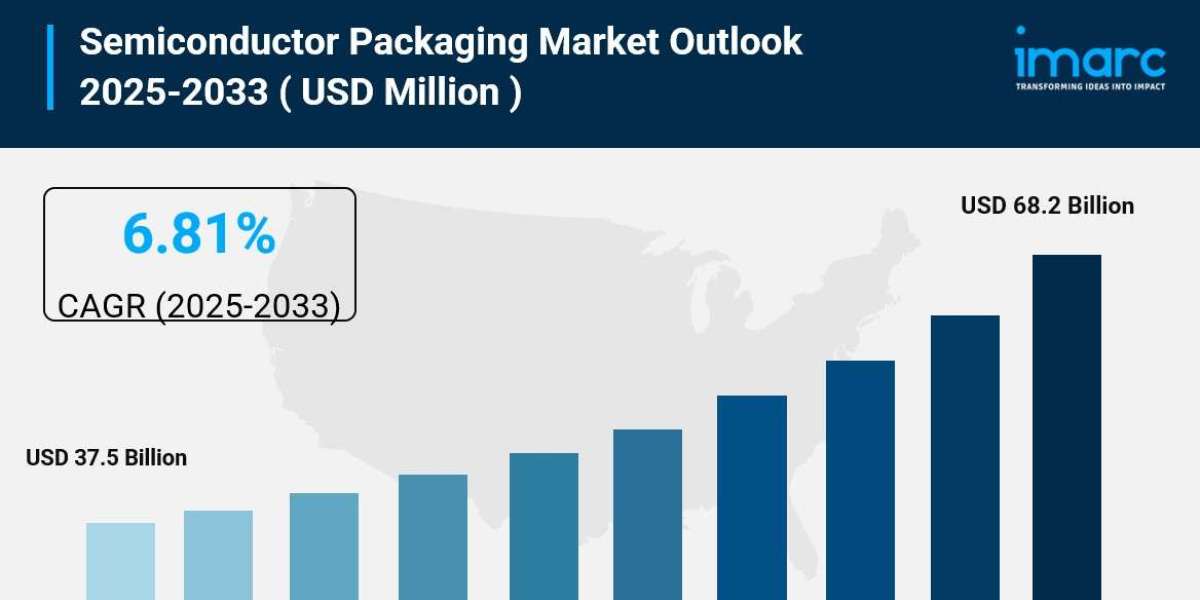

The global semiconductor packaging market size reached USD 37.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 68.2 Billion by 2033, exhibiting a CAGR of 6.81% during 2025-2033. Asia Pacific currently dominates the Semiconductor Packaging Market Share, holding a significant portion driven by the world's largest concentration of semiconductor manufacturing facilities, including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and major outsourced assembly and test (OSAT) providers. The market is experiencing robust growth driven by surging demand for AI-enabled chips, 5G infrastructure expansion, and the increasing complexity of electronic devices requiring advanced packaging solutions.

Key Stats for Semiconductor Packaging Market:

- Semiconductor Packaging Market Value (2024): USD 37.5 Billion

- Semiconductor Packaging Market Value (2033): USD 68.2 Billion

- Semiconductor Packaging Market Forecast CAGR: 6.81%

- Leading Segment in Semiconductor Packaging Market in 2024: Advanced Packaging Solutions (62.3%)

- Key Regions in Semiconductor Packaging Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top companies in Semiconductor Packaging Market: Taiwan Semiconductor Manufacturing Company (TSMC), Advanced Semiconductor Engineering (ASE) Group, Amkor Technology Inc., Samsung Electronics Co. Ltd., Jiangsu Changjiang Electronics Technology (JCET), Siliconware Precision Industries Co. (SPIL), Powertech Technology Inc., ChipMOS Technologies Inc.

Why is the Semiconductor Packaging Market Growing?

The semiconductor packaging market is experiencing explosive growth as artificial intelligence and machine learning applications create unprecedented demand for high-performance computing chips. Major tech companies are investing billions in AI infrastructure, requiring advanced packaging technologies that can handle massive data processing loads while maintaining thermal efficiency. TSMC's Chip-on-Wafer-on-Substrate (CoWoS) capacity doubled from 120,000 to 240,000 units between 2023 and 2024, yet still cannot fully meet surging demand from AI chip manufacturers.

