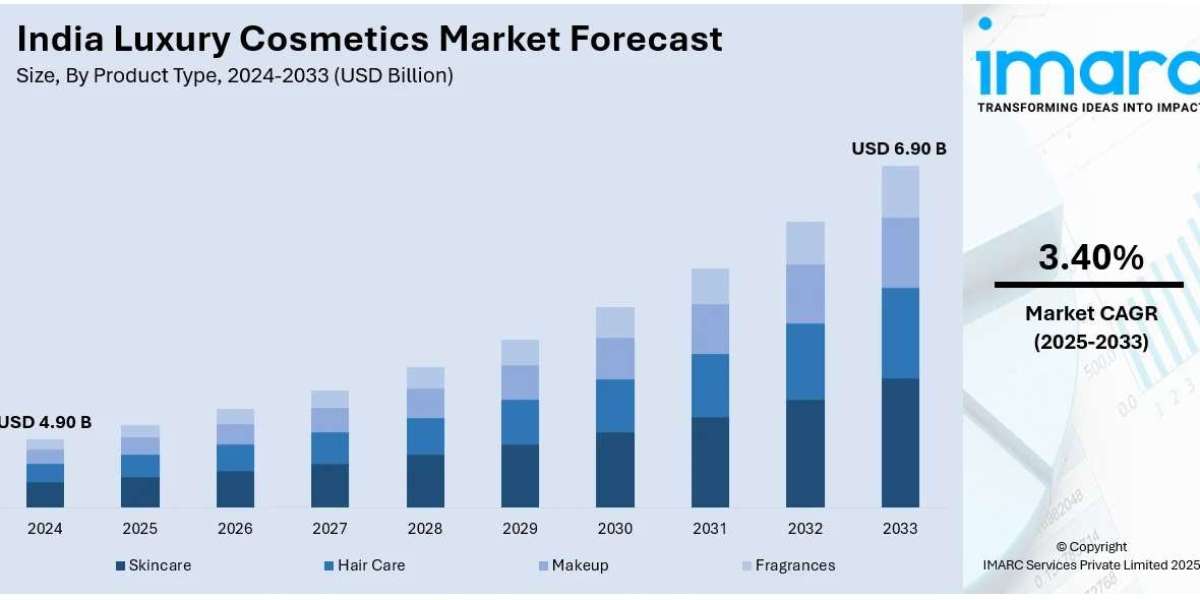

The India Luxury Cosmetics Market ( was valued at USD 4.90 Billion in 2024. The market is expected to grow to USD 6.90 Billion by 2033, exhibiting a CAGR of 3.40% during 2025-2033. Growth drivers include rising disposable incomes, increasing urban demand, clean beauty trends, and digital adoption. Expansion in premium skincare, makeup, and grooming products across metros and tier 2 cities alongside brand innovations also fuel market growth. The report presents a thorough review featuring the India luxury cosmetics market research report, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

INDIA LUXURY COSMETICS MARKET KEY TAKEAWAYS

- Current Market Size: USD 4.90 Billion in 2024

- CAGR: 3.40%

- Forecast Period: 2025-2033

- The market is driven by rising disposable income, growing urban demand, clean beauty trends, and digital adoption.

- Increasing popularity of premium skincare, makeup, and grooming products in metros and tier 2 cities fuels growth.

- Growing upper-middle class and affluent urban population in India increasingly prioritize quality and brand prestige.

- Clean and sustainable luxury is becoming a major purchase driver, with preference for cruelty-free and organic products.

- Expansion of premium, clean, and sustainable product lines by international and Indian brands is shaping the market outlook.

