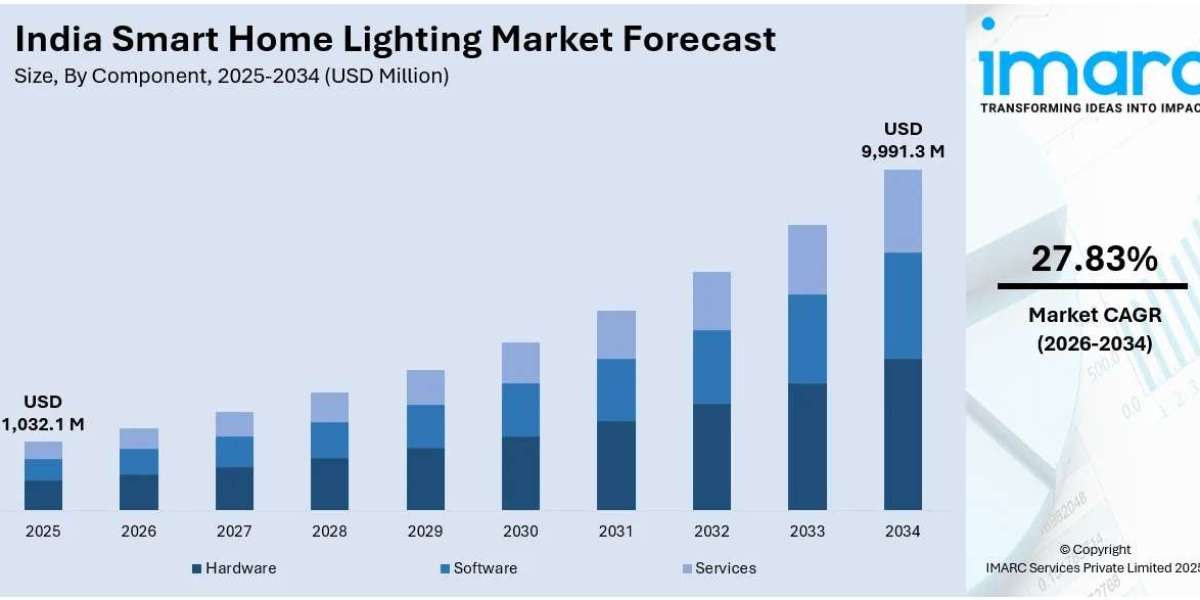

The India smart home lighting market size reached USD 1,032.1 Million in 2025. It is expected to grow to USD 9,991.3 Million by 2034, exhibiting a CAGR of 27.83% during 2026–2034. This growth is driven by rising urbanization, increased adoption of smart home technologies, and heightened energy efficiency awareness. Smartphone penetration, government smart city initiatives, and technological advancements like IoT and voice-controlled systems are further enhancing convenience, customization, and energy-saving capabilities in the market. The report presents a thorough review featuring the India smart home lighting market outlook, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA SMART HOME LIGHTING MARKET KEY TAKEAWAYS

- Current Market Size: USD 1,032.1 Million in 2025

- CAGR: 27.83% during 2026-2034

- Forecast Period: 2026-2034

- Drivers include rapid urbanization, growing disposable incomes among middle-class households, and increasing consumer interest in home automation and smart lighting systems.

- Technological advancements such as IoT integration and voice-operated assistants have made smart lighting more accessible and energy-efficient.

- Strategic collaborations, such as TP-Link with Optiemus Electronics and product launches by Signify and ABB India, indicate strong industry movement.

- The market includes hardware, software, and services across diverse segments like component, light source, communication technology, application, and region.

