The compressor rental market involves the leasing of air and gas compressors for various applications across industries such as construction, manufacturing, oil and gas, and mining. Renting compressors provides flexibility, cost savings, and access to the latest technologies without the need for significant capital investment. This market is gaining traction due to the increasing demand for compressed air solutions, particularly in sectors requiring temporary or mobile air supply.

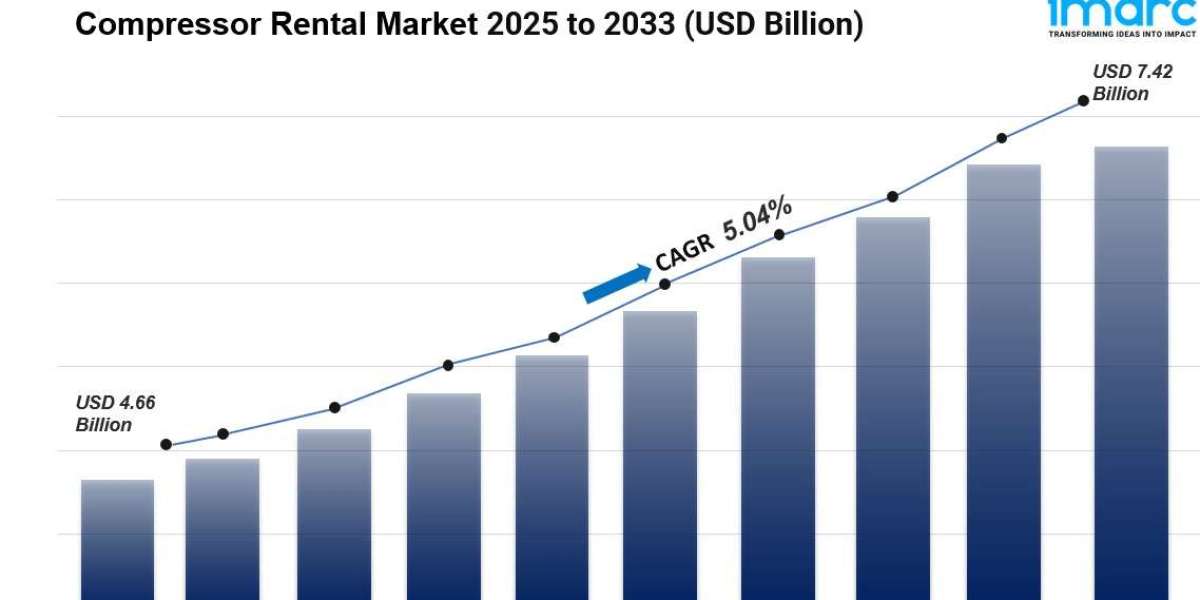

The global compressor rental market size was valued at USD 4.66 Billion in 2024. The market is projected to reach USD 7.42 Billion by 2033, exhibiting a CAGR of 5.04% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 37.6% in 2024. The market is fueled by growing needs for short-term and flexible equipment solutions across industries like construction, mining, and oil and gas. Along with this, the mounting focus on cost-effectiveness, coupled with the desire to minimize capital spending, also leads to the increased usage of rental services versus buying. Furthermore, technological advancements in compressors and an uptick in infrastructure development projects worldwide are key drivers augmenting the compressor rental market share.

Request Sample URL: https://www.imarcgroup.com/compressor-rental-market/requestsample

Key Highlights

- Market Growth:

- The global compressor rental market is projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next few years.

- The growth is driven by rising industrial activities, infrastructure development, and the need for efficient air compression solutions.

- Types of Compressors:

- The market includes various types of compressors available for rent, such as:

- Portable Air Compressors: Commonly used in construction and outdoor applications.

- Industrial Air Compressors: Used for manufacturing and large-scale operations.

- Gas Compressors: Employed in oil and gas extraction and processing.

- Refrigeration Compressors: Utilized in HVAC and refrigeration applications.

- Geographical Insights:

- North America holds a significant share of the compressor rental market, driven by robust construction and industrial sectors.

- The Asia-Pacific region is emerging as a key growth area, with rapid industrialization and increasing investments in infrastructure projects.

