South Korea Data Center Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Data Center Market Overview

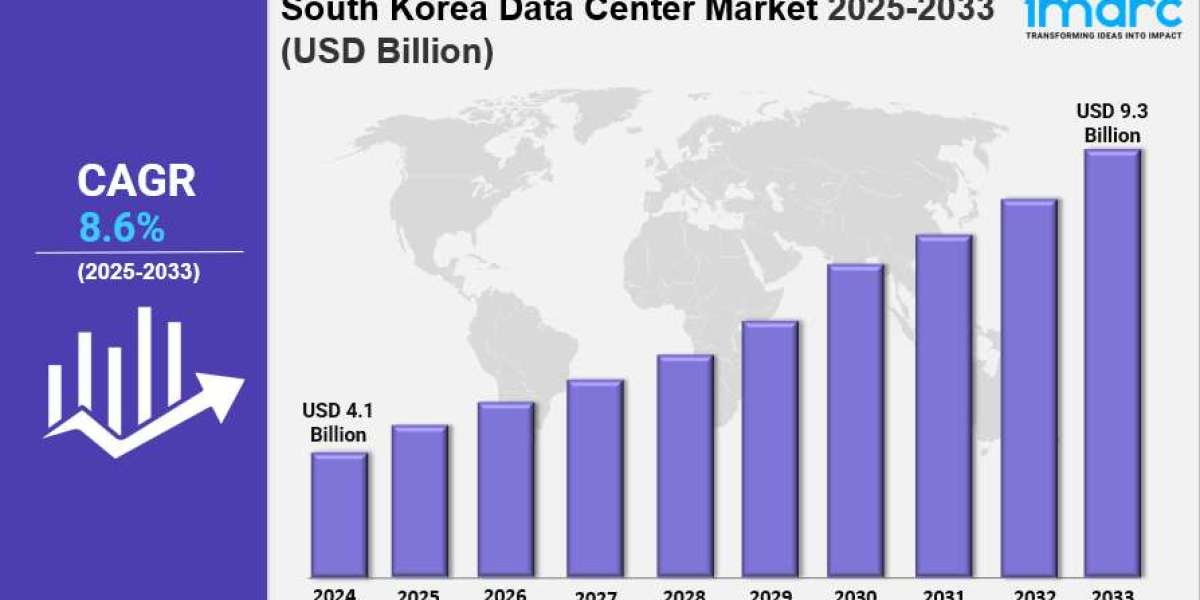

The South Korea data center market size reached USD 4.1 Billion in 2025. It is projected to reach USD 9.3 Billion by 2034, growing at a CAGR of 8.6% during the forecast period of 2026-2034. This growth is driven primarily by increasing demand for cloud computing services across the country, alongside expanding telecommunications infrastructure and government and private enterprise initiatives.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Data Center Market Key Takeaways

- Current Market Size: USD 4.1 Billion in 2025

- CAGR: 8.6% (2026-2034)

- Forecast Period: 2026-2034

- The rising number of smart cities is propelling the market.

- Transformation initiatives by government entities and private enterprises act as significant growth drivers.

- The expanding telecommunications infrastructure, characterized by high-speed internet connectivity, is augmenting the market.

- The Seoul Capital Area shows increased market activity due to conducive environments for data center investments.

- Increasing adoption of energy-efficient and eco-friendly designs is bolstering growth in Yeongnam and Honam regions.

Sample Request Link: https://www.imarcgroup.com/south-korea-data-center-market/requestsample

Trends in the South Korea Data Center Market

Increasing Demand for Cloud Services

The South Korea data center market is experiencing a significant increase in demand for cloud services as businesses continue to transition to digital operations. This trend is primarily driven by the need for scalable infrastructure that can support varying workloads and provide flexibility in resource management. As organizations increasingly adopt cloud-based solutions, the South Korea data center market size is expanding rapidly. Major cloud service providers are investing heavily in developing and enhancing data center facilities to meet this growing demand, ensuring that they can offer reliable and efficient services to their clients.

Growth of Edge Computing

Another key trend shaping the South Korea data center market is the growth of edge computing. With the rise of the Internet of Things (IoT) and the increasing need for real-time data processing, businesses are looking to deploy edge computing solutions to enhance operational efficiency. This shift is positively impacting the South Korea data center market share, as data centers adapt to accommodate edge computing architectures. By positioning computing resources closer to data sources, companies can reduce latency and improve response times, making edge computing an attractive option for various industries, including manufacturing, healthcare, and smart cities.