The 5G rollout worldwide is driving massive demand for specialized packaging solutions that support high-frequency communication chips and radio frequency components. Telecommunications infrastructure upgrades require sophisticated packaging technologies that maintain signal integrity while minimizing electromagnetic interference, creating premium opportunities for advanced packaging providers.

Electric vehicle adoption is revolutionizing automotive semiconductor requirements, with modern EVs containing over 3,000 semiconductors compared to 300 in traditional vehicles. These automotive applications demand ruggedized packaging solutions that can withstand extreme temperatures, vibration, and humidity while delivering reliable performance over decades of operation.

Internet of Things expansion continues creating demand for miniaturized packaging solutions that enable smart sensors, wearable devices, and connected appliances. The trend toward smaller, more powerful devices requires innovative packaging approaches that maximize functionality while minimizing physical footprint and power consumption.

Request Sample Report URL: https://www.imarcgroup.com/semiconductor-packaging-market/requestsample

AI Impact on the Semiconductor Packaging Market:

Artificial intelligence is revolutionizing semiconductor packaging through intelligent thermal management systems that optimize heat dissipation in real-time based on chip performance and environmental conditions. AI-powered thermal modeling predicts hotspot formation and automatically adjusts cooling strategies to prevent performance degradation and extend device lifespan.

Machine learning algorithms are transforming quality control processes by analyzing microscopic defects, bond integrity, and structural irregularities with precision impossible through traditional inspection methods. These intelligent systems can predict package reliability and identify potential failure modes before products reach end customers, significantly reducing warranty costs and improving customer satisfaction.

Smart manufacturing systems powered by AI are optimizing production workflows by predicting equipment maintenance needs, adjusting process parameters in real-time, and minimizing waste through predictive analytics. These systems analyze thousands of variables simultaneously to maintain consistent quality while maximizing throughput and reducing manufacturing costs.

Advanced AI is enabling the development of self-adaptive packaging solutions that can modify their electrical and thermal characteristics based on operating conditions. These intelligent packages incorporate sensors and microcontrollers that optimize performance dynamically, representing the future of responsive semiconductor packaging technology.

Segmental Analysis:

Analysis by Packaging Type:

- Advanced Packaging

- Traditional Packaging

- System-in-Package (SiP)

- Wafer-Level Packaging

- Others

Advanced packaging solutions dominate the market with a 62.3% share, driven by demand for high-performance computing, AI applications, and mobile devices requiring sophisticated interconnect technologies and thermal management capabilities.

Analysis by Technology:

- Flip Chip

- Wire Bonding

- Wafer-Level Chip Scale Package (WLCSP)

- Through-Silicon Via (TSV)

- Others

Flip chip technology leads the market due to its superior electrical performance, thermal characteristics, and ability to accommodate high pin counts required by modern processors and graphics chips.

Analysis by Application:

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial

- Healthcare

- Others

Consumer electronics represents the largest application segment, driven by smartphones, tablets, laptops, and gaming devices that require compact, high-performance packaging solutions.

Analysis by Material:

- Organic Substrates

- Leadframes

- Ceramic Packages

- Others

Organic substrates dominate the market due to their cost-effectiveness, design flexibility, and ability to support complex routing patterns required by advanced semiconductor devices.

Analysis of Semiconductor Packaging Market by Regions

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Asia Pacific leads the global semiconductor packaging market, hosting the world's largest concentration of semiconductor manufacturing and assembly facilities. The region benefits from established supply chains, skilled workforce, and significant government investments in semiconductor infrastructure, with countries like Taiwan, South Korea, and China dominating global production capacity.

What are the Drivers, Restraints, and Key Trends of the Semiconductor Packaging Market?

Market Drivers:

The semiconductor packaging market is propelled by explosive growth in artificial intelligence and machine learning applications that require specialized packaging solutions capable of handling massive computational loads while maintaining thermal efficiency. Major technology companies are investing hundreds of billions in AI infrastructure, creating sustained demand for advanced packaging technologies.

5G network deployment worldwide is driving demand for high-frequency packaging solutions that maintain signal integrity and minimize electromagnetic interference. The transition from 4G to 5G requires entirely new packaging approaches for radio frequency chips and communication processors, creating premium market opportunities.

