Global Automotive Coolant Market Accelerates Toward $12.67 Billion by 2030

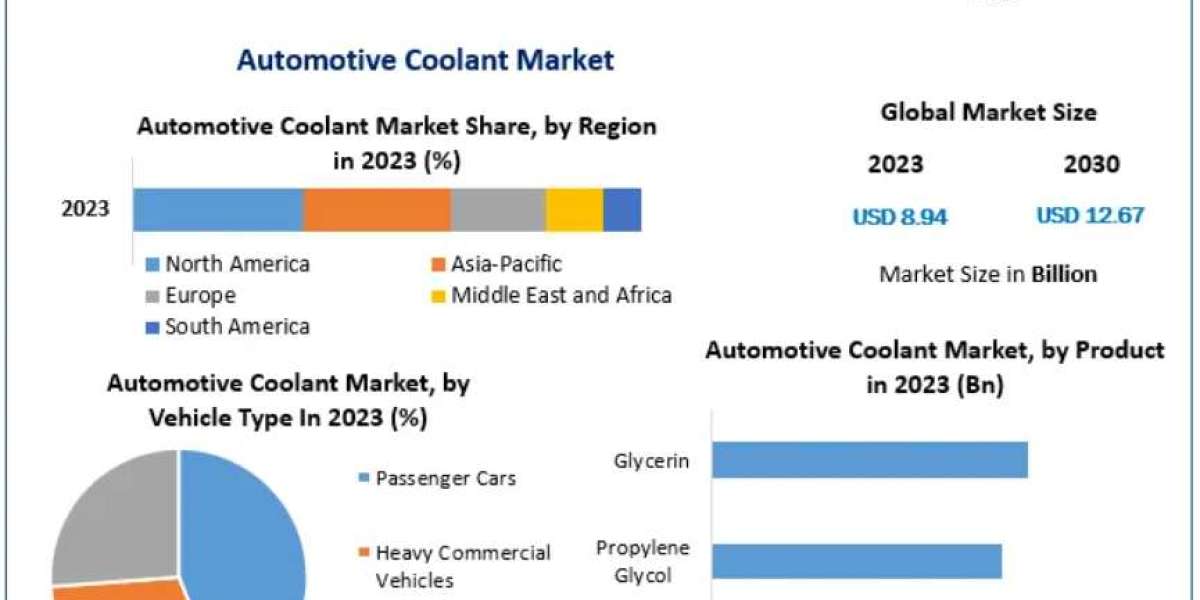

The Global Automotive Coolant Market is gaining strong momentum. With its market value standing at approximately USD 8.94 in 2024, the market is projected to reach between USD 8.94 and 12.67 billion by 2030, growing at a compound annual growth rate (CAGR) of roughly 5.1 %. This growth underscores the vital importance of advanced thermal management solutions in modern vehicles.

Market Estimation & Definition

Automotive coolant—also known as antifreeze—is an engineered fluid designed to regulate engine temperature, prevent freezing in cold climates, and protect against corrosion. Typically comprising a blend of water and glycols (such as ethylene glycol or propylene glycol), it includes additives that enhance thermal conductivity, inhibit foam formation, and promote engine longevity.

Automotive Coolant Market size was valued at USD 8.94 Bn. in 2023 and the total revenue is expected to grow at 5.1% of CAGR through 2024 to 2030, reaching USD 12.67 Bn.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/11151/

Market Growth Drivers & Opportunities

Several critical growth drivers are fueling market expansion:

Rising Global Vehicle Production

Accelerated automotive manufacturing—especially in emerging economies—is directly increasing coolant demand.Technological Progress in Coolant Formulations

Advanced solutions like Organic Acid Technology (OAT) and Hybrid Organic Acid Technology (HOAT) offer extended service life and enhanced engine protection, fueling adoption.Environmental Regulations & Eco-Friendly Trends

Stricter disposal standards and the pursuit of sustainability have prompted the development of biodegradable and low-toxicity formulations.Emergence of Electric and Hybrid Vehicles

Electrified powertrains require sophisticated cooling systems—spanning batteries to power electronics—creating new market opportunities.Commercial Vehicle Growth

Logistics expansion and increased freight volumes are boosting the demand for durable coolant solutions supporting continuous heavy-duty operation.

