According to TechSci Research report, “Co-Refining Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2030F”, the Co-Refining Market was valued at USD 20.64 Billion in 2024 and is expected to reach USD 25.67 Billion by 2030 with a CAGR of 3.55%.

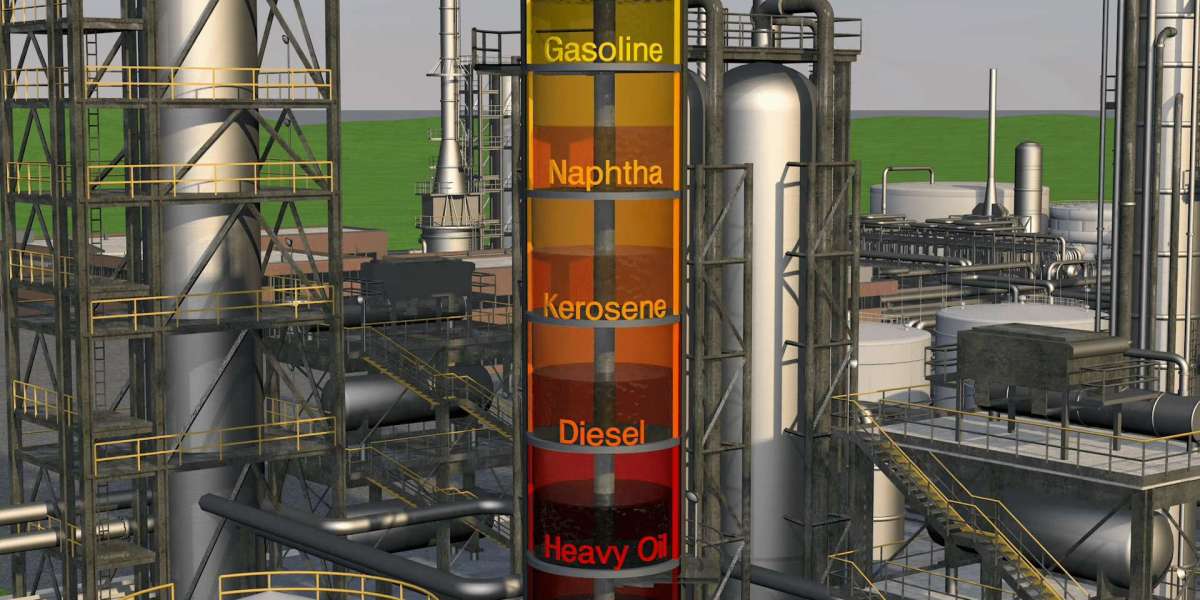

As the world intensifies its shift toward low-carbon energy systems, co-refining has emerged at the intersection of sustainability, strategy, and refinery economics. Co-refining refers to the blending of renewable feedstocks—such as used cooking oil, vegetable oils, and animal fats—into conventional petroleum refining processes to produce low-emission fuels like renewable diesel and sustainable aviation fuel (SAF).

Request For Sample Copy of Report For More Detailed Market insight: https://www.techsciresearch.com/sample-report.aspx?cid=30201#requestform

Market Drivers

1. Regulatory Support and Policy Incentives

Governments globally are implementing mandates and incentives such as tax credits, carbon pricing, and blending targets. In regions like the U.S., EU, and Brazil, retailers and refiners are compelled to blend minimum levels of renewable content. Co‑refining delivers a practical compliance pathway without prohibitive investment.

Browse over XX Market data Figures spread through XX Pages and an in-depth TOC on the "Global Co-Refining Market.” @https://www.techsciresearch.com/report/co-refining-market/30201.html

2. Transition Strategy for Oil & Gas Majors

Traditional oil companies face increasing pressure to decarbonize. Co‑refining enables them to diversify fuel offerings and present a greener portfolio while maintaining legacy operations—a helpful strategic bridge to broader energy transition.

3. Strong Demand from Aviation and Heavy Transport

End‑use sectors such as aviation and heavy-duty trucking have limited alternative fuel options. Co‑refined fuels offer high-energy density and compatibility with existing engines and infrastructure—making SAF and renewable diesel viable in hard-to-abate niches.

Emerging Trends

Trend 1: Expansion of Feedstock Types

Next-gen co‑refining initiatives experiment with plastic waste pyrolysis oil, algae-derived oils, and even synthetic/‘e-fuels,’ broadening the feedstock base considerably.

Trend 2: Blending Floors Increasing

As carbon intensity metrics become stricter, blending targets are rising. Some refiners aim for 20–30% renewable feedstock participation, significantly increasing co‑refining volumes.

Trend 3: Real-Time Fuel Carbon Monitoring

Digital traceability platforms (e.g., blockchain) are being integrated to certify carbon content and lifecycle emissions, essential for meeting end‑user sustainability claims.

Trend 4: Integrated SAF Refineries

Rather than full bio‑refineries, hybrid co‑refineries combining SAF units and conventional operations are in development, offering higher renewables output with existing capital.

Trend 5: Cross-Sector Collaborations

Enhanced partnerships between oil majors, feedstock aggregators, waste management firms, and aviation companies are resulting in end‑to‑end supply chains explicitly designed for co‑refined fuel production.

End‑Use Segment Spotlight: Petroleum Refining

The petroleum refining segment leads the co‑refining market—acting as the perfect convergence point for renewable blend stock and traditional crude processing:

High Infrastructure Availability: Most refineries already possess hydrotreaters that can accommodate renewable material with minimal retrofitting.

Ability to Scale Incrementally: Refiners can gradually ramp renewable input, tuning blending levels in response to policy changes and feedstock availability.

Commercial Readiness for Renewable Diesel & SAF: Clean fuels produced via co‑refining can be distributed through existing terminals, pipelines, and blending infrastructure.

Technical Flexibility: Modern catalytic units can adapt to higher feedstock variability without performance degradation.

Regional Insights

Asia-Pacific: The Fastest-Growing Region

Asia-Pacific is emerging as the fastest-growing co‑refining market, driven by:

Rapid industrial growth and expanding transportation sectors

Growing aviation industries in China, India, and Japan demanding SAF

Policy support via blending mandates, tax incentives, and green refinery funds

Robust waste oil supply chains and increasing domestic refining modernization

Countries like China and India are actively investing in refinery upgrades for renewable integration—positioning Asia-Pacific as a leader in co‑refining adoption.

- Major companies operating in the Global Co-Refining Market are:

- Neste Oyj

- TotalEnergies SE

- Shell plc

- Chevron Corporation

- ExxonMobil Corporation

- Repsol S.A.

- BP p.l.c.

- ENI S.p.A.

- Valero Energy Corporation

- Preem AB

Customers can also request 10% free customization in this report.

Contact US:

Techsci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

Tel: +13322586602