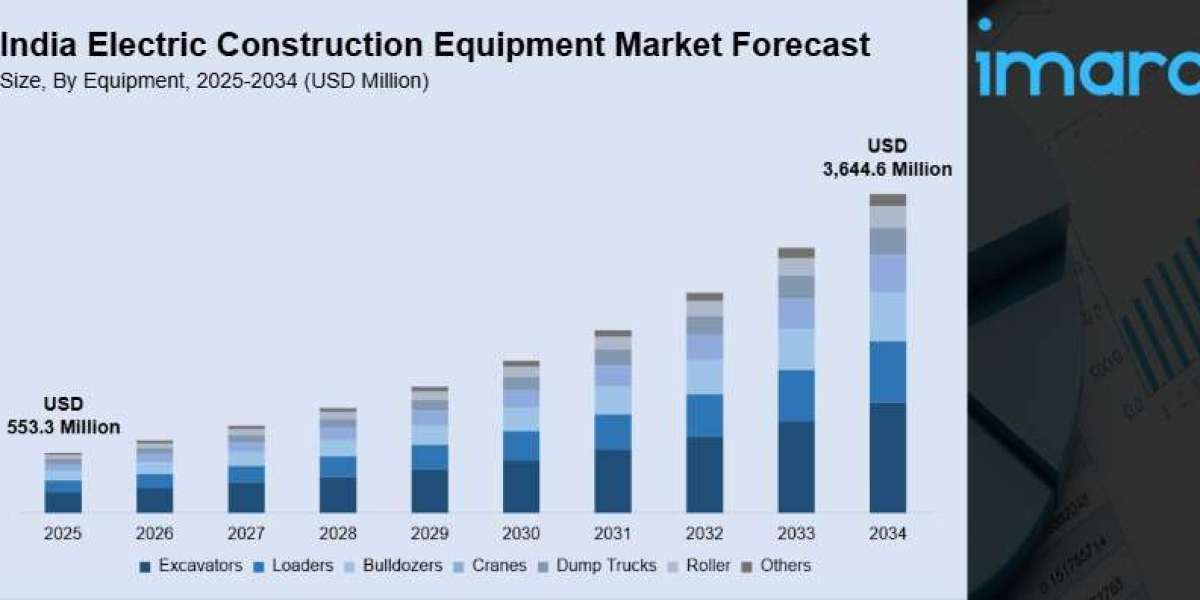

The India electric construction equipment market was valued at USD 553.3 Million in 2025 and is projected to reach USD 3,644.6 Million by 2034. It is anticipated to grow at a CAGR of 22.14% during the forecast period 2026–2034. Growth is driven by government infrastructure programs, tightening emission regulations, and advancements in battery technologies enhancing operational efficiency and reducing ownership costs. The report presents a thorough review featuring the India electric construction equipment market trends, share, growth, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA ELECTRIC CONSTRUCTION EQUIPMENT MARKET KEY TAKEAWAYS

- Current Market Size: USD 553.3 Million in 2025

- CAGR: 22.14%

- Forecast Period: 2026-2034

- Excavators dominated the market with a 34.8% share in 2025 due to their versatility in construction and mining projects requiring zero-emission vehicles.

- The 50 kWh to 200 kWh battery capacity segment led with a 46.5% share, balancing runtime and cost efficiency.

- Lithium-ion batteries held 62.9% market share in 2025, driven by energy density, lifespan, and charging advantages.

- Battery Electric Vehicles (BEV) led power source market share with 71.4%, driven by regulatory demands and lifecycle cost benefits.

- Construction was the dominant end-use segment with 57.6% share, supported by government spending on infrastructure.

- West India accounted for the largest regional market share of 36.2% in 2025, benefiting from industrial corridors and infrastructure hubs.

Sample Request Link: https://www.imarcgroup.com/india-electric-construction-equipment-market/requestsample

MARKET TRENDS

The rapid electrification of mini and compact excavators is evident as Indian cities impose stricter noise and emission controls at construction sites. In December 2024, Greaves Retail launched electric mini excavators (2–4 Ton) focused on near-silent, zero-emission operation suited for urban infrastructure projects such as metro rail corridors and smart cities, mandating low-emission machinery compliance.