Segmentation Analysis

The market segmentation, as outlined in the provided report, includes:

By Product (Base Fluid):

Ethylene Glycol – widely used, cost-effective, superior thermal properties

Propylene Glycol – less toxic alternative, growing in niche applications

Glycerin – emerging use-case for specialized or environmentally focused formulations

Others – includes water-based variants or novel blends

By Vehicle Type:

Passenger Cars – major volume driver globally

Light Commercial Vehicles – growing with expanding commercial mobility

Heavy Commercial Vehicles – high consumption due to demanding thermal requirements

Others – includes specialty and niche vehicle segments

By Technology:

Inorganic Additive Technology (IAT) – traditional, widely used especially in older models

Organic Additive Technology (OAT) – growth segment with enhanced longevity

Hybrid Organic Acid Technology (HOAT) – combines best of both, offering balanced performance

By End User:

Original Equipment Manufacturers (OEM) – factory-fitted coolants

Automotive Aftermarket – replacement and servicing segment, covering a large fleet of existing vehicles

This structured breakdown provides clarity on how coolant types, technology, and vehicle usage intersect in global demand.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/11151/

Country-Level Analysis: USA and Germany

United States

The U.S. holds a dominant position in the North American coolant landscape, accounting for over 80% of regional market share. Key contributors include:

A vast and aging vehicle fleet with strong aftermarket maintenance activity.

Continued investments in R&D for eco-friendly and advanced coolant formulations, particularly for electric vehicle cooling systems.

Robust domestic production and supply chains supporting both OEM and aftermarket segments.

This mature market infrastructure supports sustained growth even amid gradual shifts to electrification.

Germany

Germany stands as Europe’s largest automotive coolant market, contributing approximately 16% of regional market share. Growth is supported by:

A strong automotive manufacturing base, with a concentration of premium brands.

Active developments in EV production and corresponding cooling technologies.

Rigorous environmental regulations driving innovation toward more efficient and sustainable coolant solutions.

Germany’s strategic position in Europe ensures it will remain a key hub for both technical advancement and market expansion.

Commuter (End-User) Analysis

Interpreting "Commutator analysis" in context as end-user (commuter) insights:

High Replacement Demand

Regular coolant maintenance is critical—not just for performance, but also to avert corrosion and overheating—making the aftermarket a robust revenue stream.Fleet Management Use Cases

Urban delivery and transit fleets increasingly rely on coolant with extended service intervals, reducing downtime and maintenance costs.Commercial Versus Personal Usage Patterns

Passenger vehicle users typically follow OEM-recommended service intervals, while commercial operators may opt for premium or synthetic solutions for added reliability.Electrification Impact

The transition to electric and hybrid vehicles is raising demand for advanced coolant capable of managing battery, inverter, and motor heat—introducing new specifications and maintenance routines.

Press Release Conclusion

Conclusion & Outlook

The global automotive coolant market is on a steady growth path, projected to rise from USD 5.3–5.4 billion in 2024 to USD 7.9–8.3 billion by 2033, reflecting a healthy CAGR of ~4.3–4.9%. This expansion is underpinned by a dynamic interplay of rising vehicle production, technological advances, environmental mandates, and the evolution of electric mobility.

Geographically, the United States remains a dominant, mature market, while Germany leads innovation within Europe. Both regions are critical to the market’s future, especially as they drive standards and cooling technology evolution.

The end-user landscape—particularly commuters and fleet operators—continues to shape demand, with a clear trend toward premium, long-life formulations that offer operational and environmental benefits.

Call to Action

As the industry transforms, stakeholders—including manufacturers, urban mobility planners, and aftermarket specialists—must invest in:

Research and development of next-generation, eco-friendly coolant technologies.

Infrastructure and supply chain enhancements tailored to electric and hybrid vehicle needs.

Service frameworks that educate end-users on coolant importance, especially in evolving automotive ecosystems.

With strategic investments and policy support, the automotive coolant sector can achieve sustainable growth while supporting cleaner, more efficient transportation systems.