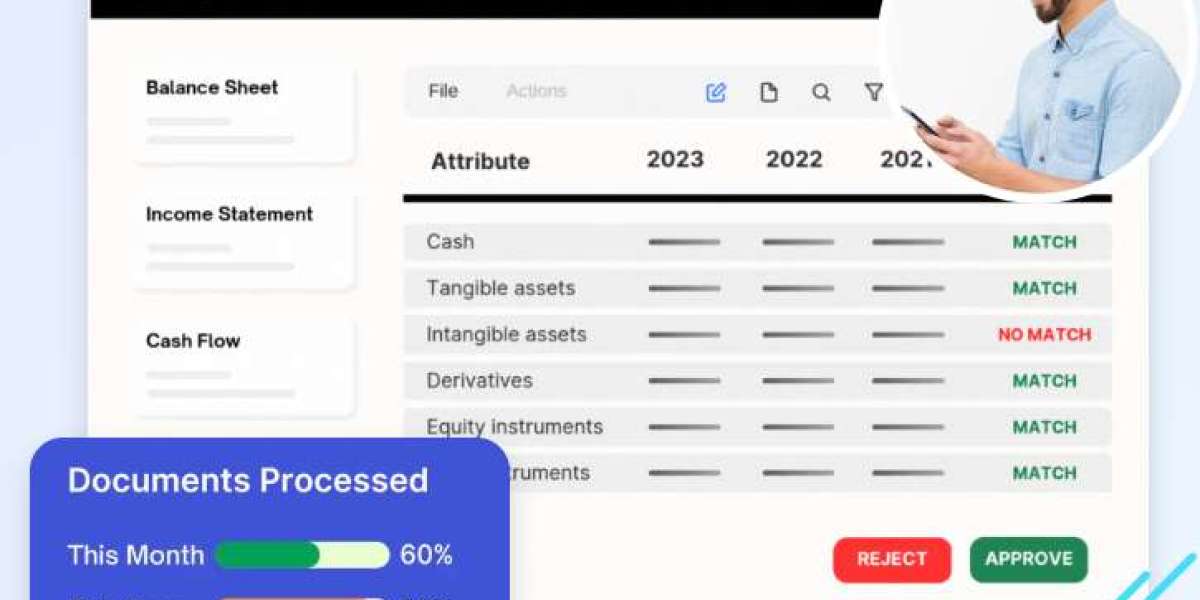

Financial spreading automation revolutionizes how organizations analyze financial statements by eliminating manual data entry and reducing human error. This technology automatically extracts, organizes, and standardizes data from balance sheets, income statements, and cash flow reports, accelerating credit analysis and risk assessment. With financial spreading automation, banks and financial institutions can handle large volumes of data quickly, ensuring consistent and accurate evaluations. It enhances productivity, shortens turnaround times, and provides real-time insights for better decision-making. Additionally, automation improves compliance and audit readiness by maintaining detailed data trails. Adopting financial spreading automation empowers analysts to focus more on strategic analysis and less on routine data processing, ultimately leading to smarter, faster, and more reliable financial decisions.

kelly walker

9 مدونة المشاركات