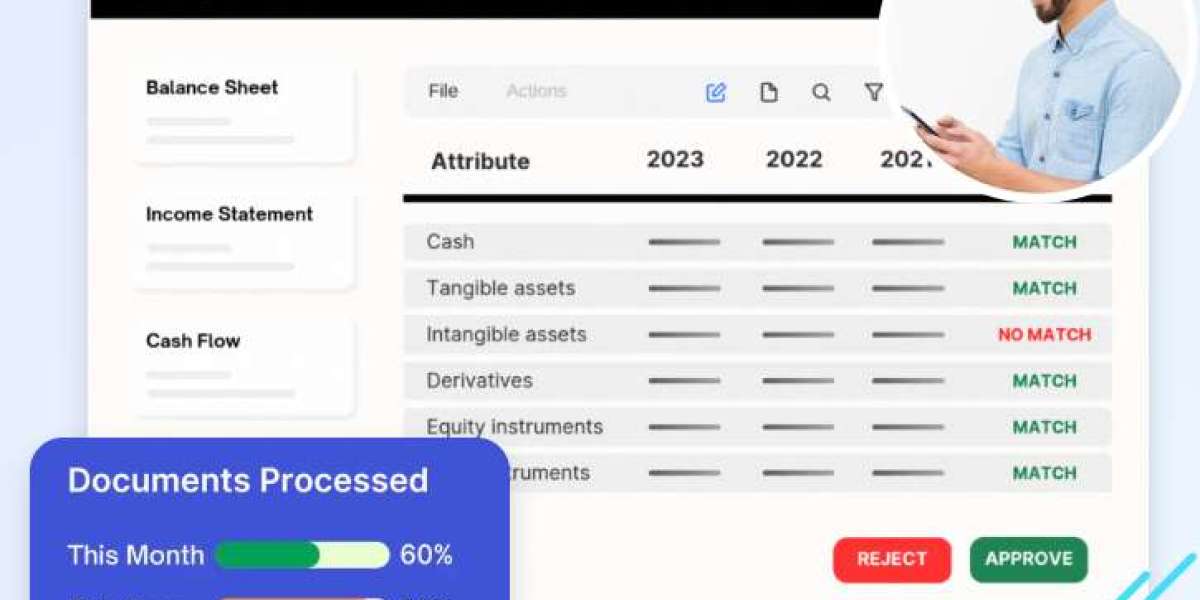

Spreading financial statements is a key step in evaluating a business’s financial health, particularly in banking, lending, and investment analysis. This process involves taking raw financial data from income statements, balance sheets, and cash flow reports and organizing it into a consistent, comparable format. By spreading financial statements, analysts can identify trends, assess ratios, and benchmark performance over time or against industry standards. It enables clearer insights into a company’s profitability, liquidity, and solvency. This step is especially important when reviewing multiple years of financials or comparing several entities. Whether done manually or through advanced software, spreading financial statements ensures data accuracy and helps institutions make better-informed credit and investment decisions with reduced risk.

kelly walker

9 مدونة المشاركات