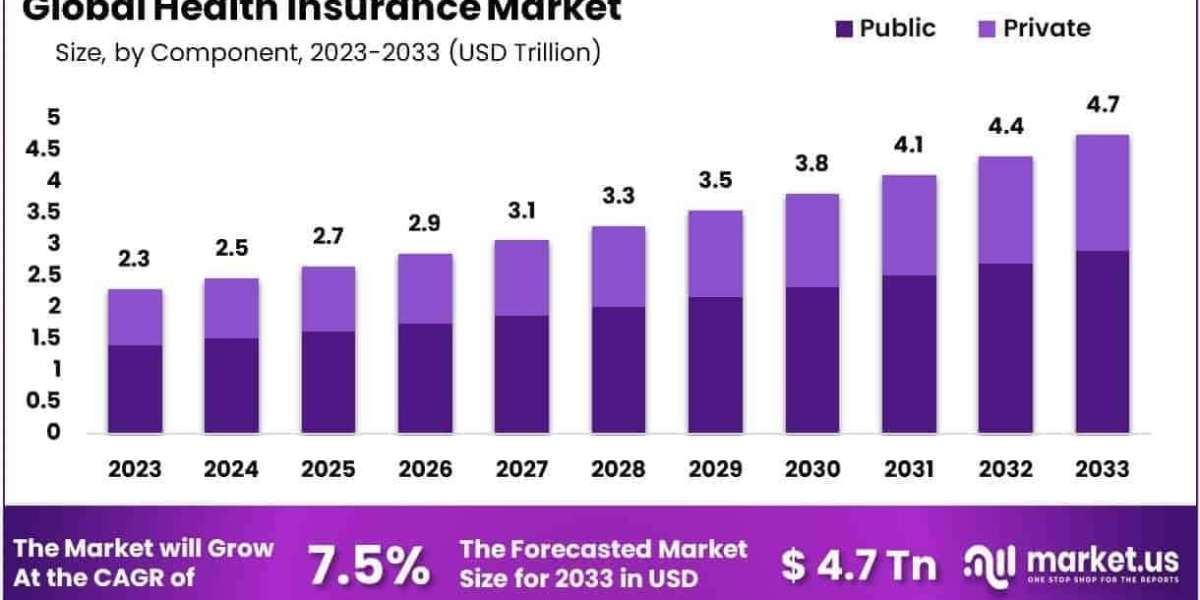

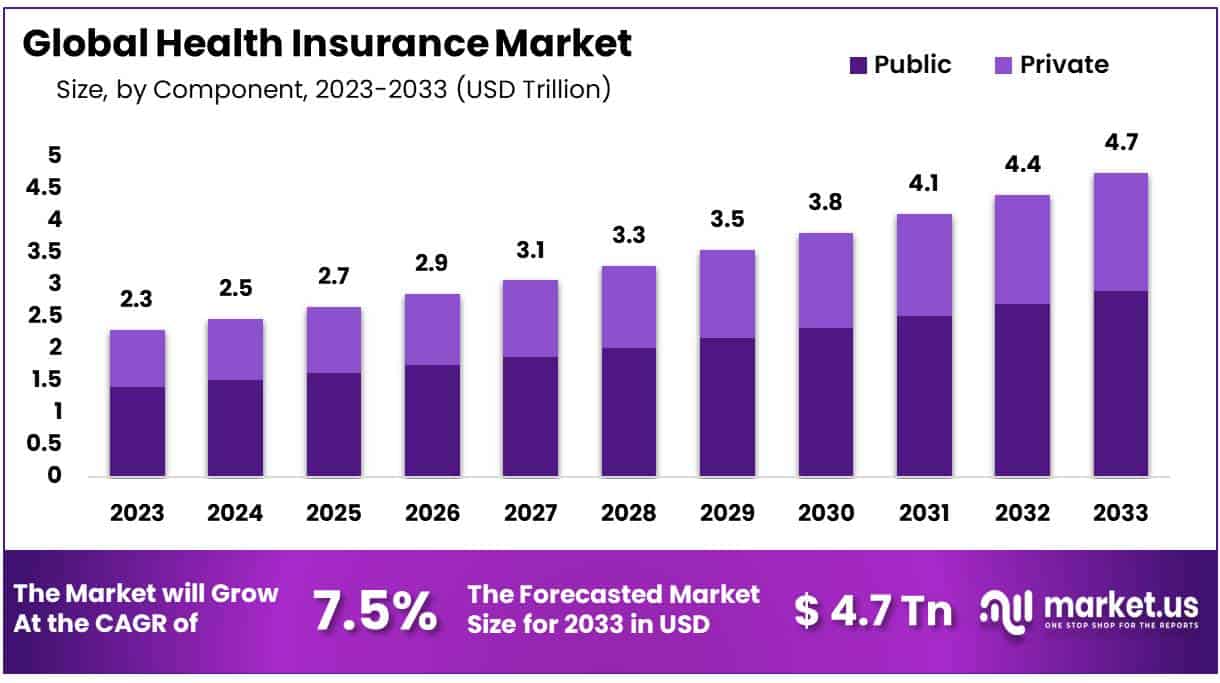

The global Health Insurance Market was valued at the USD 2.3 Trillion in 2023, and is further projected to register substantial growth of the USD 4.7 Trillion by 2033, with a 7.5% CAGR.

In 2025, the Health Insurance Market is placing stronger focus on equity, affordability, and underserved population access. Insurers are designing simplified plans with fewer exclusions and transparent pricing models to attract low-income or rural populations. Government-subsidized digital health exchanges are thriving, especially in emerging markets. Many private insurers are launching inclusive microinsurance packages priced for daily-wage earners and gig economy workers. AI tools are also helping close coverage gaps—matching users with affordable plans based on household income, location, and chronic conditions.

These shifts reflect a broader rethinking of the insurance industry’s role—not just as a payer, but as a facilitator of access to essential care. As technology scales and partnerships expand, the industry is making health insurance a more inclusive, accessible tool for population-wide well-being.

Click here for more information: https://market.us/report/health-insurance-market/

Key Takeaways

- Based on provider type, the market is dominated by public provider type segment.

- Based on demographic types, senior citizens dominated the global health insurance market in 2023.

- Based on coverage type, a laudable market shares of 75.9% is withheld by life term insurance segment.

- Based on level of coverage type, silver segment overshadows the market occupying a valuable market share of 69.5%.

- Based on health insurance plan, preferred provider organization marks its presence as a major leader.

- Based on end use, individual segment occupied an impressive market portion of 59.4% in the year 2023.

Key Market Segments

By Provider Type

- Public

- Private

By Demographic type

- Minor

- Adult

- Senior

By Coverage type

- Life insurance

- Term insurance

By Level of Coverage type

- Bronze

- Silver

- Gold

- Platinum

By Health insurance plan

- Point of service

- Preferred provider organization

- Exclusive provider organization

- Health maintenance organization

By End User

- Individuals

- Corporate

- Adults

Emerging Trends

- Growth in microinsurance plans for gig workers and daily laborers.

- Government-backed exchanges expanding in developing countries.

- AI-driven coverage-matching tools for affordability.

- Community-based insurance models supported by local health networks.

Use Cases

- A gig worker signs up for a low-cost accident coverage plan via SMS.

- A rural clinic enrolls patients in government-linked microinsurance.

- AI recommends a child-focused policy for low-income families.

- Community health workers assist locals in navigating digital exchanges.