One key aspect of managing insurance is understanding your policy limits. This is where insurance policy limit lookup becomes invaluable.

It provides clarity on the extent of coverage, helps avoid underinsurance, and ensures that claims are processed smoothly. In this article, we’ll explore what insurance policy limits are, why they matter, and how policy limit lookup works.

What Is an Insurance Policy Limit?

An insurance policy limit refers to the maximum amount an insurance company will pay for a covered loss under a policy. Policy limits vary depending on the type of insurance and the specific terms agreed upon between the insurer and the policyholder. Understanding your policy limits is essential for ensuring adequate coverage and financial protection in case of unexpected events.

Policy limits generally fall into two categories:

Per-Occurrence Limit: This is the maximum amount the insurer will pay for a single claim or event. For instance, if your auto insurance has a $50,000 per-accident limit, the insurer will pay up to $50,000 for damages resulting from one accident.

Aggregate Limit: This is the maximum amount the insurer will pay over the policy term, usually one year. For example, if your homeowner’s insurance has an aggregate limit of $200,000, the insurer will not pay more than this amount for all covered claims during the policy period.

Policy limits can also differ based on coverage type within a single policy. For example, a health insurance policy may have separate limits for hospitalization, outpatient care, and prescription medications.

Why Insurance Policy Limits Matter

Understanding your policy limits is critical for several reasons:

Financial Protection: Knowing your limits ensures you have sufficient coverage to protect against major losses. Underestimating your insurance needs could leave you responsible for expenses beyond your coverage.

Legal Compliance: Some types of insurance, such as auto insurance, require minimum coverage by law. Understanding policy limits helps ensure compliance with these legal requirements.

Claims Management: Accurate knowledge of your policy limits helps avoid surprises during claims processing. If a claim exceeds your limit, the insurer will only pay up to the specified amount, leaving you to cover the remainder.

Risk Assessment: Policy limits allow policyholders and businesses to assess their risk exposure and adjust coverage accordingly. This is particularly important for high-value assets or commercial operations.

Negotiating Power: In some cases, knowing your policy limits can provide leverage when negotiating settlements, especially if your coverage includes sub-limits for specific types of losses.

How to Perform an Insurance Policy Limit Lookup

An insurance policy limit lookup is the process of verifying the coverage limits of a particular insurance policy. This can be done through several methods:

Reviewing the Policy Document: The most straightforward way is to read the insurance policy itself. The declarations page usually lists the coverage types, per-occurrence limits, and aggregate limits. Make sure to understand the terms, exclusions, and sub-limits that may apply.

Contacting the Insurance Provider: Insurance companies provide customer service channels where policyholders can inquire about their coverage limits. This can be particularly useful if the policy document is complex or unclear.

Online Account Portals: Many insurers offer online platforms where policyholders can log in and view their coverage details, including policy limits. These portals may also provide tools for adjusting coverage or requesting additional limits.

Third-Party Verification Services: In some industries, particularly commercial insurance, third-party verification services or brokers may provide policy limit lookups. These services are often used to confirm coverage before entering contracts or agreements.

Insurance Certificates: For businesses, an insurance certificate or certificate of insurance (COI) is often requested by clients, landlords, or partners. These certificates summarize coverage, including policy limits, and serve as proof of insurance.

Tips for Effective Policy Limit Management

Managing your insurance policy limits effectively requires diligence and periodic review. Here are some best practices:

Regularly Review Policies: Insurance needs can change over time due to life events, business growth, or changes in asset value. Reviewing policies annually ensures that your coverage remains adequate.

Understand Coverage Types: Different coverages have different limits. For example, liability coverage may have high limits, while personal property coverage may be lower. Knowing the specifics helps prevent gaps.

Adjust Limits When Necessary: If you acquire valuable assets or face increased liability exposure, consider raising policy limits. This helps protect against unforeseen financial burdens.

Document and Track Coverage: Keep a record of policy limits, renewal dates, and claims history. This helps streamline future lookups and facilitates better financial planning.

