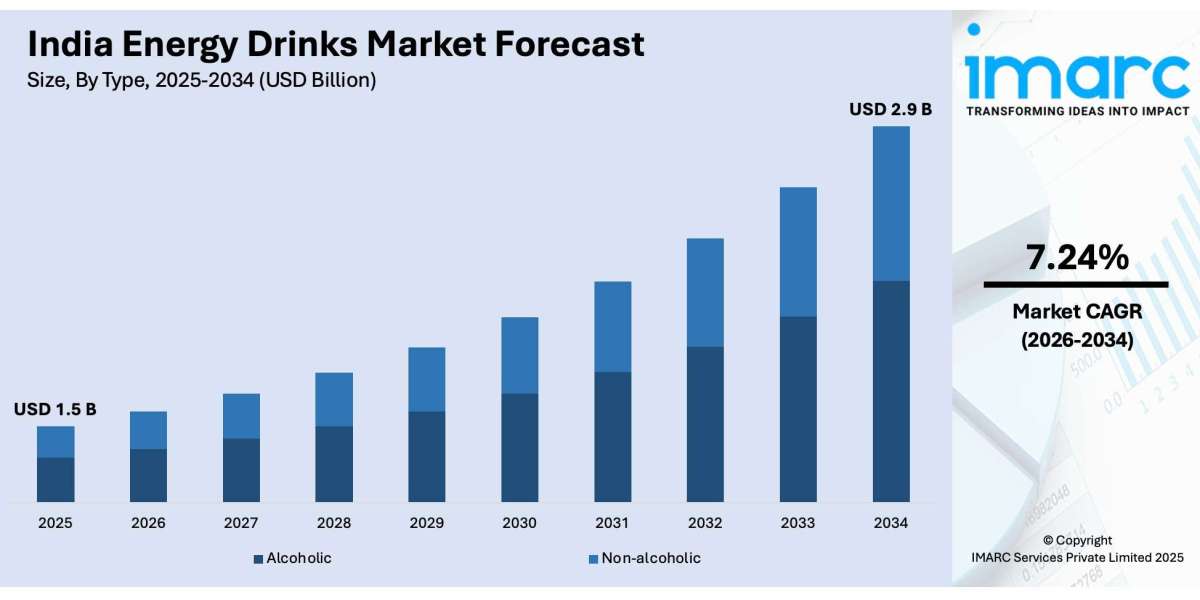

The India energy drinks market size was valued at USD 1.5 Billion in 2025 and is forecasted to reach USD 2.9 Billion by 2034, exhibiting a CAGR of 7.24% during the forecast period of 2026-2034. The sector is growing rapidly due to rising urbanization, a large youth population, and heightened fitness awareness. Increasing demand from working professionals, students, and sports persons, along with wider product availability via modern trade and e-commerce channels, continues to propel market growth. The report presents a thorough review featuring the India energy drinks market share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

INDIA ENERGY DRINKS MARKET KEY TAKEAWAYS

- Current Market Size: USD 1.5 Billion in 2025

- CAGR: 7.24% during 2026-2034

- Forecast Period: 2026-2034

- The market growth is primarily driven by changing urban lifestyles with increasing work pressures and longer hours fueling demand for quick energy solutions.

- Youth segments including students and working professionals actively consume energy drinks to improve concentration and stamina, especially for academic and work-related tasks.

- Fitness enthusiasts and sportspersons are a growing consumer base, leveraging energy drinks for performance enhancement and recovery.

- Marketing strategies like celebrity endorsements and social media campaigns successfully target younger demographics.

- Modern retail formats and online platforms have increased accessibility and convenience, boosting market penetration.

Sample Request Link: https://www.imarcgroup.com/india-energy-drinks-market/requestsample

MARKET TRENDS

Urbanization and Evolving Lifestyle Drive Energy Drink Consumption:

The India energy drinks market is propelled by rapid urbanization, with 37.08% (about 542.74 million people) of the population residing in urban cities. Here, energy drinks help combat fatigue and improve concentration amid hectic work and study schedules. Urban labor forces and students regularly rely on these beverages for instant energy, making them integral to contemporary lifestyles. The continual growth of urban populations and a shift towards busier lifestyles ensure steady demand growth.

