Introduction

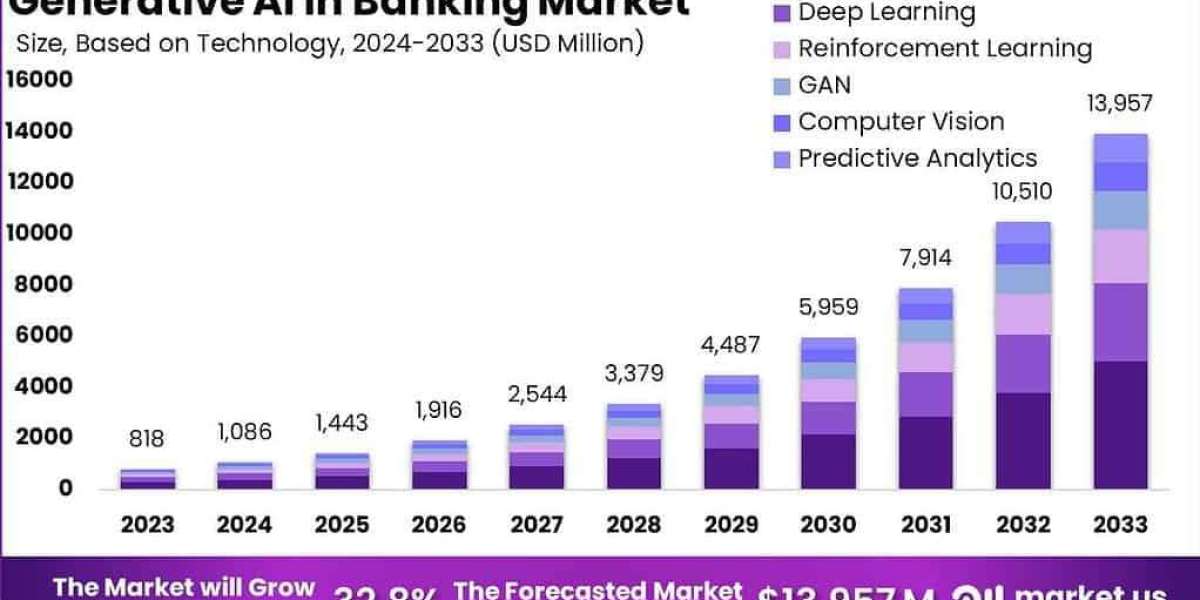

The Global Generative AI in Banking Market, valued at USD 818 million in 2023, is projected to reach USD 13,957 million by 2033, growing at a CAGR of 32.8%, driven by demands for personalized services, fraud detection, and operational efficiency. North America leads with a 38% share, fueled by advanced infrastructure and regulatory support. Generative AI technologies, including large language models and machine learning, enhance customer service, risk management, and compliance, transforming banking operations. This market’s growth underscores AI’s transformative impact on banking efficiency and customer experience.

Key Takeaways

Market growth from USD 818 million (2023) to USD 13,957 million (2033), CAGR 32.8%.

North America holds 38% share in 2023.

Large language models dominate technology with 40% share.

Retail banking leads end-users with 45% share.

Key drivers include personalization; high costs pose challenges.

Regulatory compliance and data privacy are critical restraints.

Based on Technology

In 2023, large language models (LLMs) led with a 40% share, powering chatbots and customer service automation. Machine learning supports fraud detection and risk assessment, growing steadily. Deep learning enhances predictive analytics, while generative adversarial networks (GANs) are emerging for synthetic data generation, improving compliance and testing in banking.

Based on End-User

Retail banking dominated with a 45% share in 2023, leveraging generative AI for personalized offerings and customer support. Investment banking grows fastest, using AI for market analysis and trading strategies. Corporate banking adopts AI for risk management, while wealth management uses it for tailored advisory services, driving market growth.

Market Segmentation

By Technology: Large Language Models (40% share), Machine Learning, Deep Learning, GANs.

By End-User: Retail Banking (45% share), Investment Banking, Corporate Banking, Wealth Management.

By Application: Customer Service, Fraud Detection, Risk Management, Compliance, Personalized Banking.

By Deployment: Cloud, On-Premise.

By Region: North America (38% share), Asia-Pacific, Europe, Latin America, Middle East & Africa.

Restraint

High implementation costs (USD 100,000–500,000), data privacy concerns, and regulatory complexities hinder growth. Compliance with GDPR, CCPA, and banking regulations poses challenges. Limited AI expertise and ethical concerns about AI-driven decisions limit adoption, particularly for smaller banks and in emerging markets with limited infrastructure.

SWOT Analysis

Strengths: Advanced LLMs, North America’s infrastructure, enhanced customer experience.

Weaknesses: High costs, regulatory complexities, talent scarcity.

Opportunities: Asia-Pacific growth, investment banking adoption, synthetic data advancements.

Threats: Data privacy issues, cybersecurity risks, regulatory delays. Growth relies on cost reduction and compliance solutions.

Trends and Developments

In 2023, 75% of banks adopted generative AI, driven by LLMs and machine learning. Cloud-based deployments grew 20%, enhancing scalability. Partnerships, like IBM’s 2023 collaboration with Goldman Sachs, boost AI capabilities. Asia-Pacific’s 25% CAGR reflects digital banking growth. Innovations in fraud detection and compliance drive efficiency.

Key Players Analysis

Key players include JPMorgan Chase, Goldman Sachs, IBM, AWS, and Microsoft. JPMorgan leads in customer service AI, Goldman Sachs in trading algorithms. IBM and AWS provide cloud-based AI solutions, while Microsoft excels in analytics. Strategic partnerships and R&D investments fuel market innovation.

Conclusion

The Global Generative AI in Banking Market is set for rapid growth, driven by personalization and efficiency demands. Despite cost and regulatory challenges, opportunities in Asia-Pacific and investment banking ensure progress. Key players’ innovations will redefine banking efficiency by 2033.