IMARC Group, a leading market research company, has recently released a report titled "Small Satellite Market Size, Share, Trends and Forecast by Component, Type, Frequency, Application, End User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global small satellite market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Small Satellite Market Highlights:

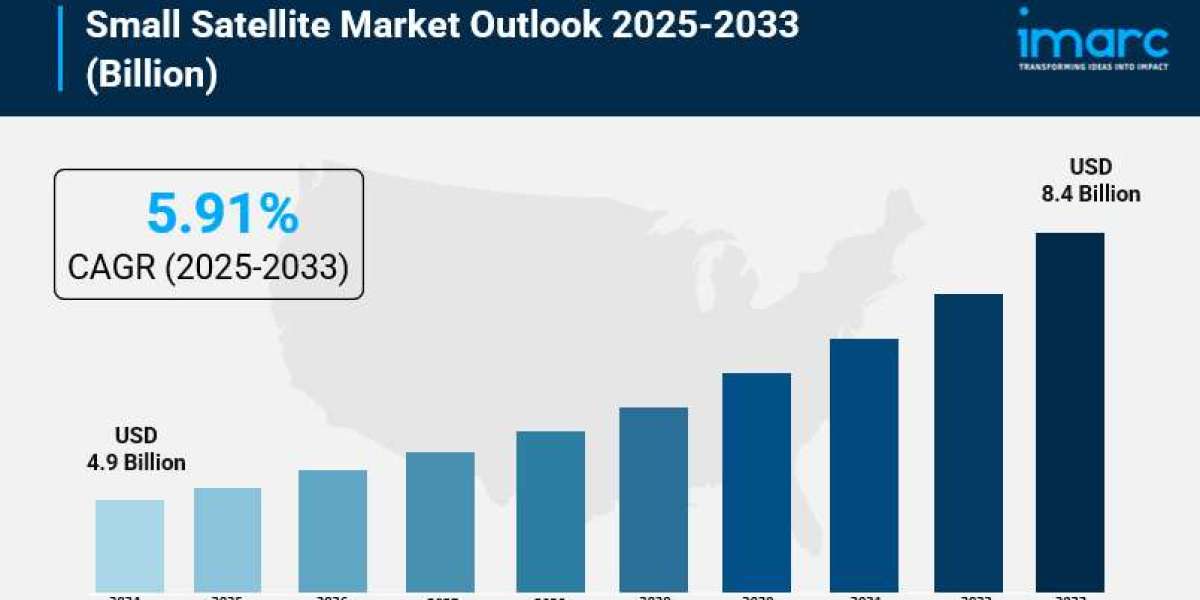

- Small Satellite Market Size: Valued at USD 4.9 Billion in 2024

- Small Satellite Market Forecast: The market is expected to reach USD 8.4 billion by 2033, growing at 5.91% annually

- Market Growth: The small satellite market is experiencing robust growth driven by expanding space infrastructure and rising demand for real-time data services

- Technology Integration: Revolutionary technologies like AI-powered analytics, IoT-enabled systems, and advanced miniaturization are transforming satellite operations

- Regional Leadership: North America commands the largest market share at 43.3%, driven by strong government support and private sector innovation

- Cost Efficiency: Dramatic reductions in launch costs through reusable rocket technology are making space more accessible than ever

- Key Players: Industry leaders include Lockheed Martin, Airbus, Blue Canyon Technologies, and AAC Clyde Space, which dominate with cutting-edge solutions

- Market Applications: Earth observation leads with strong demand for environmental monitoring and disaster management solutions.

