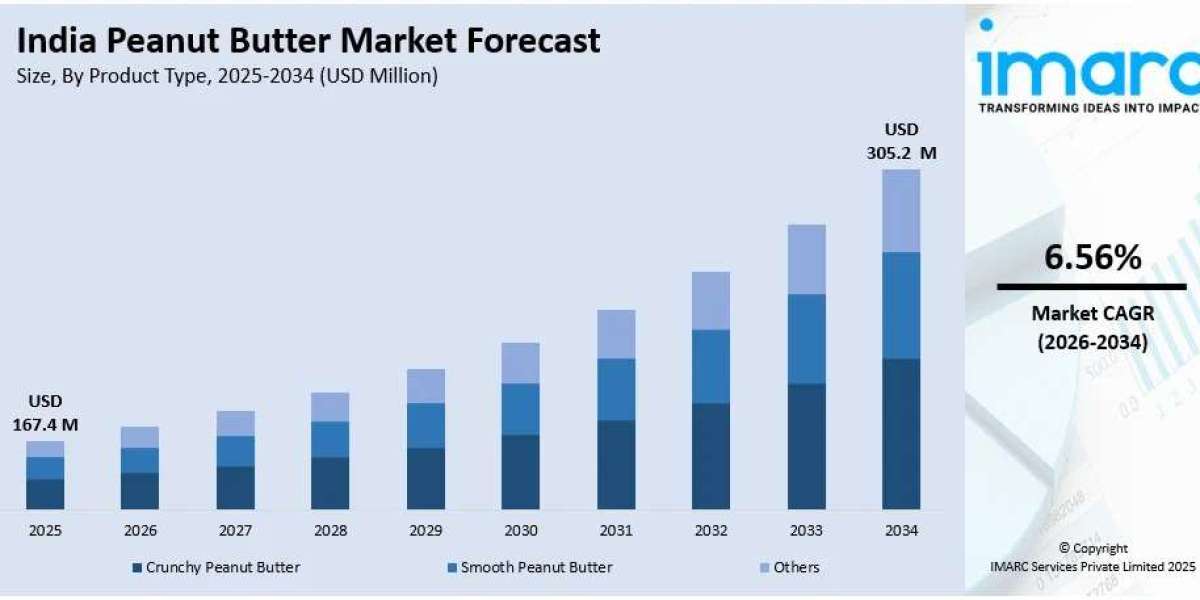

The India Peanut Butter Market was valued at USD 167.4 Million in 2025. It is expected to grow at a CAGR of 6.56% from 2026 to 2034, reaching a market size of USD 305.2 Million by 2034. The growth is driven by changing dietary trends, increased consumer health consciousness, and the rising popularity of plant-based diets which promote peanut butter as a nutritious protein source. The report presents a thorough review featuring the India Peanut Butter Market trends, share, growth, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA PEANUT BUTTER MARKET KEY TAKEAWAYS

- Current Market Size: USD 167.4 Million in 2025

- CAGR: 6.56%

- Forecast Period: 2026-2034

- Market growth is propelled by increasing health consciousness among consumers seeking high protein and healthy fat food options.

- Popularity of plant-based diets and alternatives to dairy and meat proteins boosts peanut butter demand.

- Organized retail and e-commerce platforms significantly aid market accessibility and growth.

- Introduction of innovative products such as organic, sugar-free, and flavored peanut butter variants attracts diverse demographics.

- India’s status as a strong peanut producer ensures cost-effective manufacturing and supply.

Sample Request Link: [https://www.imarcgroup.com/india-peanut-butter-market/requestsample

MARKET TRENDS

The rise of plant-based diets is a significant trend driving the India peanut butter market. Peanut butter is recognized as a healthy plant-based source of protein and fats, catering particularly to vegan customers substituting dairy spreads. Manufacturers are responding by introducing vegan-certified peanut butter products, aligning with growing health, environmental, and ethical concerns in urban populations where awareness and product availability are higher.