- Consumer Demographics:

- The compressor rental market serves a diverse range of consumers, including construction companies, manufacturers, event organizers, and oil and gas operators.

- The demand from small and medium-sized enterprises (SMEs) seeking flexible rental solutions is particularly strong.

- Distribution Channels:

- Compressor rental services are typically offered through various channels, including:

- Direct Rental Services: Companies providing rental services directly to end-users.

- Online Platforms: E-commerce websites facilitating compressor rentals.

- Equipment Rental Companies: Specialized firms focusing on equipment leasing.

Trends in the Compressor Rental Market

- Technological Advancements:

- Innovations in compressor technology, including energy-efficient models and smart monitoring systems, are enhancing the performance and reliability of rental units.

- The adoption of IoT and remote monitoring solutions is allowing users to track compressor performance and optimize usage.

- Sustainability and Energy Efficiency:

- There is a growing emphasis on renting energy-efficient compressors to reduce operational costs and environmental impact.

- Rental companies are increasingly offering eco-friendly compressors that comply with sustainability standards.

- Increasing Demand for Temporary Solutions:

- The need for temporary air supply solutions in construction, events, and emergency situations is driving the growth of the compressor rental market.

- Companies are increasingly opting for rentals rather than purchases to meet short-term project requirements.

- Customization and Flexible Rental Options:

- The demand for customized rental packages tailored to specific project needs is rising, with companies offering a range of compressor sizes and specifications.

- Flexible rental terms, including short-term and long-term leases, are becoming more common to accommodate varying project durations.

- Regulatory Compliance and Safety Standards:

- Stricter regulations regarding emissions and safety standards are influencing the compressor rental market.

- Rental companies are focusing on compliance with industry standards to ensure safety and reliability in their equipment.

Buy Now: https://www.imarcgroup.com/checkout?id=2456&method=1670

Drivers of the Compressor Rental Market

- Growing Industrial and Construction Activities:

- Increased investments in infrastructure development and industrial projects are driving the demand for rental compressors.

- The construction sector's reliance on portable and efficient air solutions is a significant driver of market growth.

- Cost-Effectiveness:

- Renting compressors allows companies to avoid high capital expenditures associated with purchasing equipment, making it a cost-effective solution for many businesses.

- The ability to access the latest technology without long-term financial commitment is appealing to many users.

- Flexibility and Convenience:

- The flexibility of rental agreements allows companies to scale their compressor needs based on project requirements, providing convenience and adaptability.

- Quick access to rental units enables businesses to respond rapidly to changing demands.

- Technological Advancements:

- Continuous improvements in compressor technology, including energy efficiency and advanced features, are driving companies to opt for rentals to leverage the latest innovations.

- The integration of smart technologies enhances operational efficiency and monitoring capabilities.

- Increased Focus on Sustainability:

- As companies strive to reduce their environmental impact, the demand for energy-efficient and eco-friendly compressors is rising.

- Renting sustainable equipment aligns with corporate social responsibility goals and regulatory compliance.

Compressor Rental Industry Segmentation:

Analysis by Technology Type:

- Rotary Screw

- Reciprocating

- Centrifugal

Rotary screw leads the market with around 67.7% of market share in 2024

Analysis by Compressor Type:

- Air Compressor

- Gas Compressor

The rising demand for air and gas compressors in various specialized applications, such as oil and gas exploration, petrochemical processing, and offshore drilling, where they are required to handle specific gases and varying pressure conditions, is influencing the market growth.

Analysis by End Use Industry:

- Construction

- Mining

- Oil and Gas

- Power

- Manufacturing

- Chemical

- Others

Construction leads the market with around 38.9% of market share in 2024

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Top Compressor Rental Market Leaders:

The gaming console market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some Of the Key Players In The Market Are:

- Acme Fabcon India Private Limited

- Aggreko Plc

- Ar Brasil Compressores Ltda

- Ashtead Group Plc

- Atlas Copco AB

- Caterpillar Inc.

- Herc Rentals Inc.

- Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc)

- Ramirent Finland Oy (Loxam)

- United Rentals Inc.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2456&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145