IMARC Group has recently released a new research study titled “United States Corporate Wellness Market Report by Service (Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, and Others), Category (Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers), Delivery (Onsite, Offsite), Organization Size (Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Corporate Wellness Market Overview

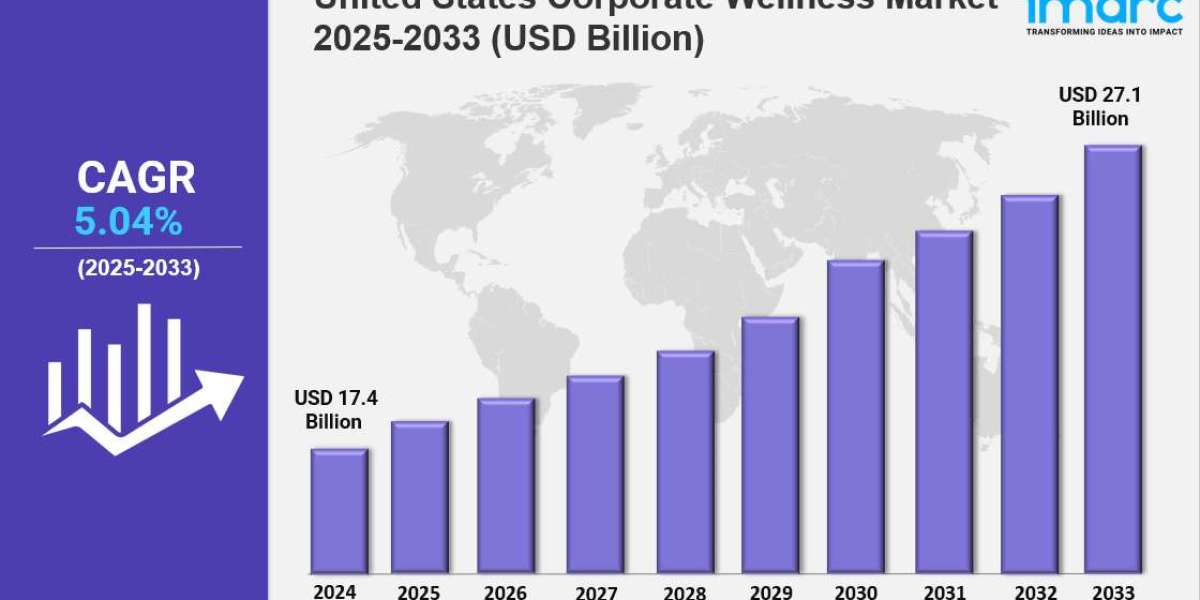

United States corporate wellness market size reached USD 17.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 17.4 Billion

Market Forecast in 2033: USD 27.1 Billion

Market Growth Rate 2025-2033: (CAGR) 5.04%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-corporate-wellness-market/requestsample

Key Market Highlights:

✔️ Rising emphasis on employee mental health and well-being is driving demand for comprehensive corporate wellness programs across U.S. businesses

✔️ Increasing adoption of digital wellness platforms and wearable technologies to track and improve workforce health outcomes

✔️ Growing focus on reducing healthcare costs and boosting productivity through preventive care initiatives and health-focused corporate policies

United States Corporate Wellness Market Trends

The United States Corporate Wellness Market Growth is undergoing a significant transformation, with mental health taking center stage. Rising workplace stress, burnout, and lingering effects of the pandemic are pushing employers to expand their wellness offerings. A 2024 Deloitte survey revealed that 72% of U.S. companies enhanced mental health benefits, adding services such as teletherapy, mindfulness apps, and stress management workshops. This shift highlights that employee productivity and retention are closely linked to psychological safety.

Partnerships with digital health platforms like Headspace for Work and Lyra Health are on the rise, offering personalized solutions and training managers to recognize signs of distress. However, challenges persist—stigma and accessibility issues still hinder progress, particularly for diverse and marginalized groups. This has fueled innovation in AI-driven tools designed to adapt to individual needs.

As hybrid work models become the norm, companies are rethinking office design. New features such as “recharge zones” and quiet rooms emphasize a holistic approach to employee well-being, moving beyond traditional fitness-based programs. The goal is to create environments that nurture both physical and mental health.

Technology Integration in Corporate Wellness

Advancements in technology are reshaping wellness strategies. In 2024, about 65% of mid-sized U.S. companies integrated wearable devices like Fitbits and Apple Watches into wellness initiatives. These devices now track sleep, stress, nutrition, and heart health—providing valuable insights for both employees and HR teams.

Platforms like Virgin Pulse and Welltok leverage AI and data analytics to interpret health metrics in real time, detect patterns, and predict potential risks, especially for employees with chronic conditions. This proactive approach is becoming a cornerstone of corporate wellness growth.

Personalization vs. Privacy Concerns

Personalization is one of the fastest-growing trends in corporate wellness. Generative AI-powered tools, including virtual fitness coaches and AI-based nutritionists, offer tailored plans based on individual goals and habits. However, privacy concerns remain a barrier. According to a 2024 Gartner study, 41% of employees worry about how their health data is used. To build trust, companies are adopting transparent policies and anonymizing data. Striking the right balance between personalization and privacy will be key to the market’s future success.

Regulatory shifts and ESG (Environmental, Social, and Governance) priorities are further shaping the market. In 2024, the Biden administration introduced new Affordable Care Act guidelines requiring companies with 50+ employees to provide basic mental health coverage and ergonomic assessments. Investors are also demanding that wellness programs align with sustainability goals, prompting firms to include well-being metrics in annual reports.

This has led to investments in ergonomic office equipment, on-site health screenings, and gym memberships. Social wellness programs, such as volunteer days and DEI-focused mentorship initiatives, are also gaining traction. However, smaller businesses often struggle with compliance costs, turning to third-party providers for scalable solutions. Notably, a 2024 McKinsey report found that 58% of Fortune 500 companies now tie executive bonuses to employee wellness KPIs.

Post-pandemic, wellness programs have expanded beyond physical fitness to cover mental, financial, and social well-being. A 2024 Willis Towers Watson study showed that 84% of employers consider wellness initiatives critical for attracting talent, particularly among Gen Z. Hybrid work has fueled demand for virtual wellness platforms offering live-streamed fitness classes and digital financial planning tools.

However, coverage gaps remain for gig workers and part-time employees. Some states are introducing regulations to address these disparities, especially in mental health access. Meanwhile, AI and machine learning continue to enhance personalization, though concerns over data misuse persist.

Market Outlook: Growth Driven by Innovation and Compliance

The United States Corporate Wellness Market is projected to grow at a 6.8% CAGR through 2033, driven by the dual forces of employee retention needs and evolving regulations. The future could see greater integration of wellness into workplace culture, with initiatives like well-being sabbaticals and AI-powered mental health bots becoming commonplace.

Companies that embrace innovation, address privacy concerns, and adapt to employee expectations will be best positioned to thrive in this rapidly evolving market.

United States Corporate Wellness Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Service:

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

Breakup by Category:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

Breakup by Delivery:

- Onsite

- Offsite

Breakup by Organization Size:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

Breakup by Region:

- Northeast

- Midwest

- South

- West

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20536&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302