Electric vehicle adoption is transforming automotive semiconductor requirements, with modern EVs containing over 10 times more semiconductors than traditional vehicles. These applications demand automotive-qualified packaging solutions that can withstand extreme operating conditions while delivering decades of reliable performance.

Internet of Things expansion continues creating demand for miniaturized, power-efficient packaging solutions that enable smart sensors, wearable devices, and connected infrastructure. The trend toward edge computing requires distributed processing capabilities that demand innovative packaging approaches.

Market Restraints:

The market faces challenges from extremely high capital requirements for advanced packaging equipment and facilities, which can limit market entry for smaller players and create barriers to capacity expansion. Leading-edge packaging tools can cost tens of millions of dollars and require specialized facilities.

Technical complexity and yield challenges associated with advanced packaging technologies can impact profitability and production schedules. As package geometries shrink and interconnect densities increase, manufacturing becomes increasingly challenging and error-prone.

Supply chain vulnerabilities and material shortages can disrupt production schedules and impact customer deliveries. The semiconductor industry's complex global supply chains are susceptible to geopolitical tensions, natural disasters, and logistics disruptions.

Intense pricing pressure from customers and competition among packaging providers can limit margin expansion and profitability, particularly in commodity packaging segments where differentiation is minimal.

Market Key Trends:

Key trends shaping the semiconductor packaging market include the rapid adoption of chiplet architectures that enable modular semiconductor design by combining specialized dies in single packages. This approach allows manufacturers to optimize performance and yields while reducing development costs and time-to-market.

Heterogeneous integration is becoming standard as manufacturers combine different technologies, materials, and functions within single packages to create system-level solutions. This trend enables unprecedented functionality and performance while reducing system size and power consumption.

Sustainability initiatives are gaining momentum as manufacturers focus on reducing packaging material usage, improving recyclability, and minimizing environmental impact throughout the product lifecycle. Lead-free soldering and halogen-free materials are becoming industry standards.

Furthermore, artificial intelligence integration in packaging design and manufacturing is enabling optimization of thermal performance, electrical characteristics, and reliability while reducing development time and manufacturing costs through intelligent automation and predictive analytics.

Leading Players of Semiconductor Packaging Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Semiconductor Packaging landscape include:

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Advanced Semiconductor Engineering (ASE) Group

- Amkor Technology Inc.

- Samsung Electronics Co. Ltd.

- Jiangsu Changjiang Electronics Technology (JCET)

- Siliconware Precision Industries Co. (SPIL)

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- Unisem (M) Berhad

- Signetics Corporation

- Stats ChipPAC Pte. Ltd.

- Lingsen Precision Industries Ltd.

These leading providers are expanding their footprint through strategic partnerships, advanced manufacturing capabilities, and cutting-edge technology development to meet growing demand across AI, 5G, automotive, and consumer electronics applications. Market strategies focus on advanced packaging innovation, capacity expansion, and vertical integration with emphasis on thermal management, electrical performance, and reliability optimization.

Ask An Analsyt: https://www.imarcgroup.com/request?type=report&id=4930&flag=C

Key Developments in Semiconductor Packaging Market:

- January 2025: TSMC and Amkor announced expanded partnership to collaborate on advanced packaging facilities in Arizona, supporting critical markets including high-performance computing and communications with leading-edge packaging technologies. This strategic alliance represents billions in investment to establish domestic US advanced packaging capabilities.

- December 2024: Global advanced packaging revenue reached nearly USD 40 billion, with outsourced assembly and testing companies like ASE, Amkor, and JCET jointly accounting for more than 30% market share. These companies are expanding capacity to meet surging demand from AI and high-performance computing applications.

- November 2024: Major semiconductor companies announced significant investments in chiplet packaging technologies, enabling modular chip architectures that reduce development costs while improving performance. This trend represents a fundamental shift toward disaggregated semiconductor design approaches.

- October 2024: Apple announced plans to work closely with Amkor on strategic vision and manufacturing for advanced packaging facilities, supporting high-volume production of leading-edge technologies for consumer electronics and automotive applications requiring sophisticated thermal and electrical performance.

- September 2024: Asia Pacific region demonstrated continued dominance in semiconductor packaging with major facility expansions in Taiwan, South Korea, and China. Government support and presence of key players like TSMC, Samsung, and SK Hynix are driving the region's fastest growth rates in advanced packaging capabilities.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302