In the rapidly evolving life sciences sector, cell culture media has become a cornerstone technology driving innovation across biopharmaceutical production, diagnostics, and regenerative medicine. Once regarded primarily as a supporting laboratory material, cell culture media has now emerged as a strategic enabler of drug discovery, therapeutic development, and large-scale biologics manufacturing.

The global cell culture media market is projected to grow from USD 6.2 billion in 2023 to USD 13.0 billion by 2028, at a CAGR of 16%. This exceptional pace reflects not only the rising demand for biologics and biosimilars but also the expansion of stem cell research, advanced therapies, and vaccine production. For C-level executives, this is more than a market statistic—it is a signal of a shifting paradigm in healthcare delivery and a window into substantial business opportunities.

The Strategic Importance of Cell Culture Media

Cell culture media is no longer viewed as a consumable commodity but rather as a critical element of the biopharma value chain. Its importance lies in enabling the controlled growth, proliferation, and differentiation of cells under laboratory and industrial conditions.

Executives should recognize three core reasons why this market is becoming strategically important:

- Foundation of Biologics Manufacturing – Biopharmaceuticals, especially monoclonal antibodies (mAbs) and vaccines, rely heavily on optimized culture conditions for efficacy, consistency, and scalability.

- Acceleration of Advanced Therapies – Stem cell and regenerative medicine therapies demand specialized and high-quality media, creating niche opportunities.

- Transition to Sustainable Solutions – The shift toward serum-free and chemically defined media reflects a broader trend toward safety, reproducibility, and regulatory compliance.

This makes investment in cell culture media more than a laboratory necessity—it positions organizations at the forefront of therapeutic innovation.

Market Drivers Powering Growth

Several macro and sector-specific forces are converging to propel the cell culture media market forward:

- Rising Demand for Biosimilars and Monoclonal Antibodies

Global healthcare systems are increasingly reliant on biologics for treating cancer, autoimmune disorders, and infectious diseases. The push for affordable biosimilars is expanding biomanufacturing capacity worldwide, and with it, the demand for advanced culture media formulations.

- Expanding Stem Cell Research and Regenerative Medicine

Stem cell-based therapies are transitioning from experimental pipelines to commercial reality. Governments and private investors are boosting funding, and media optimized for pluripotent and differentiated cell lines is becoming a critical growth enabler.

- Vaccine Innovation and Pandemic Preparedness

The COVID-19 pandemic highlighted the importance of scalable, cell-based vaccine platforms. Continued focus on preparedness against emerging infectious diseases ensures that culture media will remain central to vaccine R&D and mass production.

- Shift Toward Serum-Free and Chemically Defined Media

The industry is steadily moving away from animal-derived components due to regulatory, ethical, and reproducibility concerns. Serum-free and chemically defined media not only provide safety but also offer consistency, making them attractive for large-scale manufacturing.

- Regional Growth Dynamics

The Asia Pacific region is experiencing the fastest CAGR due to cost-effective manufacturing, favorable government policies, and a surge in clinical research. For decision-makers, this signals both partnership and expansion opportunities in high-growth markets.

Segmentation Insights: Where the Opportunities Lie

By Type: Serum-Free Media Leads the Way

The serum-free media segment dominates the market due to its superior reproducibility, safety profile, and regulatory acceptance. With the rising focus on cell-based therapies and scalable vaccine production, this trend will accelerate. Specialty media and chemically defined formulations will also expand as biopharma companies pursue tailored solutions for specific applications.

By Application: Biopharmaceutical Production at the Core

Unsurprisingly, biopharmaceutical production holds the largest market share. Applications include mAbs, vaccines, therapeutic proteins, and engineered biologics. This segment will continue to expand as biologics outpace small molecules in pipeline growth and commercialization.

Emerging applications such as tissue engineering and personalized diagnostics are expected to generate new high-value demand, further diversifying market opportunities.