Youth Population and Fitness Enthusiasm Drive Market Expansion:

India’s young population, where 65% are under 35 years old, is a key consumer group for energy drinks. Students and young adults consume these products to stay alert during exams and extended work hours. The popularity of sports and fitness activities is also pushing consumption among athletes and gym enthusiasts who use energy drinks to boost endurance and aid recovery. In 2023, over 570 million liters of energy drinks were consumed, reflecting strong demand from this demographic.

Marketing Strategies, Cultural Impact, and Increased Accessibility Drive Growth:

Indian energy drink companies employ intensive marketing, including celebrity endorsements and event sponsorships, to engage youth. Western cultural influences portray energy drinks as symbols of a dynamic lifestyle. Furthermore, expanding modern retail formats such as supermarkets and e-commerce platforms have greatly enhanced product availability in urban and semi-urban regions. Rising disposable income levels, expected to reach USD 4.34 thousand per capita by 2029, also favor increased consumption.

MARKET GROWTH FACTORS

Changing Urban Lifestyle and Convenience:

The India energy drinks market is largely driven by a hectic urban lifestyle characterized by longer working hours and increased work pressures. Energy drinks offer a convenient option for quick energy and fatigue management, especially for students and working professionals aiming to maintain alertness during demanding periods.

Increasing Health Awareness and Sports Participation:

Growing health consciousness has expanded the consumer base to gym-goers and athletes who use energy drinks to enhance physical performance and recovery. This trend is supported by targeted marketing campaigns that position energy drinks as lifestyle enhancers, appealing to fitness-oriented consumers.

Expanding Distribution and Rising Disposable Income:

The market benefits from wider distribution through supermarkets, specialty stores, convenience stores, and online platforms, making energy drinks readily available. Increasing disposable incomes and exposure to Western lifestyle patterns have also enabled a broader consumer base to afford these premium functional beverages, further accelerating market growth.

MARKET SEGMENTATION

By Type:

- Alcoholic: Combine caffeine and alcohol to appeal to consumers seeking alertness and relaxation; modest growth due to lifestyle trends and regulatory challenges.

- Non-alcoholic: Provide instant energy without alcohol, targeting students, professionals, and fitness enthusiasts; driven by urbanization, hectic lifestyles, and health awareness.

By End User:

- Kids: Minimal consumption due to health concerns and parental restrictions; low market impact as marketing does not target this group.

- Adults: Significant users consuming energy drinks for alertness and performance, boosted by fitness trends among corporate and fitness consumers.

- Teenagers: Growing segment driven by social trends and advertising; consume for alertness in school, sports, and social activities.

By Distribution Channel:

- Supermarkets and Hypermarkets: Wide reach with large product offerings and promotions; preferred by urban and semi-urban shoppers.

- Specialty Stores: Sell high-end, health-focused energy drinks with expert guidance; attract health-conscious consumers and build brand loyalty.

- Convenience Stores: Serve impulse buyers needing quick purchase access; located in city centers with long hours.

- Online Stores: Growing rapidly with a broad range, doorstep delivery, tailored promotions, and subscriptions.

- Others: Include vending machines, local retailers, and kirana stores; important for accessibility in rural and less reachable areas.

REGIONAL INSIGHTS

South India is the dominant region in the India energy drinks market, driven by rapid urbanization, expanding IT and educational sectors, and a growing fitness culture. Enhanced availability through modern trade and e-commerce further accelerates growth here. The combined effect of these factors makes South India a leading consumer base in the market.

RECENT DEVELOPMENTS & NEWS

In April 2025, Centrum launched Centrum Recharge, an energy drink mix promoting energy, hydration, and immunity. The same month, 28 BLACK announced plans to enter the Indian market mid-2025, adding to its presence in 26 countries. Varun Beverages declared the start of commercial production of energy and soft drinks at its Gorakhpur plant, backed by a INR 1,100 crore investment. In February 2025, Huckleberry Beverages introduced Huckleberry Stamina Spike Energy Drink, catering to energy demand sustainably. January 2025 saw Reliance Consumer Products launch RasKik Gluco Energy, combining glucose, electrolytes, and lemon juice for energy and hydration during sports.

KEY PLAYERS

- PepsiCo India

- Coca-Cola

- Centrum

- 28 BLACK

- Varun Beverages

- Huckleberry Beverages Pvt. Ltd.

- Reliance Consumer Products Limited (RCPL)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91-120-433-0800,

United States: +1-201-971-6302