IMARC Group has recently released a new research study titled “South Korea Tire Market Size, Share, Trends and Forecast by Design, End Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Tire Market Overview

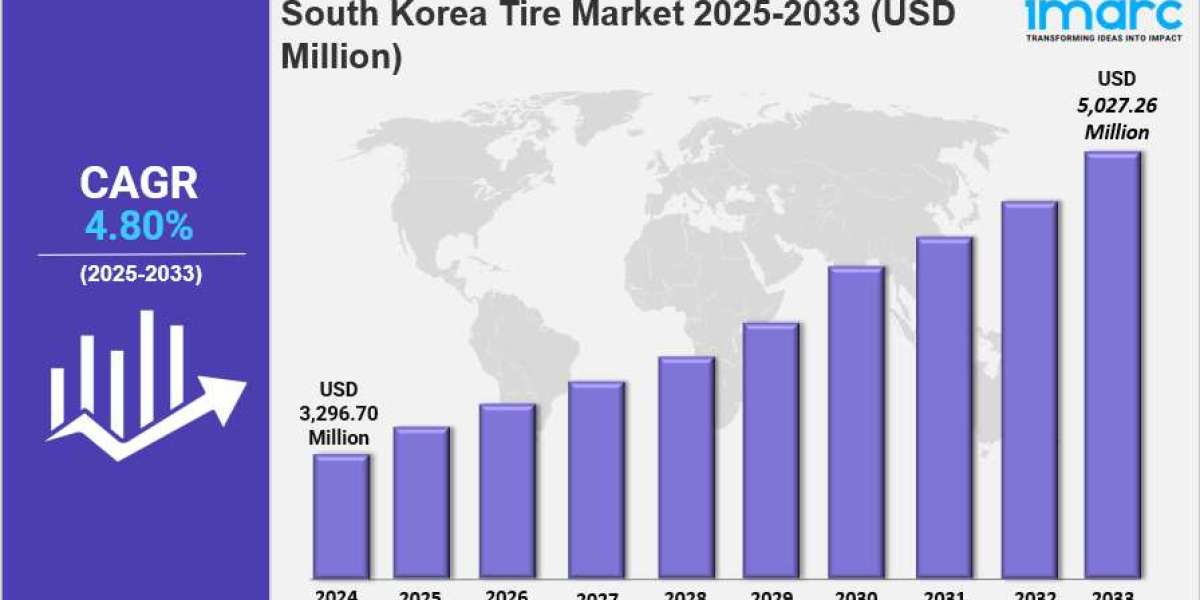

The South Korea tire market size was valued at USD 3,296.70 Million in 2024 and is projected to reach USD 5,027.26 Million by 2033, growing at a CAGR of 4.80% during the forecast period of 2025-2033. This growth is driven by strong automotive manufacturing, rising adoption of electric vehicles, and demand for high-performance and eco-friendly tires. Advancements in smart tire technologies and expanding online distribution channels further enhance market expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Tire Market Key Takeaways

- Current Market Size: USD 3,296.70 Million in 2024

- CAGR: 4.80% (2025-2033)

- Forecast Period: 2025-2033

- The market is primarily driven by South Korea’s robust automotive manufacturing sector with increasing motor vehicle production.

- Rising demand for replacement tires owing to an aging vehicle fleet and growing vehicle ownership enhances market growth.

- Growth in electric vehicle adoption stimulates innovation in tire design focusing on durability and energy efficiency.

- Expansion of e-commerce and digital retailing platforms improves accessibility and convenience in tire purchases.

- Technological innovation, including smart tire technologies, strengthens the market by improving vehicle safety and performance.

Sample Request Link: https://www.imarcgroup.com/south-korea-tire-market/requestsample

Trends in the South Korea Tire Market

Growing Demand for Electric Vehicle Tires

The South Korea tire market is witnessing a growing demand for specialized tires designed for electric vehicles (EVs). As the automotive industry shifts towards electrification, manufacturers are increasingly focusing on developing tires that cater to the unique requirements of EVs, such as reduced rolling resistance and enhanced durability. This trend is significantly contributing to the South Korea tire market size, as tire manufacturers invest in research and development to create innovative products. The rise of EVs not only presents new opportunities for tire manufacturers but also drives competition within the market, leading to advancements in tire technology.

Expansion of High-Performance Tires

Another notable trend shaping the South Korea tire market is the expansion of high-performance tires. As consumers become more enthusiastic about automotive performance and driving experience, there is a growing preference for tires that offer superior handling, grip, and stability. This trend is positively impacting the South Korea tire market share, as manufacturers respond by introducing premium tire lines that cater to performance-oriented vehicles. The increasing popularity of motorsports and car enthusiast culture further fuels this demand, encouraging tire companies to innovate and enhance their product offerings to capture this segment of the market.

