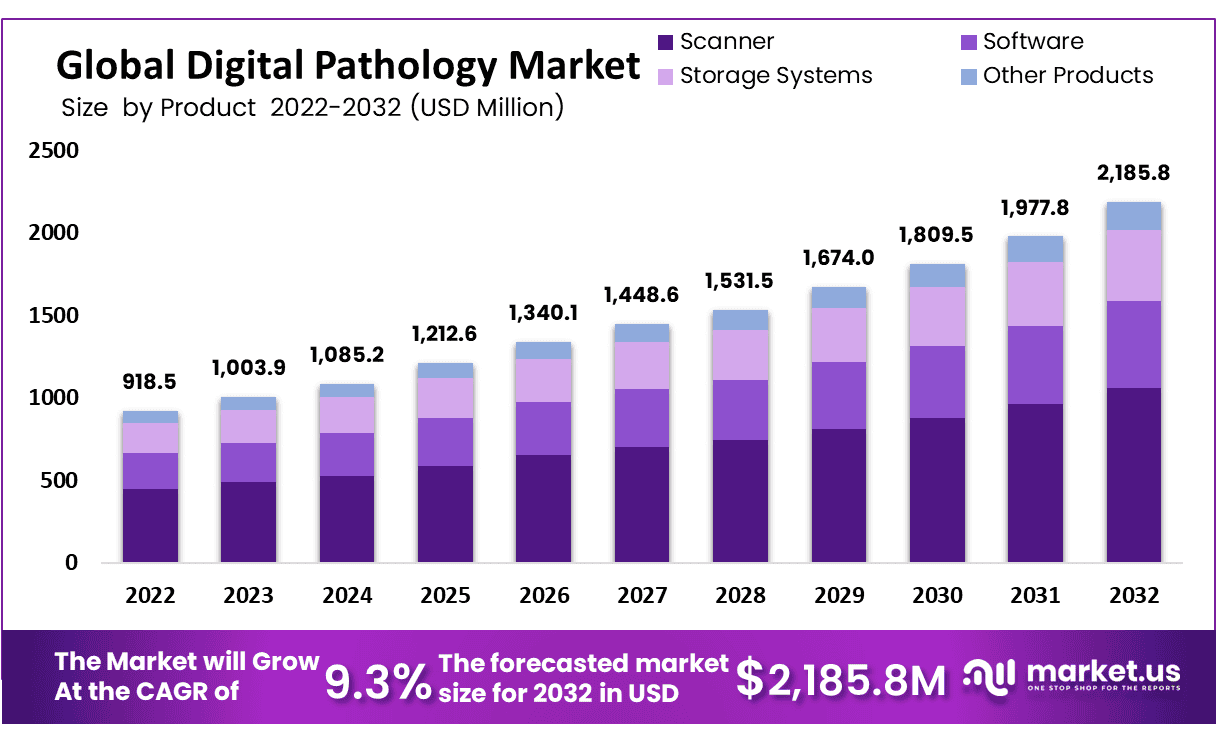

Digital Pathology Market size is expected to be worth around USD 2185.8 Million by 2032 from USD 918.5 Million in 2022, growing at a CAGR of 9.3% during the forecast period from 2023 to 2032.

In 2025, the Digital Pathology Market is staking its position as a frontline diagnostic powerhouse, currently valued at approximately USD 9.1 billion and anticipated to reach USD 31.3 billion by 2035, driven by a projected 13% CAGR . The rise in chronic diseases like cancer and soaring biopsy volumes is pushing labs to adopt whole-slide imaging and AI-powered analysis tools. Industry leaders—including Roche, Philips, and Proscia—are pioneering FDA-cleared AI tools for tumor subtyping and biomarker quantification . Cloud-based platforms now enable telepathology and remote consultations, empowering pathologists to collaborate globally. Additionally, deployment of mixed-reality tools like PathVis in teaching hospitals is boosting efficiency and reducing fatigue .

Though barriers in cost and data infrastructure persist, government funding and public–private collaborations are accelerating adoption, especially across North America and Europe. As diagnostic expectations rise, digital pathology is evolving from a niche tool to a comprehensive, precision-driven standard, ensuring scalable, accurate, and collaborative tissue analysis.

Click here for more information: https://market.us/report/digital-pathology-market/

Key Takeaways

- In 2022, industry analysts valued the global digital pathology market at approximately USD 918.5 million, reflecting a growing reliance on digital diagnostic tools.

- Experts predict the market will expand at a CAGR of 9.3% from 2023 to 2032, driven by healthcare digitization and research needs.

- The rising global cancer burden and increasing use of digital pathology in drug development are considered key accelerators of market growth.

- Adoption of cost-efficient scanners by smaller, private pathology labs has significantly boosted the market's growth potential in recent years.

- Technological advances in digital imaging and aging demographics worldwide are further fueling demand for digital pathology systems.

- Scanners led the market in 2022 and are forecasted to remain the top-performing product segment throughout the upcoming forecast period.

- Disease-focused software solutions are expected to experience steady growth as pathology labs seek more accurate and automated diagnostic tools.

- Hospitals and clinics dominate the end-user segment, driven by the need for quick, accurate diagnostic capabilities in high-patient-load environments.

- Integration with AI, drug research applications, and broader interoperability with healthcare IT systems are emerging as major market opportunities.

- North America captured 42% of global digital pathology revenue in 2022, while Asia Pacific is projected to grow at the fastest CAGR through 2032.

Key Market Segments

Based on Product

- Scanner

- Brightfield

- Other Scanners

- Software

- Integrated Software

- Standalone Software

- Storage Systems

- Other Products

- Scanner

Based on Application

- Drug Discovery

- Disease Diagnosis

- Training & Education

- Other Applications

Based on End-User

- Hospitals & Clinics

- Clinical Laboratories

- Pharma & Biotech Companies

- Other End-Users

Emerging Trends

- AI-enabled tumor classification and biomarker quantification at scale.

- Telepathology enabling remote and expert consultations.

- Mixed-reality slide review tools improving workflow and reducing fatigue.

- FDA-cleared AI apps accelerating clinical confidence and adoption.

Use Cases

- Roche AI toolkit supports NSCLC subtype identification in pathology labs.

- Community hospitals connect via telepathology to experts for breast biopsy readings.

- Academic centers implement PathVis for immersive slide review training.

- Proscia’s Concentriq AP-Dx automates complex stain quantification in clinical trials.