Work with Professionals: Insurance agents and brokers can help you understand complex policies and recommend appropriate limits based on your risk profile.

Common Challenges in Insurance Policy Limit Lookup

While the process seems straightforward, policy limit lookup can sometimes be challenging:

Complex Policy Language: Insurance policies are often written in legal or technical terms, making it difficult for the average policyholder to interpret limits accurately.

Multiple Policies: Individuals and businesses often have multiple insurance policies. Tracking limits across various policies can be cumbersome.

Changing Coverage: Policies may have endorsements, riders, or amendments that change limits. Ensuring all updates are accounted for is crucial.

Third-Party Reliance: Businesses relying on client or partner insurance must verify coverage limits carefully to avoid liability exposure.

The Future of Insurance Policy Limit Lookup

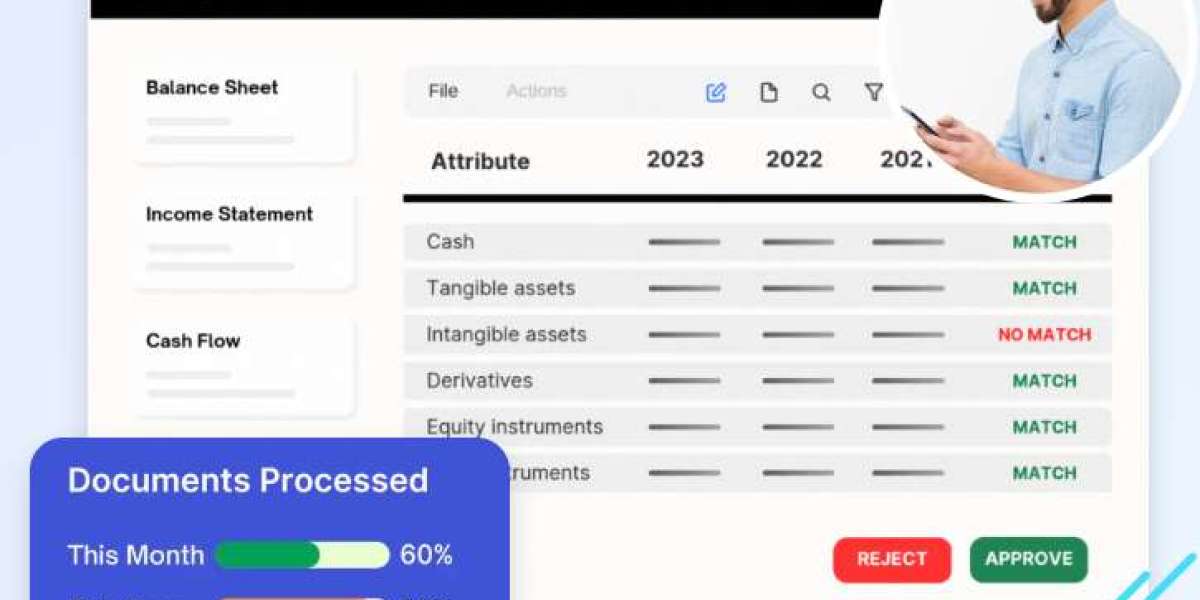

Technology is transforming how insurance policy limits are managed. Insurers increasingly provide digital dashboards, mobile apps, and AI-powered tools to make policy limit lookup faster and more accurate. These tools offer benefits such as:

- Real-time access to coverage details

- Alerts for expiring or insufficient coverage

- Easy comparison of different policies

- Simplified claims management

Artificial intelligence can also help identify gaps in coverage and recommend adjustments to policy limits, providing policyholders with personalized risk management strategies.

Conclusion

Insurance policy limits are a fundamental aspect of financial protection, risk management, and legal compliance. Performing an insurance policy limit lookup helps policyholders understand their coverage, manage risk effectively, and make informed decisions about their insurance needs.

Whether through reviewing policy documents, consulting with insurers, or using online tools, knowing your policy limits is crucial in today’s uncertain world. By actively managing and verifying coverage, individuals and businesses can protect themselves from unexpected losses and ensure peace of mind.