IMARC Group has recently released a new research study titled “United States Engineering Plastics Market Report by Resin Type (Fluoropolymer, Liquid Crystal Polymer (LCP), Polyamide (PA), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyether Ether Ketone (PEEK), Polyethylene Terephthalate (PET), Polyimide (PI), Polymethyl Methacrylate (PMMA), Polyoxymethylene (POM), Styrene Copolymers (ABS and SAN)), End Use Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Engineering Plastics Market Overview

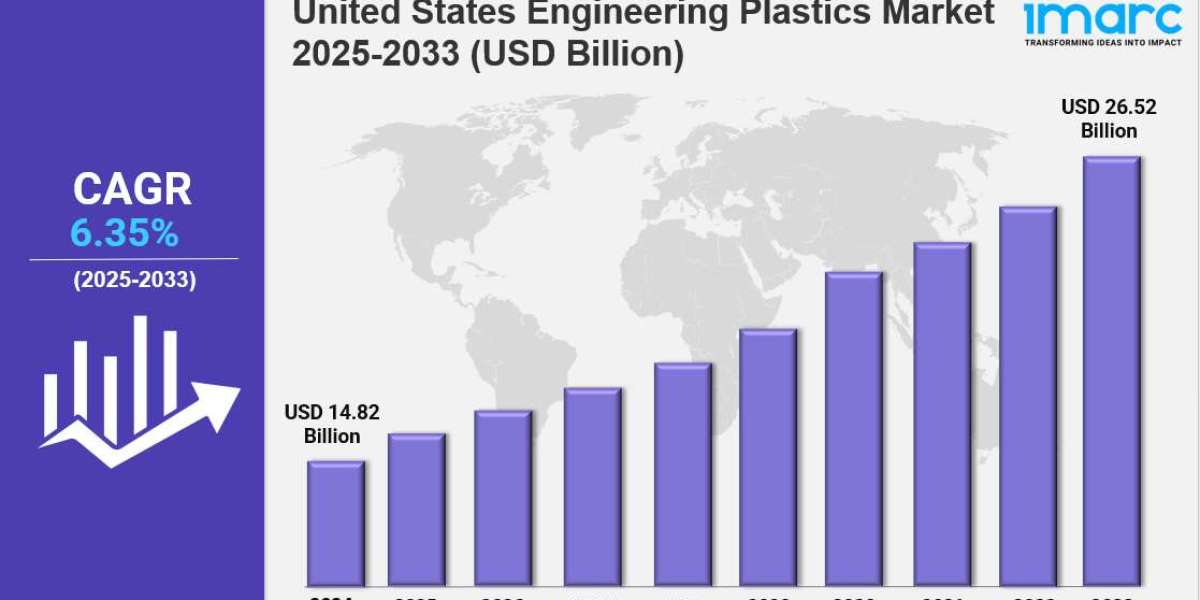

United States engineering plastics market size reached USD 14.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.35% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 14.82 Billion

Market Forecast in 2033: USD 26.52 Billion

Market Growth Rate 2025-2033: 6.35%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-engineering-plastics-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by rising demand across automotive, electronics, and industrial applications

✔️ Increasing preference for lightweight, durable, and high-performance materials over traditional metals

✔️ Expanding innovation in bio-based and recyclable engineering plastics supporting sustainability initiatives and regulatory compliance

United States Engineering Plastics Market Trends

The United States Engineering Plastics Market is witnessing consistent growth due to increasing demand from key industries such as automotive, electronics, aerospace, healthcare, and construction. These sectors rely heavily on engineering plastics for their superior properties, including high strength-to-weight ratio, chemical resistance, durability, and thermal stability. As industries shift toward lightweight and efficient alternatives to metals and conventional plastics, engineering plastics have become critical materials in advanced manufacturing.

Sector-Wise Contribution to Market Expansion

The automotive industry remains a leading consumer, driven by the need for lighter components that improve fuel efficiency and reduce emissions. Engineering plastics are also being used in under-the-hood applications and structural parts, helping automakers meet both performance and regulatory requirements. In the electronics industry, the miniaturization of devices has led to growing demand for high-precision and heat-resistant materials, contributing to United States Engineering Plastics Market Growth.

Healthcare is another key sector, where the use of engineering plastics in medical devices, surgical tools, and packaging continues to rise due to their biocompatibility and sterilization compatibility. These developments are supporting overall market expansion and enhancing the United States Engineering Plastics Market Share across end-user segments.

Technological Advancements and Sustainability Trends

Innovation in polymer blends and manufacturing techniques is leading to the development of new grades of engineering plastics with enhanced properties. The rise of 3D printing in industrial applications is also boosting demand for engineering thermoplastics suitable for additive manufacturing. In addition, increasing focus on sustainability is encouraging the use of recyclable and bio-based engineering plastics, especially in packaging and consumer goods.

Government regulations related to emissions and waste management are pushing industries to adopt environmentally friendly materials, further influencing the market dynamics. As a result, the United States Engineering Plastics Market is adapting to both performance and sustainability expectations.

Market Key Players

Several key companies are contributing to the development and competitiveness of the United States Engineering Plastics Market:

- BASF Corporation – Offers a broad portfolio of engineering plastics, including polyamide and polybutylene terephthalate (PBT), widely used in automotive and electrical applications.

- DuPont – Known for high-performance materials such as Delrin® and Zytel®, catering to a wide range of industrial and consumer needs.

- SABIC – Provides engineering thermoplastics with applications in electronics, automotive, and healthcare sectors.

- Celanese Corporation – Specializes in POM, LCP, and other advanced polymers used in precision components.

- Solvay – Offers specialty polymers with high heat and chemical resistance, suitable for aerospace and medical use.

These companies play a significant role in shaping the United States Engineering Plastics Market Share by driving product innovation, expanding distribution networks, and responding to the evolving requirements of industrial clients.

United States Engineering Plastics Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Resin Type:

- Fluoropolymer

- Ethylenetetrafluoroethylene (ETFE)

- Fluorinated Ethylene-Propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinylfluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Others

- Liquid Crystal Polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

- Styrene Copolymers (ABS and SAN)

Breakup by End Use Industry:

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20359&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302