The global shift toward finance process digitization has made Accounts Payable Automation (APA) a strategic priority for organizations seeking efficiency, accuracy, and financial control. As enterprises modernize back-office operations, SPARK Matrix Accounts Payable Automation research highlights how automation is redefining invoice processing, payment workflows, and supplier collaboration across industries. With growing transaction volumes, regulatory complexity, and pressure to optimize working capital, APA solutions are no longer optional—they are foundational to resilient financial operations.

QKS Group’s Accounts Payable Automation (APA) Market Research delivers a detailed and forward-looking assessment of the global APA ecosystem. The study examines how technological advancements, evolving enterprise expectations, and market dynamics are shaping the future of accounts payable functions. It provides valuable insights for technology vendors aiming to strengthen product strategies and for enterprises evaluating automation platforms based on capability, scalability, and long-term value.

Evolving Role of Accounts Payable Automation

Traditionally viewed as a transactional back-office function, accounts payable is rapidly evolving into a strategic financial lever. Manual invoice handling, fragmented approval processes, and disconnected payment systems have historically resulted in delays, errors, and limited visibility into cash flow. APA platforms address these challenges by digitizing and automating the entire invoice-to-pay lifecycle—from invoice capture and validation to approvals, payments, and reconciliation.

Modern APA solutions leverage artificial intelligence (AI), machine learning (ML), and intelligent data extraction to process invoices with high accuracy, regardless of format or source. Automated workflows reduce cycle times, eliminate bottlenecks, and enable finance teams to focus on higher-value activities such as financial planning and supplier relationship management.

Technology Trends Driving APA Adoption

The research highlights several technology trends accelerating APA adoption globally. AI-driven invoice processing enables faster data capture and exception handling, while rule-based and adaptive workflows ensure consistency and compliance across approval hierarchies. Cloud-native architectures allow organizations to scale operations seamlessly, support remote finance teams, and deploy updates without disruption.

Another critical trend is real-time analytics. APA platforms now provide actionable insights into spend patterns, outstanding liabilities, payment performance, and cash flow forecasts. These insights empower finance leaders to make informed decisions, optimize payment timing, and take advantage of early payment discounts. Integration capabilities with enterprise resource planning (ERP) systems further enhance data consistency and operational efficiency.