Sample Request Link: https://www.imarcgroup.com/india-luxury-cosmetics-market/requestsample

MARKET TRENDS

India’s expanding upper-middle class and affluent urban population are reshaping the luxury cosmetics landscape. According to IBEF, India’s middle class is expected to rise from 31% in 2020-21 to 61% by 2047, increasing the consumer base from 432 million to 1.02 billion. This demographic shift drives demand for premium beauty products, with urban professionals in metros and tier 1 cities investing in high-end skincare, makeup, and fragrances. Influences from global beauty standards, travel exposure, and social media accelerate demand, as consumers seek efficacy, ingredients, and premium packaging, moving the market toward indulgence and self-expression.

Clean and sustainable luxury is emerging as a major purchase driver, particularly among millennials and Gen Z consumers. Demand is rising for cruelty-free, organic, and eco-friendly formulations that avoid parabens, sulfates, and synthetic fragrances. Brands like EO Naturals by Siddhayu International, launched in September 2023, exemplify this trend with natural, luxury skincare products that support environmental sustainability and local communities. Packaging trends favor recyclability, refillable designs, and minimalism to reduce environmental impact. Certifications such as vegan and non-toxic are enhancing consumer trust and loyalty.

The influence of social media and influencer advocacy for conscious beauty promotes awareness and demand for clean beauty. Both international and Indian brands are launching high-end clean beauty lines to capture evolving consumer preferences. As sustainability integrates into brand values, clean luxury products are expected to define the market's future. These trends contribute significantly to the growth and diversification of the India luxury cosmetics market.

MARKET GROWTH FACTORS

Rising disposable incomes and increased urban demand underpin the market's expansion. Consumers in metro and tier 2 cities increasingly invest in premium skincare, makeup, and grooming products. Brand investments and innovations are enhancing product appeal. Growing beauty consciousness and the influence of global fashion trends encourage consumers to prioritize quality and prestige, which drives the shift towards luxury cosmetics.

Digital adoption, including e-commerce and online beauty platforms, enhances accessibility of luxury cosmetics throughout the country. This enables broader penetration into urban and tier 2 markets. Exclusive launches and personalized services further attract consumers. The proliferation of digital marketing and celebrity endorsements supports consumer awareness and engagement, stimulating market growth.

The market benefits from growing preference for clean, organic, and sustainable cosmetics. This aligns with global consumer trends favoring ethically sourced, cruelty-free products that emphasize wellness and environmental responsibility. Indian brands alongside international players are introducing formulations free from harmful chemicals, using plant-based ingredients, and embracing eco-friendly packaging, broadening their appeal in a socially conscious market.

MARKET SEGMENTATION

Product Type:

- Skincare: Includes premium skin treatments focusing on efficacy and luxury skincare routines.

- Hair Care: Encompasses high-end hair care products tailored for Indian consumers.

- Makeup: Comprises luxury cosmetics for facial beautification.

- Fragrances: Covers premium perfumes and scents offered in India’s luxury market.

Type:

- Organic: Products featuring natural and eco-friendly ingredients.

- Conventional: Traditional luxury cosmetics with established formulations.

Distribution Channel:

- Supermarkets and Hypermarkets: Large retail outlets offering luxury cosmetics.

- Specialty and Monobrand Stores: Exclusive brand stores providing personalized product ranges.

- Online Stores: E-commerce platforms enabling digital access to luxury cosmetics.

- Others: Includes additional channels not specified.

End User:

- Male: Luxury cosmetic products targeted at male consumers.

- Female: Luxury cosmetic products targeted at female consumers.

REGIONAL INSIGHTS

The report highlights key markets across North India, South India, East India, and West India but does not specify a dominant region or exact statistics. Regional data is comprehensive but no explicit dominant region with market share or CAGR details is provided.

Summary: Not provided in source.

RECENT DEVELOPMENTS & NEWS

- In October 2024, Reliance’s beauty platform Tira launched the luxury skincare brand Augustinus Bader in India, featuring innovative TFC8 technology, available online and in select major cities.

- In July 2024, Cosmus Skincare was launched in India, offering innovative, holistic skincare solutions designed for Indian skin, using advanced technology and natural ingredients like turmeric and rice extracts.

CUSTOMIZATION NOTE:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302