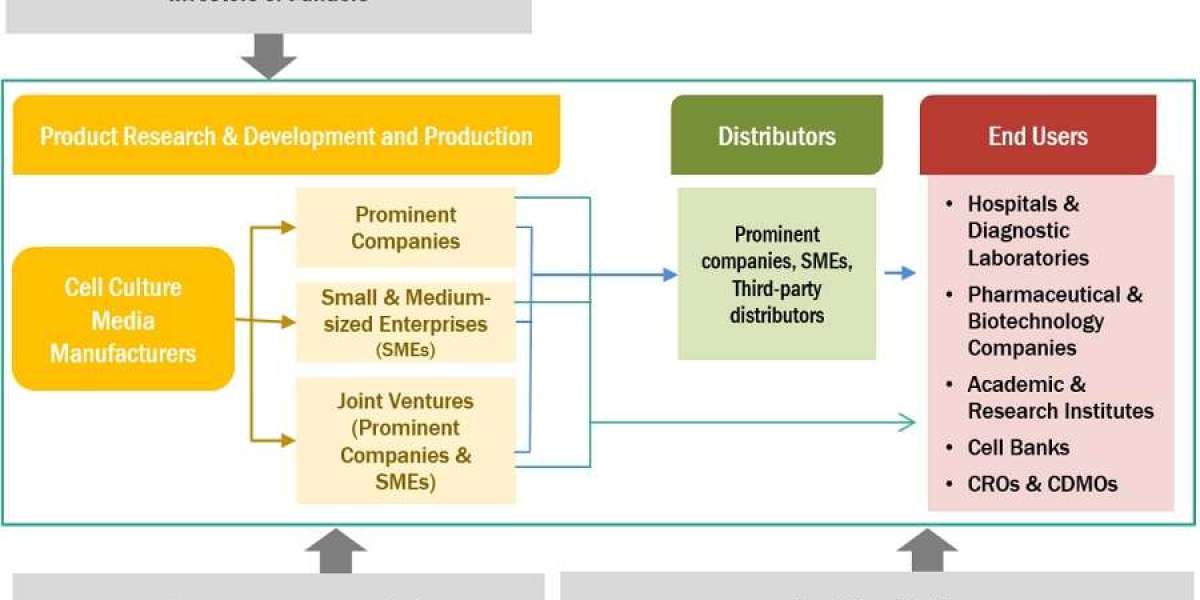

By End User: Pharma and Biotech Drive Demand

Pharmaceutical and biotechnology companies are the largest end users of cell culture media. Their adoption of advanced formulations reflects both the scale of their operations and the regulatory requirements for high-quality, reproducible results. Academic institutions and diagnostics players will contribute additional growth momentum.

Industry Transformation: From Lab Supply to Strategic Differentiator

The cell culture media market is undergoing a profound transformation that executives cannot ignore:

- Integration with Bioprocessing Platforms – Media optimization is being closely integrated with bioreactor technologies and automation platforms, improving efficiency and scalability.

- Digitalization of Media Development – AI-driven optimization is enabling predictive formulation, reducing time-to-market for new therapeutics.

- Customization for Niche Applications – Media suppliers are increasingly providing tailored solutions for specific cell lines, creating opportunities for premium pricing models.

- Sustainability in Media Manufacturing – Eco-friendly, animal-free, and resource-efficient formulations are gaining traction as both environmental and regulatory expectations evolve.

This transformation means that executives should no longer view media as interchangeable but as a lever for innovation, efficiency, and differentiation.

Regional Outlook: Why Asia Pacific Is the Market to Watch

While North America and Europe remain innovation hubs, Asia Pacific is emerging as the fastest-growing region. Several factors explain this trajectory:

- Lower Manufacturing Costs – APAC provides a cost-efficient environment for large-scale biologics and vaccine production.

- Government Incentives – Countries such as China, India, and South Korea are heavily investing in life sciences infrastructure and R&D.

- Growing Clinical Research Activity – The region is increasingly hosting early-stage and late-stage clinical trials, driving demand for cell culture products.

- Strategic Market Expansion – Global players are entering APAC markets through acquisitions, partnerships, and local production facilities.

For C-level executives, this makes APAC not only a supply chain hub but also a long-term strategic market for biopharma growth.

Business Opportunities and Strategic Considerations

As the market expands, executives should consider the following strategic opportunities:

- Invest in Media Innovation – Companies that innovate in serum-free, chemically defined, and specialty media can secure competitive differentiation.

- Expand Biopharma Partnerships – Collaboration with pharmaceutical and biotech firms can secure recurring demand and co-development opportunities.

- Localize in Emerging Markets – Establishing a footprint in Asia Pacific can provide access to high-growth regions while optimizing cost structures.

- Leverage Digital and AI Platforms – Media optimization through AI not only accelerates innovation but also enhances reproducibility and regulatory compliance.

- Adopt a Sustainability Agenda – Positioning cell culture media as part of a greener value chain can build long-term brand value and align with global ESG priorities.

The Future Outlook: A Market of Strategic Scale

Looking ahead, the cell culture media market will be defined by three transformative shifts:

- Mainstreaming of Advanced Therapies – As regenerative medicine and cell-based therapies move into commercial stages, the demand for advanced culture media will accelerate.

- Industrialization of Biologics Production – Large-scale, automated facilities will depend on highly consistent media formulations, creating opportunities for premium and customized solutions.

- Globalization of Research and Manufacturing – With APAC at the center of expansion, companies will need to balance global supply chain resilience with regional specialization.

For executives, the cell culture media market is not simply about laboratory inputs—it represents a strategic opportunity to participate in shaping the future of healthcare delivery.

Conclusion

The cell culture media market is undergoing a period of accelerated transformation, projected to reach USD 13.0 billion by 2028 at a remarkable 16% CAGR. Driven by the rising demand for biologics, breakthroughs in regenerative medicine, and regional expansion in Asia Pacific, this market is redefining its role from laboratory consumable to strategic differentiator in the biopharma value chain.

For business leaders, the key lies in recognizing that investment in cell culture media is not just operational—it is a catalyst for innovation, market leadership, and long-term growth. Companies that align their strategies with this evolving landscape will be well-positioned to capitalize on one of the most dynamic growth opportunities in life sciences.