IMARC Group has recently released a new research study titled “United States C4ISR Market Report by Platform (Land, Naval, Airborne, Space), Solution (Products, Services), End Use Sector (Defense, Commercial), Application (Intelligence, Surveillance and Reconnaissance, Electronic Warfare, Computers, Communication, Command and Control, and Others), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States C4ISR Market Overview

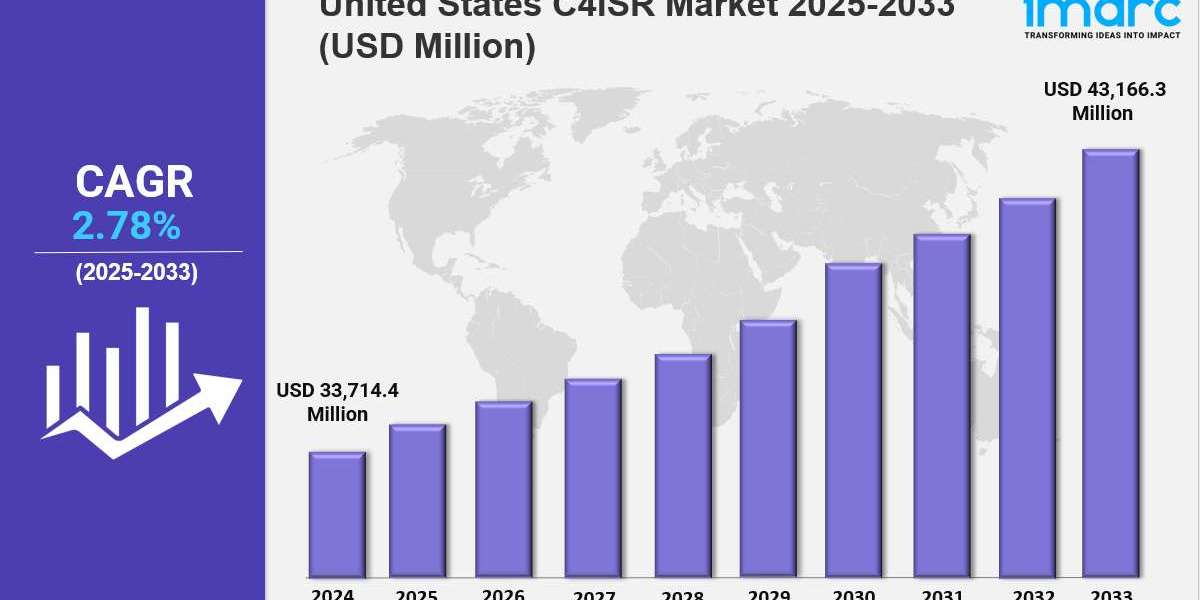

United States C4ISR market size reached USD 33,714.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 43,166.3 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 33,714.4 Million

Market Forecast in 2033: USD 43,166.3 Million

Market Growth Rate 2025-2033: 2.78%

Key Market Highlights:

✔️ Strong expansion driven by workforce optimization and digital transformation

✔️ Growing interest in employee wellness programs and skill development initiatives

✔️ Rising implementation of AI and analytics for talent management solutions

Request for a sample copy of the report https://www.imarcgroup.com/united-states-c4isr-market/requestsample

United States C4ISR Market Trends:

The United States C4ISR market is expanding steadily, supported by increased defense budgets and the Department of Defense’s Joint All-Domain Command and Control (JADC2) initiative. In 2024, JADC2 secured $12.3 billion in funding to improve coordination across land, air, sea, space, and cyber domains.

New technologies, including TITAN ground stations and Lockheed Martin’s MATRIX middleware, are already reducing delays between sensor detection and action, strengthening overall operational readiness. These improvements are directly influencing United States C4ISR market share, especially as the military adapts to emerging threats like hypersonic weapons.

Space Force Contributions and Technological Progress

The U.S. Space Force has become a key player in advancing the United States C4ISR market. The launch of the Resilient GPS constellation, designed to operate even in electronic warfare environments, represents a major milestone. At the same time, artificial intelligence integration is reshaping command systems by enabling faster and more accurate data processing. These advancements reflect broader United States C4ISR market trends, where advanced, networked systems are becoming essential for modern defense strategies.

Commercial innovation is also shaping the market. For example, Microsoft’s Azure Tactical Edge provides quantum-resistant encryption and forward-deployed ISR data processing, highlighting the trend toward secure cloud-enabled operations. Yet, interoperability challenges remain. A Joint Requirements Oversight Council (JROC) study in 2024 showed that more than two-thirds of Army legacy systems cannot fully integrate with Navy networks, an obstacle that could limit long-term market growth. Addressing these gaps is critical to maintaining a positive United States C4ISR market outlook.

Artificial intelligence and automation continue to redefine C4ISR systems. Platforms such as Palantir’s AIP-Conductor integrate multiple data sources—from satellite imagery to signals intelligence—into a single operating picture. NVIDIA’s Jetson AGX Orin enables autonomous drone targeting, while Project Maven processes millions of hours of video daily. These innovations enhance U.S. competitiveness globally and contribute to stronger United States C4ISR market share. At the same time, new validation frameworks are being introduced to ensure transparency and reduce risks of bias in AI-driven decision-making.

Cybersecurity, Electronic Warfare, and Strategic Importance

Cybersecurity and electronic warfare are among the fastest-growing segments. Initiatives such as MIT’s Quantum Key Distribution technology and Raytheon’s advanced jamming systems highlight progress in safeguarding communications. To support supply chain resilience, Congress has invested $3.2 billion in domestic semiconductor production, reinforcing the infrastructure that underpins C4ISR capabilities. The Indo-Pacific region accounted for nearly half of U.S. C4ISR investments in 2024, underlining its strategic importance. Programs like the Replicator Initiative, which deployed thousands of SIGINT-enabled drones, illustrate how innovation is driving United States C4ISR market trends in contested regions.

Workforce Development and Future Outlook

Emerging materials and workforce readiness are also shaping the market. Breakthroughs such as graphene-based terahertz sensors and DARPA’s neuromorphic processors are raising performance standards. Meanwhile, programs like the Cyber Operations Academy are helping address skill shortages by training the next generation of specialists.

Looking ahead, the United States C4ISR market outlook remains highly favorable, with projections suggesting the market could reach $140 billion by 2029. Upcoming initiatives, including quantum radar trials and autonomous electronic warfare platforms, point toward continued growth. As global security challenges intensify, investment in secure, interoperable, and AI-driven systems will remain central to United States C4ISR market growth and long-term strategic dominance.

United States C4ISR Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Platform:

- Land

- Naval

- Airborne

- Space

Breakup by Solution:

- Products

- Services

Breakup by End Use Sector:

- Defense

- Commercial

Breakup by Application:

- Intelligence

- Surveillance and Reconnaissance

- Electronic Warfare

- Computers

- Communication

- Command and Control

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145