Sample Request Link: https://www.imarcgroup.com/india-smart-home-lighting-market/requestsample

MARKET TRENDS

Urbanization and Rising Disposable Incomes: The rapid growth of urban areas in India has created increased demand for homes with intelligent technologies. More individuals moving to cities has led to growing consumer interest in upgrading their home lifestyle with smart lighting systems. Additionally, rising disposable incomes among middle-class households enable consumers to invest in innovative lighting solutions that offer convenience, aesthetics, and energy efficiency. The aspiration for smart living spaces and the growing trend of home automation in urban areas have significantly boosted the market share in both residential and commercial infrastructure.

Advancements in IoT and Smart Technologies: The integration of the Internet of Things (IoT) with lighting systems has revolutionized the smart home lighting landscape. IoT-enabled devices allow consumers to manage lighting systems via mobile phones, voice assistants, and automated platforms. Features such as adaptive lighting, motion sensing, and scheduling improve efficiency and user experience. The affordability of IoT devices and the proliferation of voice assistants like Alexa and Google Home have made these solutions more accessible, turning smart lighting from a luxury to a practical energy-saving solution.

Technological Enhancements and Product Launches: In September 2024, ABB India introduced ABB-free@home®, an advanced smart home automation system with enhanced interoperability, including the Matter Bridge Add-on, facilitating seamless interaction with diverse smart devices. Signify’s launch of the Philips Smart Light Hub in major Indian cities further exemplifies the focus on delivering comprehensive smart lighting solutions. These advancements underscore the positive market outlook, driven by comfort, safety, energy efficiency, and customizable smart home experiences.

MARKET GROWTH FACTORS

The market is propelled by rising urbanization which demands intelligent home solutions to accommodate the growing urban population. More city dwellers desire smart lighting that enhances convenience and lifestyle. The rise in disposable incomes among India’s middle class empowers consumers to adopt advanced lighting technologies, fostering market expansion from residential to commercial applications.

Government initiatives focusing on smart cities also stimulate market growth by promoting energy-efficient and technologically advanced infrastructures. Smartphone penetration facilitates easy control and customization of lighting through apps and voice assistants, making smart lighting highly accessible for Indian consumers.

Technological progress, especially in IoT, smart sensors, and wireless communication, bolsters energy efficiency and user-friendliness. Companies introducing innovative products with interoperability features enhance consumer appeal, driving widespread adoption. These factors collectively support the forecast CAGR of 27.83% during 2026-2034.

MARKET SEGMENTATION

Component Insights:

- Hardware

- Lamps and Luminaires

- Lighting Controls

- Sensors

- Switches and Dimmers

- Gateways

- Software

- Services

The component segment covers hardware items including lamps and lighting controls such as sensors, switches, dimmers, and gateways, along with software and services supporting smart home lighting.

Light Source Insights:

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps (CFLs)

- High-Intensity Discharge Lamps

The market breaks down by light source into LED lamps, fluorescent lamps, CFLs, and high-intensity discharge lamps, detailing the various lighting technologies used.

Communication Technology Insights:

- Wired

- Wireless

The communication technology segment includes wired and wireless technologies used for controlling and managing smart home lighting systems.

Application Insights:

- Indoor

- Outdoor

Applications cover indoor and outdoor use of smart home lighting systems, reflecting different usage environments.

Regional Insights:

- North India

- South India

- East India

- West India

The regional analysis addresses the market dynamics in North, South, East, and West India.

REGIONAL INSIGHTS

The report does not specify a dominant region or provide specific market share or CAGR data by region. It segments the India smart home lighting market into North India, South India, East India, and West India, covering a comprehensive analysis of all major regional markets.

RECENT DEVELOPMENTS & NEWS

In January 2025, TP-Link and Optiemus Electronics formed a strategic alliance to produce networking devices and smart home products in India, supporting the "Make in India" initiative and expanding export markets.

In October 2024, Signify opened the Philips Smart Light Hub (SLH) in Lucknow, India’s largest smart lighting store, spanning over 3000+ square feet with a broad portfolio of 450+ SKUs, enhancing access to smart lighting products across the country.

KEY PLAYERS

- Signify

- ABB India

- TP-Link

- Optiemus Electronics

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302