Peanut butter's culinary applications are expanding beyond traditional usage as a spread. It is increasingly incorporated into baked goods, smoothies, protein bars, and savory dishes, appealing to a wide consumer base. This aligns with the increasing demand for convenient, versatile ingredients with nutritional benefits. The growing Indian foodservice sector, projected to reach USD 123.5 Billion by 2033, is also adopting peanut butter as a key ingredient in various cuisines.

India's packaged food and beverage sector growth further propels peanut butter demand. With a shift towards ready-to-eat meals and increased consumption of packaged goods, peanut butter is featured in snack bars, spreads, and breakfast kits. The packaged food segment is expected to reach USD 46.3 Billion by 2028, encouraging manufacturers to innovate with organic, protein-rich, and low-fat peanut butter options to meet consumer demand for clean-label and healthy foods.

MARKET GROWTH FACTORS

Increasing health consciousness among consumers is a primary growth factor for the India peanut butter market. Consumers are gravitating towards foods rich in proteins, healthy fats, and essential vitamins. Peanut butter, rising in popularity due to these nutritional benefits, is positioned as a preferred dietary choice for fitness enthusiasts and health-conscious individuals. Its versatility as a breakfast spread, smoothie ingredient, and cooking base accelerates its acceptance.

The market benefits from the growth of organized retail and expanding e-commerce platforms in India. Digital platforms enhance consumer access to a wider variety of premium and locally manufactured peanut butter. The Indian e-commerce sector is projected to reach USD 325 Billion by 2030, facilitating wider distribution and encouraging single-serve packaging and eco-friendly formats that appeal to busy and environmentally conscious consumers.

India's strong production of peanuts presents a strategic advantage to manufacturers by enabling cost-effective peanut butter production. Domestic suppliers leverage this resource availability to cater not only to domestic demand but also to international markets. The synergy between healthy consumer trends, innovative marketing, and expanding distribution channels drives sustained market growth.

MARKET SEGMENTATION

Product Type:

- Crunchy Peanut Butter: Contains parts of peanuts, offering a more textured and robust spread preferred by consumers desiring texture.

- Smooth Peanut Butter: Creamier and silkier with finely ground peanuts, ideal for bread spreads, baking, and multiple recipes.

- Others: Not specifically detailed in the source.

Distribution Channel:

- Supermarkets and Hypermarkets: Significant for extensive variety and large quantity sales, favored in urban areas due to organized retail growth.

- Convenience Stores: Cater to on-the-go consumers with quick product access and small or single-serve packages.

- Online Stores: Growing due to convenience, home delivery, variety, and competitive pricing.

- Others: Not specifically detailed in the source.

Regions Covered:

- South India

- East India

- West and Central India

- North India

REGIONAL INSIGHTS

South India is the dominant region in the peanut butter market. Growth is driven by consumer health consciousness and urbanization in cities like Bengaluru, Chennai, and Hyderabad, increasing demand for nutritious snacks. The ready-to-eat market is expected to grow nearly 45% from 2024, fueling peanut butter consumption. Other regions such as East India, West and Central India, and North India are also witnessing rising demand influenced by growing urban populations, disposable incomes, and diversified dietary preferences.

RECENT DEVELOPMENTS & NEWS

In December 2024, Nutty Village launched peanut butter flavors coffee and barbeque in tribute to US President Jimmy Carter, recognizing his contribution to peanut farming.

In September 2024, Gujarat-based Alpino raised $1.2 million funding to expand offline presence and innovate peanut-based products.

On January 1, 2025, Boyo expanded with 20 new retail outlets and plans 100 stores in 180 days, witnessing a 1000% increase in online sales in FY 2023.

In June 2025, Mensa Brands’ FMCG brand MyFitness expanded peanut butter sales, projecting ARR Rs 1000 crore in three years, with plans to enter breakfast cereals, protein bars, and supplements.

KEY PLAYERS

- Nutty Village

- Alpino

- Boyo

- Mensa Brands (MyFitness)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302