The silver market has always held a unique place in the global economy, balancing between its identity as a precious metal and its extensive use in industrial applications. Unlike gold, which is often viewed purely as a store of value or a hedge against inflation, silver plays a dual role that makes its market more dynamic and sensitive to global economic changes. Investors, manufacturers, and even governments keep a close watch on the silver market because its movements reflect not just the appetite for safe-haven assets but also the pace of industrial and technological growth.

Silver is a precious metal that carries centuries of historical importance, often used as currency, jewelry, and a symbol of wealth. Over time, its role has expanded far beyond ornamental use. Today, silver is essential in many industries such as electronics, solar energy, medical instruments, and automotive manufacturing. This combination of investment and industrial demand makes the silver market more versatile and volatile compared to other commodities.

One of the key features of the silver market is its affordability compared to gold. While both metals are considered safe havens during times of economic uncertainty, silver provides an accessible option for small investors who wish to diversify their portfolios. Its lower price point allows greater participation from retail investors, contributing to increased liquidity. This aspect of affordability also means that fluctuations in silver prices can appear sharper and more dramatic, as shifts in investor sentiment quickly influence demand.

Industrial demand plays a significant role in shaping the silver market. In the modern era, silver’s properties such as high electrical conductivity, reflectivity, and antimicrobial characteristics make it indispensable across sectors. For instance, the global push toward renewable energy has boosted demand for silver in the production of photovoltaic cells used in solar panels. As more countries commit to sustainable energy, this trend is expected to strengthen the industrial side of silver demand. Similarly, advancements in electric vehicles and electronics rely heavily on silver components, further adding layers of growth potential to the market.

In addition to its industrial use, silver remains a popular metal in jewelry, cutlery, and decorative items. Cultural traditions in many regions, particularly in Asia, fuel a steady demand for silver ornaments and gifts. Seasonal festivals, weddings, and special occasions often increase silver consumption, creating a recurring cycle of demand that supports the overall market. This cultural dimension keeps silver consumption resilient even when global industrial demand faces temporary slowdowns.

Another fascinating aspect of the silver market is the way it responds to global economic conditions. In times of inflation, currency depreciation, or geopolitical tension, investors often flock to silver as a safe-haven asset. While gold tends to dominate this narrative, silver benefits from the same underlying sentiment, often experiencing sharp upward moves when uncertainty is high. On the other hand, during periods of strong economic expansion and stable financial systems, silver demand from investors may soften, but industrial usage helps balance the trend. This dual demand creates a natural hedge within the silver market itself.

Price volatility is a hallmark of silver trading. Unlike gold, which generally moves steadily, silver prices can fluctuate more aggressively within short time frames. This volatility attracts traders and speculative investors who aim to capitalize on price swings. For long-term investors, however, such movements can be seen as opportunities to accumulate silver at lower levels, building positions gradually in anticipation of future growth.

The supply side of the silver market is equally important. Silver is mined both as a primary metal and as a byproduct of other mining operations, particularly copper, lead, and zinc. This makes its production levels partly dependent on the demand for other base metals. Consequently, disruptions in mining activities or changes in global demand for base metals can influence silver availability and, in turn, its price. Recycling also contributes to the supply, as old jewelry, electronic scrap, and industrial residues are refined to extract silver, adding to market circulation.

Market participants in the silver industry range from miners, refiners, and manufacturers to large institutional investors and small retail buyers. The global nature of silver trade ensures that it is deeply connected with financial markets, commodity exchanges, and physical bullion dealers. Futures contracts and exchange-traded funds provide accessible platforms for investors to participate in silver trading without the need to hold the physical metal, further enhancing liquidity and reach.

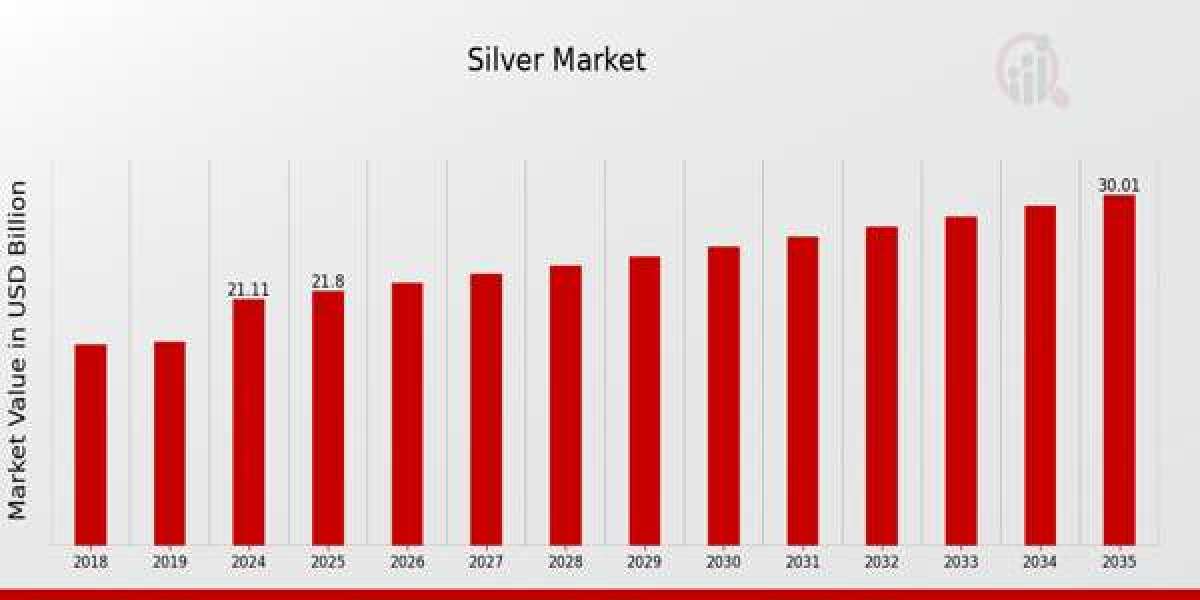

Looking ahead, the silver market continues to benefit from long-term structural trends. The accelerating transition toward green technologies, especially solar and electric vehicles, ensures steady growth in industrial demand. Simultaneously, concerns about economic cycles, inflation, and financial stability keep silver attractive as an investment asset. This dual demand outlook provides a balanced foundation for the silver market, making it resilient against downturns in any single sector.