Overview of the Trade Credit Insurance Market:

The trade credit insurance market involves the provision of insurance policies that protect businesses against the risk of non-payment by buyers for goods and services supplied on credit. This type of insurance is crucial for companies engaged in international trade, as it mitigates the risk of default due to insolvency, political instability, or other unforeseen circumstances. Trade credit insurance helps businesses manage their receivables more effectively, ensuring financial stability and fostering growth.

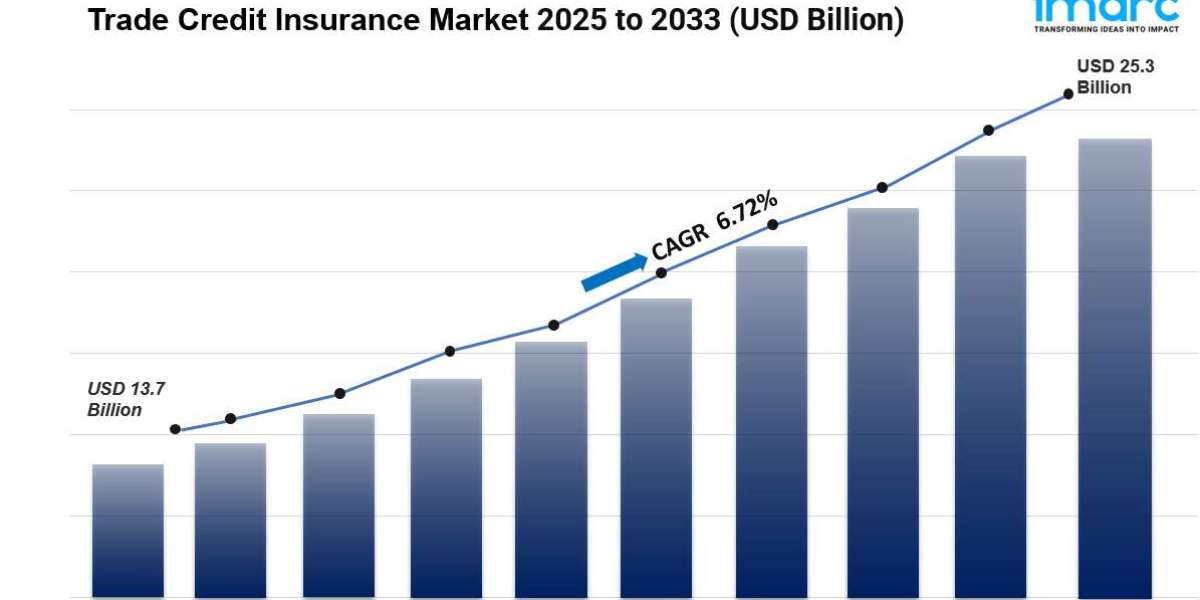

The global trade credit insurance market share reached USD 13.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/trade-credit-insurance-market/requestsample

Key Highlights:

Market Growth:

The trade credit insurance market is experiencing robust growth, driven by increasing global trade activities, rising demand for credit protection, and the need for businesses to manage risks associated with extending credit to buyers.

Key Players:

Major players in the trade credit insurance market include Euler Hermes, Atradius, Coface, Zurich Insurance Group, and AIG. These companies offer a range of products tailored to different industries and risk profiles.

Applications:

Trade credit insurance is utilized across various sectors, including:

Manufacturing: Protecting against buyer defaults in supply chains.

Wholesale and Retail: Ensuring payment for goods sold on credit.

Exporters: Safeguarding against international buyer insolvency and political risks.

Regional Insights:

Europe holds a significant share of the trade credit insurance market, owing to the high volume of international trade and established insurance frameworks. The Asia-Pacific region is expected to witness rapid growth due to increasing trade activities and economic development.

Trends in the Trade Credit Insurance Market:

Digital Transformation:

The trade credit insurance market is undergoing digital transformation, with providers leveraging technology to enhance underwriting processes, risk assessment, and claims management. Digital platforms are improving accessibility and efficiency for clients.

Increased Demand for Risk Management Solutions:

Businesses are increasingly recognizing the importance of comprehensive risk management strategies. As a result, there is a growing demand for trade credit insurance as part of broader risk mitigation plans, especially in volatile markets.

Focus on Emerging Markets:

Insurers are expanding their offerings in emerging markets, where trade credit risk is often higher due to economic instability and regulatory challenges. This trend is driven by the increasing globalization of trade and the need for businesses to enter new markets.

Customization of Policies:

There is a rising trend towards the customization of trade credit insurance policies to meet the specific needs of businesses. Insurers are providing tailored solutions based on industry, buyer profiles, and geographical risks.

Regulatory Changes and Compliance:

The trade credit insurance market is influenced by regulatory changes and compliance requirements. Insurers must adapt to evolving regulations related to credit risk assessment, data privacy, and reporting standards.

Buy Now: https://www.imarcgroup.com/checkout?id=4666&method=1670

Trade Credit Insurance Market Segmentation:

Breakup by Component:

- Product

- Services

Breakup by Coverages:

- Whole Turnover Coverage

- Single Buyer Coverage

Breakup by Enterprises Size:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Breakup by Application:

- Domestic

- International

Breakup by Industry Vertical:

- Food and Beverages

- IT and Telecom

- Metals and Mining

- Healthcare

- Energy and Utilities

- Automotive

- Others

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to high consumer spending power and a strong presence of major cosmetic brands.

Top Trade Credit Insurance Market Leaders:

The trade credit insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- American International Group Inc.

- Aon plc

- Axa S.A.

- China Export & Credit Insurance Corporation, Chubb Limited (ACE Limited)

- Coface

- Euler Hermes (Allianz SE)

- Export Development Canada

- Nexus Underwriting Management Ltd.

- QBE Insurance Group Limited

- Willis Towers Watson Public Limited Company and Zurich Insurance Group Ltd.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=4666&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145