Claim Your Free “Small Satellite Market” Insights Sample PDF: https://www.imarcgroup.com/small-satellite-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Revolutionary Constellation Deployments Reshaping Space Access:

The satellite industry witnesses an unprecedented transformation within as mega-constellations redefine global connectivity. Amazon plans on investing more than $10 billion to launch Kuiper with 3,232 satellites into Low Earth Orbit before 2029 while SpaceX also plans to launch nearly 12,000 satellites for the Starlink constellation. Networks that are linked providing smooth global coverage mark this massive deployment as a shift that is fundamental from customary single-satellite missions. Starlink has now launched almost 6,000 small satellites so far. This action establishes its dominance within the global broadband connectivity market. These constellation projects drive demand for standardized, cost-effective small satellites, ready for mass production plus rapid deployment, creating industry-wide economies.

- Game-Changing Cost Reductions Through Launch Innovation:

Reusable launch technology transformed space access economics in totality. Rideshare programs did also contribute to this revolution. Since 2018, weekly Falcon 9 launches and reusable boosters have lifted annual global satellite deployments by more than 70%. Due to the increase, dramatic per-bit cost reductions have come about. For smaller organizations including startups and universities, this cost efficiency breakthrough enables access to space for the first time. ISRO's SSLV for example can place satellites weighing 5 kg to 500 kg in orbit plus it needs little launch structure and launch capability on demand. Space access promotes and creates innovation in industries. These industries range from agriculture as well as environmental monitoring to telecommunications plus defense applications.

- Cutting-Edge Government Initiatives Driving Innovation:

Worldwide government agencies actively develop small satellites through targeted investing also planned partnering. In August 2024, ISRO successfully launched its Earth Observation Satellite, EOS-08, which weighed approximately 175.5 kg, as well as was designed for a mission life of one year in Circular Low Earth Orbit at 475 km altitude. Government missions show small satellites are reliable and capable for applications that are critical. Additionally, defense coupled with security applications are becoming increasingly important since governments recognize small satellites' planned value for surveillance, communication, also intelligence gathering in an era of evolving security challenges.

- Advanced Technology Integration Creating New Possibilities:

Small satellites increasingly do integrate artificial intelligence and also advanced sensors. They do also process data at any time that is real, which makes them quite advanced. Much more larger and more expensive platforms were at one time required for complex tasks that are now performed by modern small satellites. Ananth Technologies, Digantara, and Space Machines Company worked together in September 2024 to improve satellite services, scheduling their Optimus spacecraft's launch on ISRO's SSLV in 2026. These technological advances enable applications like real-time disaster monitoring, precision agriculture, and autonomous navigation systems giving users immediate value on Earth.

Small Satellite Market Report Segmentation:

Breakup by Component:

- Payloads and Structures

- Electric Power System

- Solar Panels and Antenna System

- Propulsion System

- Others

Payloads and structures dominate with 38.2% market share, remaining the critical component that determines satellite functionality and mission success.

Breakup by Type:

- Mini Satellite

- Micro Satellite

- Nano Satellite

- Others

Micro satellites lead with 40.4% market share, reflecting their optimal balance between capability and cost-effectiveness for diverse mission requirements.

Breakup by Frequency:

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- Ka-Band

- Q/V-Band

- HF/VHF/UHF-Band

- Others

Ku-Band commands 22.8% of market share, representing the preferred choice for high-data-rate communications and broadband internet services.

Breakup by Application:

- Communication

- Earth Observation and Remote Sensing

- Science and Exploration

- Mapping and Navigation

- Space Observation

- Others

Earth observation and remote sensing leads with 34.3% market share, driven by increasing demand for environmental monitoring and disaster management solutions.

Breakup by End User:

- Commercial

- Academic

- Government and Military

- Others

Government and military sectors account for 47.3% of the market, reflecting the strategic importance of satellite technology for national security and defense applications.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- AAC Clyde Space

- Airbus U.S. Space & Defense, Inc.

- Blue Canyon Technologies LLC (RTX Corporation)

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Millennium Space Systems, Inc. (The Boeing Company)

- Northrop Grumman

- Spire Global

- Tyvak International (Terran Orbital Corporation)

Request Customization: https://www.imarcgroup.com/request?type=report&id=6120&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302