Introduction

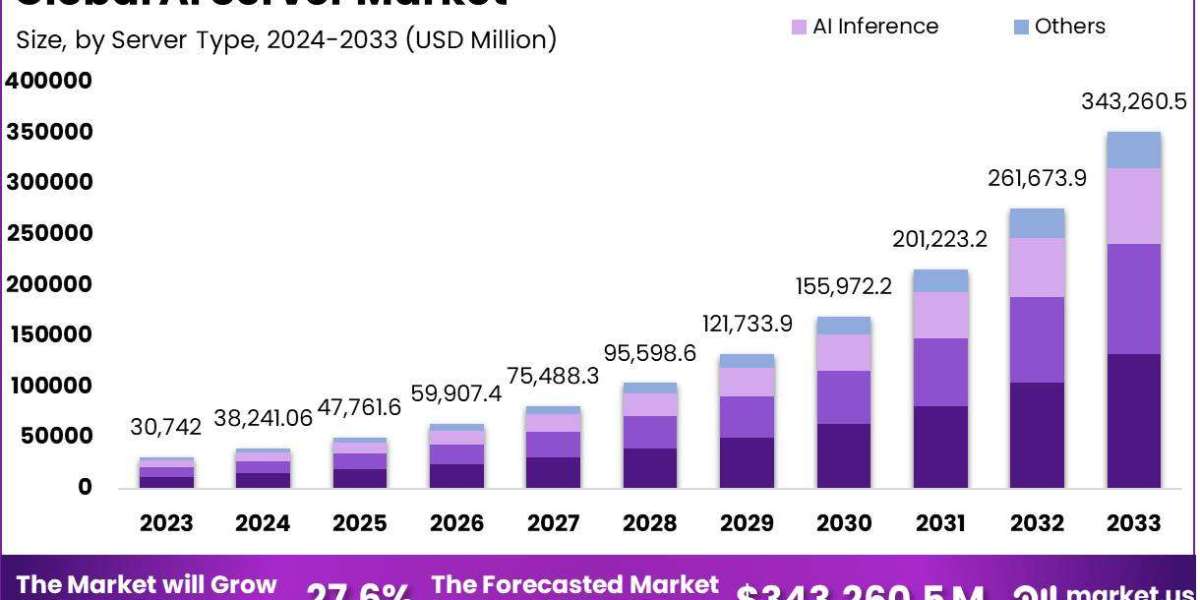

The Global AI Server Market, valued at USD 30,742.0 million in 2023, is projected to reach USD 343,260.5 million by 2033, growing at a CAGR of 27.6%, driven by surging demand for AI-driven computing, cloud adoption, and data-intensive applications. North America led with a 35.98% share, generating USD 11,060.9 million in 2023, fueled by advanced infrastructure. AI servers, powered by GPUs and specialized hardware, support machine learning, analytics, and enterprise AI solutions, transforming industries like IT, healthcare, and finance by enabling scalable, high-performance computing.

Key Takeaways

Market growth from USD 30,742.0 million (2023) to USD 343,260.5 million (2033), CAGR 27.6%.

North America holds 35.98% share, valued at USD 11,060.9 million in 2023.

GPU servers dominate with 42% share.

GPUs lead hardware with 38% share.

IT & telecom sector holds 25% share.

Key drivers include AI workloads; high costs pose challenges.

North America AI Server Market Size

In 2023, North America held a 35.98% share, valued at USD 11,060.9 million, driven by robust technological infrastructure and high cloud adoption. The U.S. leads due to its concentration of tech giants and data centers. By 2033, North America is expected to maintain leadership, growing at a CAGR of 26.5%, fueled by AI advancements in healthcare and finance.

Server Type Analysis

The market segments into GPU servers (42% share), ASIC servers, FPGA servers, and others. GPU servers dominate due to their parallel processing capabilities for AI workloads like machine learning. ASIC servers grow fastest, offering energy efficiency for specialized tasks. FPGA servers provide flexibility for custom AI applications, gaining traction in R&D.

Hardware Analysis

GPUs led hardware with a 38% share in 2023, excelling in accelerating AI computations. CPUs support general-purpose tasks, while storage systems and networking hardware grow due to data-intensive applications. Specialized chips like TPUs and NPUs gain traction for energy-efficient, high-performance AI processing in cloud and edge computing environments.

Industry Analysis

The IT & telecom sector held a 25% share in 2023, leveraging AI servers for analytics and network optimization. Healthcare grows fastest, using AI for diagnostics and research. BFSI employs AI servers for fraud detection, while retail and manufacturing use them for personalization and predictive maintenance, driving market expansion.

Market Segmentation

By Server Type: GPU Servers (42% share), ASIC Servers, FPGA Servers, Others.

By Hardware: GPUs (38% share), CPUs, Storage Systems, Networking Hardware.

By Industry: IT & Telecom (25% share), Healthcare, BFSI, Retail, Manufacturing, Others.

By Deployment: Cloud, On-Premise.

By Region: North America (35.98% share), Asia-Pacific, Europe, Latin America, Middle East & Africa.

Restraint

High implementation costs (USD 50,000–500,000 per server), energy consumption, and a shortage of skilled professionals hinder growth. Complex integration and GDPR compliance pose challenges. Scalability issues and frequent upgrade needs limit adoption, particularly for SMEs and in emerging markets with limited AI infrastructure.

SWOT Analysis

Strengths: Advanced GPU technology, North America’s infrastructure, scalability.

Weaknesses: High costs, energy demands, talent shortage.

Opportunities: Asia-Pacific growth, healthcare AI adoption, edge computing advancements.

Threats: Regulatory hurdles, cybersecurity risks, economic volatility. Growth depends on cost optimization and energy-efficient solutions.

Trends and Developments

In 2023, 65% of enterprises adopted AI servers, with cloud-based deployments growing 22%. Partnerships, like IBM’s 2023 collaboration with AWS, enhance performance. Asia-Pacific’s 28% CAGR reflects rapid digitalization. Innovations in TPUs and edge AI drive efficiency in healthcare and retail, supporting market growth.

Key Players Analysis

Key players include NVIDIA, Intel, AMD, IBM, and Dell Technologies. NVIDIA leads with a 40% share, driven by GPU dominance. Intel excels in CPUs and AI chips, AMD in high-performance computing. IBM and Dell focus on enterprise solutions, with partnerships and R&D driving innovation.

Conclusion

The Global AI Server Market is poised for rapid growth, driven by AI workloads and cloud adoption. Despite cost and energy challenges, opportunities in Asia-Pacific and healthcare ensure progress. Key players’ innovations will redefine computing efficiency by 2033.