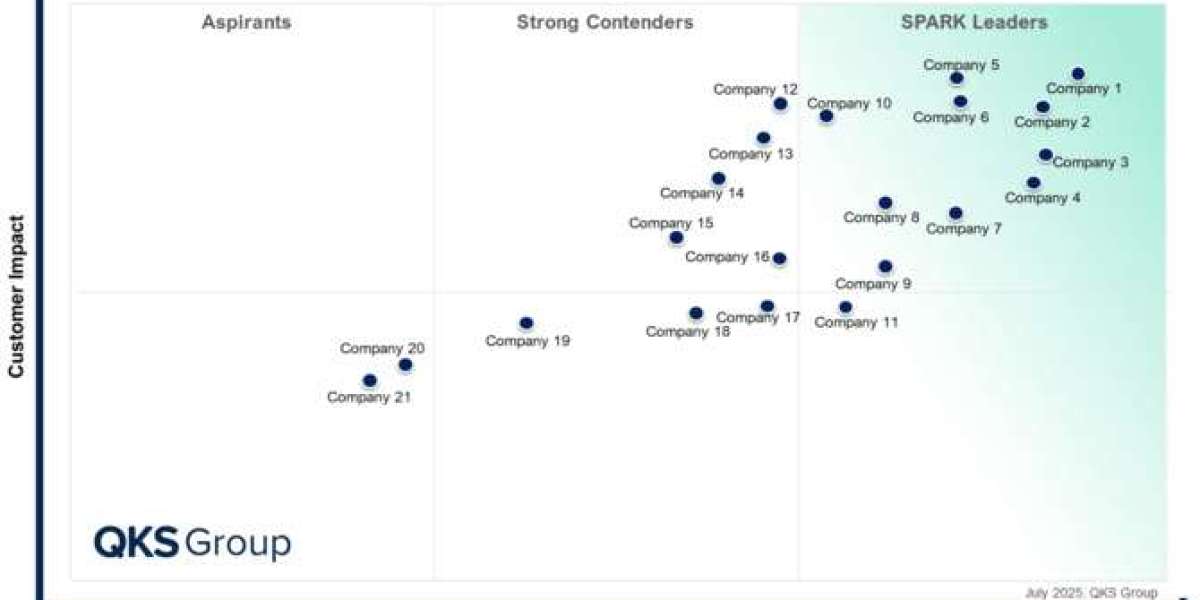

Competitive Evaluation Through SPARK Matrix Framework

A core component of the research is the competitive assessment conducted using the proprietary SPARK Matrix framework. The SPARK Matrix Accounts Payable Automation evaluation benchmarks vendors based on two key dimensions: technological excellence and customer impact. This structured analysis enables enterprises to compare vendors objectively while helping solution providers understand their competitive positioning.

The study evaluates a diverse set of APA vendors, including Airbase, AvidXchange, Basware, Bill.com, Corcentric, Coupa, Emburse, Esker, Global PayEX, Medius, MHC, MineralTree, OnPhase, Ottimate, Pagero, Quadient, Sage, SAP Ariba, Serrala, Stampli, and Tipalti. These vendors differ in terms of target market focus, deployment models, feature depth, and geographic reach, offering organizations a broad range of choices aligned to specific business needs.

Key Capabilities Defining Leading APA Platforms

Leading APA platforms are characterized by their ability to streamline complex payment environments while ensuring accuracy, compliance, and transparency. Intelligent automation reduces manual intervention and minimizes errors, helping organizations avoid duplicate payments, late fees, and compliance risks. Advanced compliance features support adherence to evolving tax regulations, audit requirements, and financial controls across regions.

Predictive cash flow forecasting is another differentiator, enabling finance teams to anticipate liquidity needs and optimize working capital. Dynamic discounting capabilities allow organizations to strengthen supplier relationships by offering early payments in exchange for discounts, creating mutual value. Additionally, multi-currency and cross-border payment support is increasingly critical for global enterprises managing diverse supplier networks.

Benefits for Enterprises and Vendors

For enterprises, APA adoption delivers measurable benefits, including faster invoice processing, improved visibility into liabilities, reduced operational costs, and enhanced governance. Automation also improves supplier satisfaction by ensuring timely and accurate payments, strengthening trust and collaboration.

For technology vendors, the evolving APA landscape presents opportunities to differentiate through innovation, ecosystem integrations, and customer-centric design. Vendors that invest in AI, analytics, and seamless ERP connectivity are better positioned to address enterprise expectations and adapt to changing market demands.

Future Outlook of the APA Market

Looking ahead, the APA market is expected to continue its strong growth trajectory as organizations prioritize digital finance transformation. Increased regulatory scrutiny, rising transaction complexity, and the demand for real-time financial insights will further drive adoption. APA solutions will increasingly integrate with broader financial management platforms, supporting end-to-end process orchestration across procure-to-pay and record-to-report functions.

In this evolving environment, SPARK Matrix Accounts Payable Automation research serves as a critical guide for enterprises navigating vendor selection and for providers refining go-to-market strategies. By offering a clear view of market trends, competitive dynamics, and technological innovation, the research helps stakeholders make informed, future-ready decisions.

Conclusion

Accounts Payable Automation has moved beyond efficiency gains to become a strategic enabler of financial agility and control. As organizations seek scalable, intelligent, and compliant solutions, APA platforms will play a central role in modern finance operations. The insights derived from SPARK Matrix Accounts Payable Automation analysis empower enterprises to identify the right solutions and enable vendors to innovate in alignment with market needs. In a digital-first economy, APA is no longer just about paying invoices—it’s about unlocking financial intelligence and operational excellence.

#AccountsPayableAutomation #SPARKMatrix #FinanceTransformation #APAutomation #DigitalFinance