Emphasis on Sustainability and Eco-Friendly Products

The emphasis on sustainability and eco-friendly products is becoming increasingly important in the South Korea tire market. With rising environmental concerns, consumers are seeking tires that are made from sustainable materials and designed to minimize environmental impact. This trend is contributing to the overall South Korea tire market growth, as manufacturers explore eco-friendly alternatives and implement sustainable practices in their production processes. By developing tires that are more environmentally friendly, companies can not only meet consumer demand but also enhance their brand image in a competitive marketplace.

Digital Transformation and E-Commerce Expansion

Digital transformation and the expansion of e-commerce are also significant trends influencing the South Korea tire market. As online shopping becomes more prevalent, tire retailers are increasingly establishing their digital presence to reach a broader audience. This trend is impacting the South Korea tire market size, as consumers prefer the convenience of purchasing tires online, often accompanied by home delivery and installation services. The integration of technology in tire sales, including virtual fitting tools and customer reviews, enhances the buying experience, driving growth in the online tire market segment. As e-commerce continues to evolve, its influence on the tire market is expected to grow, reshaping how consumers purchase tires in South Korea.

Buy Now- https://www.imarcgroup.com/checkout?id=19184&method=3759

Market Segmentation

Analysis by Design

- Radial Market: Dominates due to superior performance, durability, and fuel efficiency; preferred for passenger cars and commercial vehicles; growth fueled by high-performance and eco-friendly tire demand and EV requirements.

- Bias Market: Niche presence for specific commercial and off-road uses emphasizing durability and cost-effectiveness; simpler construction with less ride comfort and lifespan.

Analysis by End Use

- OEM Market: Driven by automotive manufacturing and government policies; focus on quality tires meeting evolving vehicle specifications.

- Replacement Market: Fueled by growing vehicle population and aging fleet; expanded aftermarket channels and e-commerce support sales of durable and premium tires.

Analysis by Vehicle Type

- Passenger Cars: Significant share; consumers prioritize performance, comfort, and fuel efficiency; influenced by rise of electric and hybrid vehicles.

- Light Commercial Vehicles: Demand boosted by e-commerce and delivery services; focus on durability, fuel efficiency, and load capacity.

- Medium and Heavy Commercial Vehicles: Steady demand; logistics and industry sectors emphasize fuel economy and minimal maintenance.

- Two Wheelers: Moderate demand influenced by urban commuting; rising eco-friendly vehicle use increases demand.

- Three Wheelers: Minimal share; used in specific industrial and utility applications focusing on affordability and strength.

- Off-The-Road (OTR): Essential for construction, mining, and agriculture; emphasis on durability and wear resistance.

Analysis by Distribution Channel

- Offline: Dominates with trusted brands and personal consultations; includes tire shops, dealerships, and service centers.

- Online: Growing steadily with e-commerce platforms offering convenience, home delivery, and installation partnerships.

Analysis by Season

- All Season Tires: Strong presence for versatility and cost-effectiveness; suitable for urban environments.

- Winter Tires: Essential for colder regions with heavy snowfall; increasing safety awareness boosts demand.

- Summer Tires: Preferred for grip and handling in warm conditions; common among high-performance and luxury vehicle owners.

Speak To an Analyst- https://www.imarcgroup.com/request?type=report&id=19184&flag=C

Regional Insights

The Seoul Capital Area leads the South Korea tire market due to its dense population, high vehicle ownership, and advanced infrastructure. Demand spans all vehicle categories, especially passenger and electric cars, with a focus on high-performance and premium tires. Established distribution networks and increasing emphasis on smart, eco-friendly mobility solutions further strengthen this region's market dominance.

Recent Developments & News

In April 2025, LD Carbon inaugurated a tire pyrolysis plant in Dangjin with an annual capacity of 50,000 tons of tire chips, producing 20,000 tons of recovered carbon black and 24,000 tons of pyrolysis oil, supporting sustainable tire manufacturing. In January 2025, Hankook Tire became the exclusive supplier of rally tires for WRC1, WRC2, and WRC3 categories in the 2025 FIA World Rally Championship season, with its Ventus, Dynapro, and Winter tire lines. In October 2024, Hankook Tire commenced mass production of tires with ISCC PLUS-certified carbon black derived from recycled end-of-life tires, aiming for 100% sustainable materials by 2050 to reduce carbon emissions.

Key Players

- Bridgestone Tire Sales Korea Ltd. (Bridgestone Corporation)

- Hankook Tire & Technology

- Kumho Tire Co. Inc.

- Nexen Tire Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302