Focus on Energy Efficiency and Sustainability

The focus on energy efficiency and sustainability is becoming increasingly important in the South Korea data center market. As environmental concerns grow, data center operators are prioritizing green initiatives and energy-efficient technologies to minimize their carbon footprint. This trend is contributing to the overall South Korea data center market growth, as businesses seek to align with sustainability goals while reducing operational costs. Implementing advanced cooling systems, utilizing renewable energy sources, and optimizing power usage effectiveness (PUE) are some of the strategies being adopted. The commitment to sustainability not only enhances operational efficiency but also attracts clients who prioritize eco-friendly solutions.

Investment in Cybersecurity Measures

Investment in cybersecurity measures is another significant trend influencing the South Korea data center market. As data centers become more interconnected and reliant on digital technologies, the risk of cyber threats increases. Companies are prioritizing the protection of their data and operational technology systems, leading to a surge in demand for advanced cybersecurity solutions. This trend is impacting the South Korea data center market size, as businesses recognize the importance of safeguarding their digital assets. By implementing robust cybersecurity protocols, manufacturers can protect themselves against potential breaches and ensure the integrity of their operations, further driving growth in the data center market.

Buy Now- https://www.imarcgroup.com/checkout?id=19824&method=1370

Market Segmentation

Breakup by Data Center Size

- Large: Typically serve major corporations and cloud service providers, offering extensive computing power and storage capabilities.

- Massive: Like large, providing substantial capacities for significant users.

- Medium: Cater to regional enterprises and service providers with moderate capacity needs.

- Mega: Establish facilities to support increasing demand for digital content and cloud services, incorporating advanced cooling and energy efficiency technologies.

- Small: Used by specific industries or local businesses, focusing on low latency and proximity with specialized services.

Breakup by Tier Type

- Tier 1 and 2: Utilized by smaller businesses or less critical applications, offering limited redundancy and lower uptime guarantees.

- Tier 3: More prevalent in South Korea, balancing reliability and cost with multiple paths for power and cooling.

- Tier 4: Highest security and reliability level with fully redundant infrastructure and fault-tolerant systems designed for zero downtime.

Breakup by Absorption

- Non-Utilized: Areas within data centers not yet leased or activated.

- Utilized:

- Colocation Type:

- Hyperscale: Serve tech giants and large-scale cloud providers, offering vast capacity and scalability.

- Retail: Target smaller enterprises seeking cost-effective and flexible solutions.

- Wholesale: Appeal to medium-sized businesses, providing a middle ground.

- End User:

- BFSI

- Cloud

- E-Commerce

- Government

- Manufacturing

- Media and Entertainment

- Telecom

- Others

Breakup by Region

- Seoul Capital Area: Leading region driven by conducive data center investment environments.

- Yeongnam (Southeastern Region): Known for energy-efficient designs, includes cities like Daegu and Busan, strategic for industrial zones.

- Honam (Southwestern Region): Growing popularity of eco-friendly practices.

- Hoseo (Central Region): Focal point for research institutions, encompassing Sejong and Daejeon.

- Others

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=19824&flag=C

Regional Insights

The Seoul Capital Area dominates the South Korea data center market due to its favorable environment for data center investments. This region benefits from advanced infrastructure and government support, making it a hub for expanding data center capacity. Additionally, the Yeongnam region (Southeastern), including Daegu and Busan, is important due to its proximity to industrial zones and adoption of energy-efficient designs, while Honam (Southwestern Region) is noted for increasing eco-friendly practices. This regional distribution supports balanced market growth across South Korea.

Recent Developments & News

In September 2024, Empyrion Digital signed a binding agreement with one of Japan’s largest diversified financial services groups to develop a 25MW AI-ready data center, enhancing the market outlook. In August 2024, South Korea Investment Real Asset Management Co. partnered with Indonesian conglomerate Sinar Mas to establish a joint venture building a hyperscale data center in Jakarta worth US$300 Million, expanding the market share. In February 2024, South Korean regulatory authorities announced plans for a 1-gigawatt data center hub near Donghae and Gangneung cities, capable of hosting up to 50 data centers with an average capacity of 20MW each.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302