Introduction

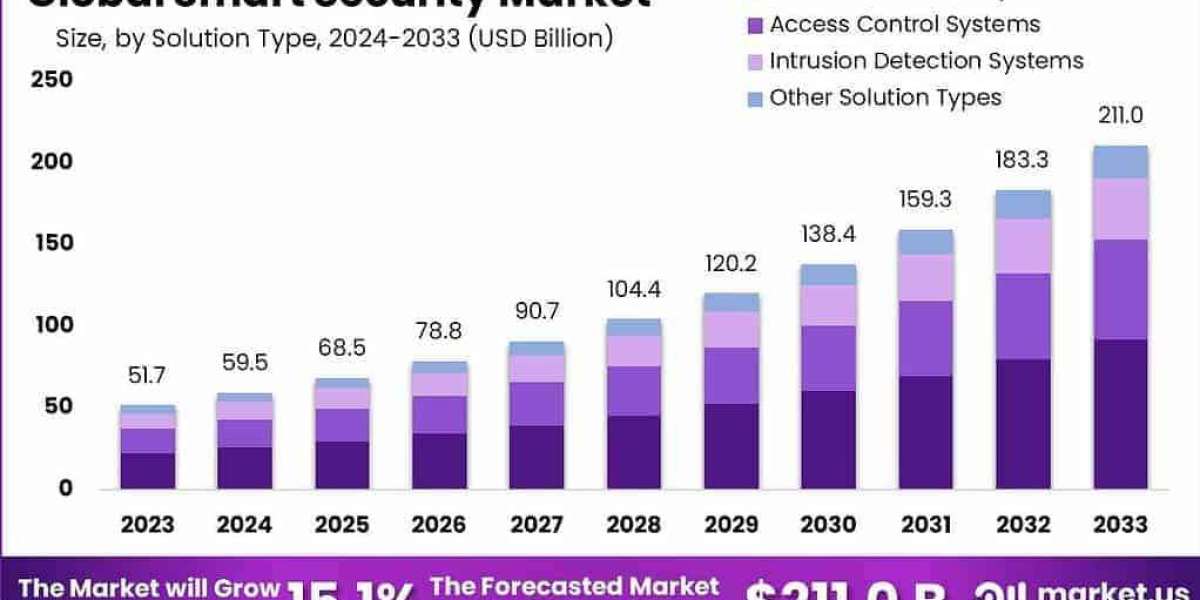

The Global Smart Security Market, valued at USD 51.7 billion in 2023, is projected to reach USD 211.0 billion by 2033, growing at a CAGR of 15.1%, driven by rising cybersecurity threats, IoT expansion, and smart city initiatives. Smart security solutions, including AI-driven surveillance and biometric systems, enhance safety across residential, commercial, and public sectors. North America leads with advanced infrastructure, while Asia-Pacific grows rapidly due to urbanization. Leveraging AI, cloud computing, and IoT, the market delivers scalable, real-time security, positioning smart security as a critical enabler of modern safety and global digital transformation.

Key Takeaways

Market growth from USD 51.7 billion (2023) to USD 211.0 billion (2033), CAGR 15.1%.

North America dominates; Asia-Pacific grows fastest at 16.5% CAGR.

Video surveillance leads solutions; AI integration drives innovation.

Commercial sector leads applications with 40% share.

Key drivers include IoT expansion and smart city projects.

Challenges include high costs and data privacy concerns.

Solution Type Analysis

The market segments into video surveillance, access control, intrusion detection, and cybersecurity solutions. Video surveillance holds a 45% share in 2023, driven by AI analytics and facial recognition. Access control, including biometrics, grows at a 16% CAGR, fueled by demand for secure entry systems. Intrusion detection systems see steady growth in residential applications. Cybersecurity solutions, leveraging cloud and AI, grow rapidly due to rising cyber threats, enabling real-time threat detection and response across industries.

Application Analysis

Applications include commercial (40% share), residential, government, and transportation. The commercial sector leads due to demand for advanced surveillance and access control in offices and retail. Residential applications grow at a 15.5% CAGR, driven by smart home security systems. Government applications focus on public safety and smart city initiatives, while transportation leverages IoT for real-time monitoring. AI and cloud-based solutions enhance scalability, with commercial and residential sectors driving rapid adoption due to security needs.

Market Segmentation

By Solution Type: Video Surveillance (45% share), Access Control (16% CAGR), Intrusion Detection, Cybersecurity.

By Application: Commercial (40% share), Residential (15.5% CAGR), Government, Transportation.

By Component: Hardware, Software, Services.

By Region: North America, Asia-Pacific (16.5% CAGR), Europe, Latin America, Middle East & Africa.

By End-User: Enterprises, Residential Users, Government Agencies.

Restraint

High implementation costs, data privacy concerns, and interoperability issues hinder growth. Enterprise smart security setups cost USD 10,000–50,000, limiting SME adoption. Data privacy regulations like GDPR raise compliance challenges. Lack of standardized protocols restricts system integration, while cybersecurity vulnerabilities in IoT devices pose risks, slowing market expansion in emerging regions.

SWOT Analysis

Strengths: AI-driven analytics, North America’s infrastructure, IoT integration.

Weaknesses: High costs, privacy concerns, interoperability issues.

Opportunities: Asia-Pacific urbanization, smart city growth, AI advancements.

Threats: Cybersecurity risks, regulatory hurdles, economic volatility. Growth depends on cost reduction and enhanced data protection.

Trends and Developments

Smart security grows with AI and IoT adoption, with 60% of systems using AI analytics in 2023. Cloud-based security solutions rose 20% in adoption. Partnerships, like Axis Communications’ 2023 collaboration with NVIDIA, enhance AI surveillance. Asia-Pacific’s 16.5% CAGR reflects smart city initiatives in China and India. 5G and edge computing improve real-time monitoring, driving adoption in commercial and residential sectors.

Key Players Analysis

Key players include Hikvision, Dahua Technology, Axis Communications, Cisco, and Honeywell. Hikvision leads with a 25% share, driven by AI surveillance. Cisco dominates cybersecurity solutions, while Axis Communications excels in IP cameras. Honeywell integrates IoT for access control. Partnerships, like Cisco’s 2023 AI collaboration, enhance competitiveness.

Conclusion

The Global Smart Security Market is poised for robust growth, driven by AI, IoT, and smart city initiatives. Despite high costs and privacy challenges, opportunities in Asia-Pacific and AI advancements promise a secure future. Key players’ innovations will redefine safety by 2033.