Advanced battery management systems combined with IoT-based digital fleet technologies are revolutionizing electric equipment deployment and maintenance. Sany India introduced an Intelligent Service Platform with telematics integration, enabling real-time tracking, remote diagnostics, and predictive maintenance to optimize utilization and energy consumption, thereby increasing machine uptime and operational efficiency.

Modular and containerized charging infrastructure is becoming vital for supporting dispersed construction sites. Unlike fixed stations, portable "Charger on Wheels" systems supported by Exicom Tele-Systems in 2025 provide flexible, on-demand charging solutions that overcome the challenge of electrification in dynamic project environments. Regulatory standards on battery and electric system safety further encourage investment in site-level charging ecosystems.

MARKET GROWTH FACTORS

Government flagship initiatives have propelled the India electric construction equipment market by fostering infrastructure development. With investments spanning energy, roads, urban infrastructure, and railways, equipment demand has surged. For instance, the Ministry of Housing and Urban Affairs launched the Green Metro Rail Equipment Program in 2025 to accelerate adoption of electric machinery across metro rail projects, curbing urban emissions and noise.

Stringent emission norms for construction vehicles serve as a significant growth catalyst. India enforces advanced emission standards for wheeled equipment, increasing costs for diesel machines and making electric alternatives more competitive. Proposed safety regulations governing battery safety and vehicle design bolster the confidence of manufacturers and users to transition fleets toward electrification.

Technological advancements in lithium-ion battery systems have reduced costs and improved performance, making electric machinery more viable. Battery pack costs have fallen substantially, aided by government incentive programs targeting domestic battery manufacturing. For example, the ACC PLI scheme commissioned just 1.4 GWh (2.8%) of a 50 GWh target, with $330 million invested primarily by Ola Electric, enhancing supply chain resilience and cost reductions.

MARKET SEGMENTATION

Equipment:

- Excavators: Most widely adopted due to versatility across earthmoving, trenching, demolition, with models from compact to heavy-duty mining variants.

- Loaders

- Bulldozers

- Cranes

- Dump Trucks

- Roller

- Others

Battery Capacity:

- Less than 50 kWh

- 50 kWh to 200 kWh: Powers medium-duty machines such as mini excavators, loaders, rollers suited for urban and road projects; favored due to manageable charging using standard industrial power.

- More than 200 kWh

Battery Technology:

- Lead-acid

- Lithium-ion: Dominant due to high energy density, long cycle life, rapid charging. Indigenous BMS systems and lithium iron phosphate chemistry adoption reduce supply vulnerabilities.

- Nickel-metal hydride

Power Source:

- Battery Electric Vehicles (BEV): Preferred for zero tailpipe emissions, lower lifecycle costs, and simpler maintenance compared to hybrids.

- Plug-in Hybrid Electric Vehicles (PHEV)

End Use:

- Construction: Leading segment driven by government infrastructure projects including highways, affordable housing, metro rail, and smart cities.

- Mining

- Material Handling

- Agriculture

- Others

Region:

- North India

- South India

- East India

- West India

REGIONAL INSIGHTS

West India leads the India electric construction equipment market, holding a 36.2% share in 2025. This dominance is due to a concentration of industrial corridors, port infrastructure, manufacturing hubs, and robust logistics networks enabling effective equipment adoption and servicing. Ongoing mega projects, including high-speed rail and metro rail expansions, further drive demand in this region.

RECENT DEVELOPMENTS & NEWS

In December 2025, Chennai-based IEPL launched India's first Dual Electric-Diesel Hybrid Excavator, delivering over 100 machines to 27 customers. These hybrid excavators improve fuel efficiency and support sustainable construction. IEPL also opened a new facility and planned a training academy to enhance customization, after-sales service, and workforce skill development for the sector.

In the same month, Volvo Construction Equipment showcased the EC215 excavator, SD110 compactor, and commercially launched the L120 Electric Wheel Loader at EXCON 2025, reinforcing its sustainability strategy focused on the Indian market.

KEY PLAYERS

- Volvo Construction Equipment

- Greaves Retail

- Sany India

- Exicom Tele-Systems

- Propel Industries

- Godrej & Boyce

- Schwing Stetter

- Qucev Technologies

- JCB India

- IEPL

CUSTOMIZATION NOTE:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302