Keeping track of your credit score is one of the smartest financial habits you can build. In the UK, your score plays a vital role when applying for a mortgage, car finance, personal loans, or even everyday services like a mobile phone contract. Lenders use it to judge how reliable you are at managing credit, and a healthy score can mean better rates, higher chances of approval, and less financial stress. If you have ever asked yourself, “How can I check my credit score uk quickly and securely?”, this guide will walk you through the process in detail.

What Is a Credit Score?

A credit score is a three-digit number that summarises your credit history and financial behaviour. It is calculated by credit reference agencies (CRAs), using data such as your repayment history, outstanding debts, credit applications, and even how long you have lived at your current address. While each CRA uses its own scoring system, the principle is the same: the higher your score, the more likely lenders are to view you as a trustworthy borrower. This is why it is so important to understand your score and check it regularly.

Why Checking Your Credit Score Matters

Monitoring your credit score goes far beyond curiosity—it is a powerful way to take control of your financial wellbeing. Firstly, it helps you spot errors on your credit file. Something as simple as an old address not being updated or a payment incorrectly marked as late can bring your score down, and identifying issues early means you can raise a dispute and fix them quickly. Secondly, checking your score protects you against fraud. If someone has tried to open accounts in your name, you will notice unusual activity on your report and can take steps to prevent further damage. Another important reason is that it gives you the chance to improve your chances of approval. If you know your score is not where it should be, you can take practical steps like reducing outstanding debt, paying bills on time, or registering on the electoral roll before making an application. Finally, a strong credit score can save you money in the long run, as lenders often reward responsible borrowers with better deals and lower interest rates.

Where to Check Your Credit Score in the UK

In the UK, there are three main credit reference agencies: Experian, Equifax, and TransUnion. Each one gathers slightly different information about you, which means your score can vary depending on the agency. Thankfully, you can access your score from all three for free. Experian is the largest CRA in the UK, offering a free credit score updated every 30 days, along with a paid subscription if you want more detailed insights and alerts. Equifax powers ClearScore, a popular app and website that lets you check your credit report and score for free with monthly updates and personalised financial tips. TransUnion, meanwhile, is accessible through services like Credit Karma, which also provides free ongoing access to your credit score, plus tools to help you understand how lenders might view you. By using one or more of these services, you can get a complete picture of your financial standing.

How to Check Your Credit Score Fast and Securely

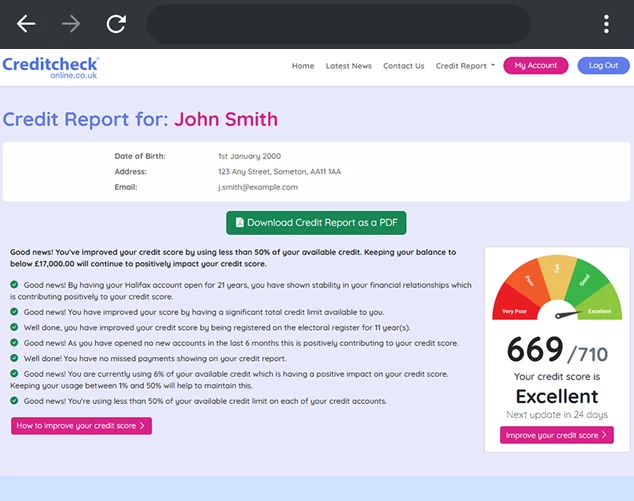

The good news is that checking your credit score in the UK is quick, easy, and secure. Most providers only require a few personal details such as your name, date of birth, and address history. After verifying your identity, they will give you instant access to your score and report, usually through a secure online portal or mobile app. All three major CRAs use encrypted systems to keep your information safe, so you do not need to worry about your data being misused. Importantly, checking your own credit score is considered a “soft search,” which means it does not impact your credit rating in any way. You can check as often as you like without harming your score.

Tips to Improve Your Credit Score After Checking

Once you have checked your credit score, you may want to take steps to improve it. A few simple habits can make a big difference. Always make payments on time, whether that is a credit card bill, loan instalment, or utility payment. Reducing outstanding balances also helps, as lenders look favourably on people who are not using too much of their available credit. Make sure you are registered on the electoral roll at your current address, as this makes it easier for CRAs to confirm your identity. Limiting the number of credit applications you make in a short period also protects your score, since multiple applications can suggest financial difficulty. Over time, these actions build a stronger profile and increase your financial flexibility.

Final Thoughts

Checking your credit score in the UK does not have to be complicated. Thanks to free tools from Experian, Equifax (via ClearScore), and TransUnion (via Credit Karma), you can access your score quickly, securely, and as often as you like. By keeping an eye on your credit health, you gain valuable insights, protect yourself from fraud, and put yourself in a stronger position when it comes to borrowing. The process takes only a few minutes but can have long-term benefits for your financial wellbeing. So the next time you wonder, “How do I check my credit score uk fast and securely?”, you will know that the answer is just a few clicks away.