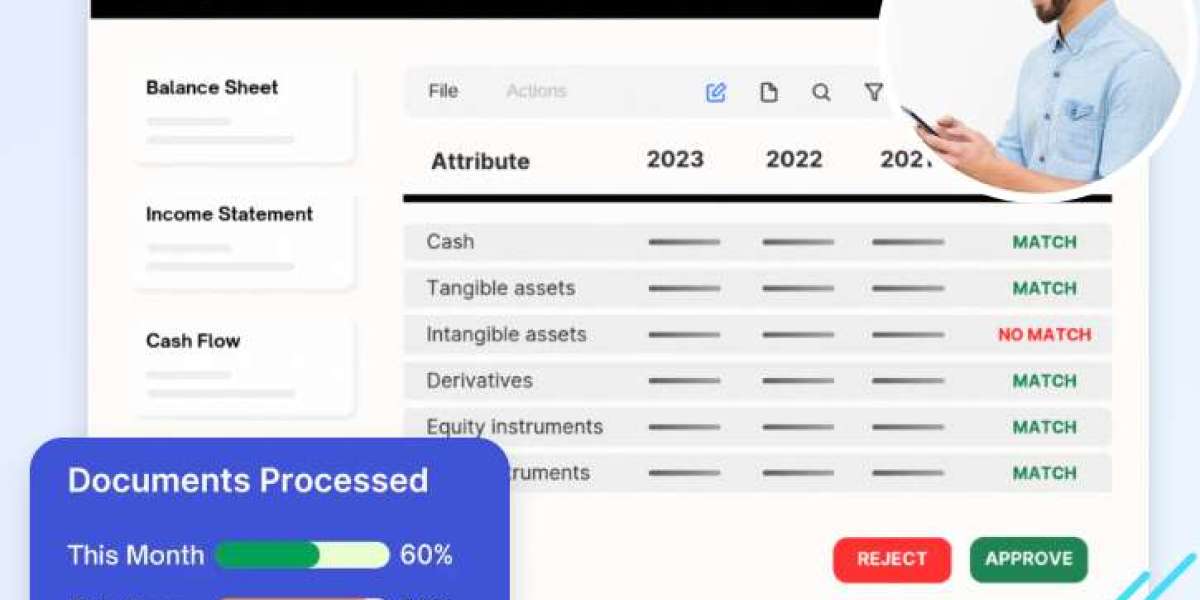

Financial spreading automation is transforming how institutions handle financial data by replacing manual processes with intelligent, technology-driven solutions. Traditionally, spreading financial statements required hours of data entry and formatting, often leading to errors and inconsistencies. With financial spreading automation, balance sheets, income statements, and cash flow reports are quickly standardized into structured formats, enabling accurate ratio analysis, risk assessment, and performance comparisons. This not only saves time but also enhances precision and regulatory compliance. Banks and businesses benefit from faster credit evaluations, improved forecasting, and streamlined decision-making. Financial spreading automation empowers analysts to focus on strategic insights rather than repetitive tasks, driving greater efficiency and reliability in financial management.

kelly walker

9 وبلاگ نوشته ها