The recovered carbon black market is gaining rapid momentum across the global industrial landscape as sustainability, circular economy practices, and cost-efficient alternatives continue to transform traditional manufacturing processes. Recovered carbon black, often abbreviated as rCB, is derived from the pyrolysis process of end-of-life tyres and rubber waste, enabling industries to reduce environmental impact while maintaining material performance comparable to virgin carbon black. The market is driven by the rising emphasis on waste tyre management, stringent government regulations related to landfill and incineration, and the growing inclination towards eco-friendly raw materials in rubber, plastics, coatings, and ink industries.

Recovered carbon black holds a crucial role in the tyre and non-tyre rubber product segments due to its reinforcing properties and cost advantages. The global tyre manufacturing sector remains the largest consumer of carbon black, and with leading tyre companies introducing sustainability goals to incorporate recycled materials, the demand for rCB is accelerating. The recovered carbon black market is further benefiting from increased investment in pyrolysis plants and technological advancements to improve rCB purity, consistency, and surface area properties to meet the quality standards of virgin carbon black grades. This technological evolution is bridging the gap between traditional carbon black and recovered carbon black, enabling seamless integration into existing production lines.

In terms of production, pyrolysis technology plays a central role in the recovered carbon black supply chain. Pyrolysis breaks down waste tyres at high temperatures in an oxygen-free environment to produce tyre-derived oil, steel, gas, and carbon black char, which is then refined to produce rCB. The quality of recovered carbon black largely depends on feedstock quality, reactor design, operational efficiency, and post-treatment processes. Advanced post-treatment technologies such as milling, granulation, and pelletisation are increasingly adopted by rCB manufacturers to enhance the dispersion, purity, and performance attributes required by end-users in rubber compounds and other industrial applications.

The market is witnessing significant expansion across regions such as Europe, North America, and Asia Pacific. Europe holds a prominent position owing to its strict environmental regulations and circular economy directives promoting tyre recycling and waste-to-resource technologies. In countries like Germany, the Netherlands, and France, recovered carbon black is becoming an integral part of the sustainable raw material portfolio for tyre, automotive, and plastics manufacturers. North America is also experiencing strong growth driven by increasing sustainability initiatives among tyre producers, along with the presence of established pyrolysis technology providers focusing on capacity expansions to meet the surging demand. Meanwhile, the Asia Pacific region, led by China and India, is expected to showcase remarkable growth prospects due to the sheer volume of waste tyres generated, emerging recycling infrastructure, and cost competitiveness of recovered carbon black for domestic rubber and plastics manufacturers.

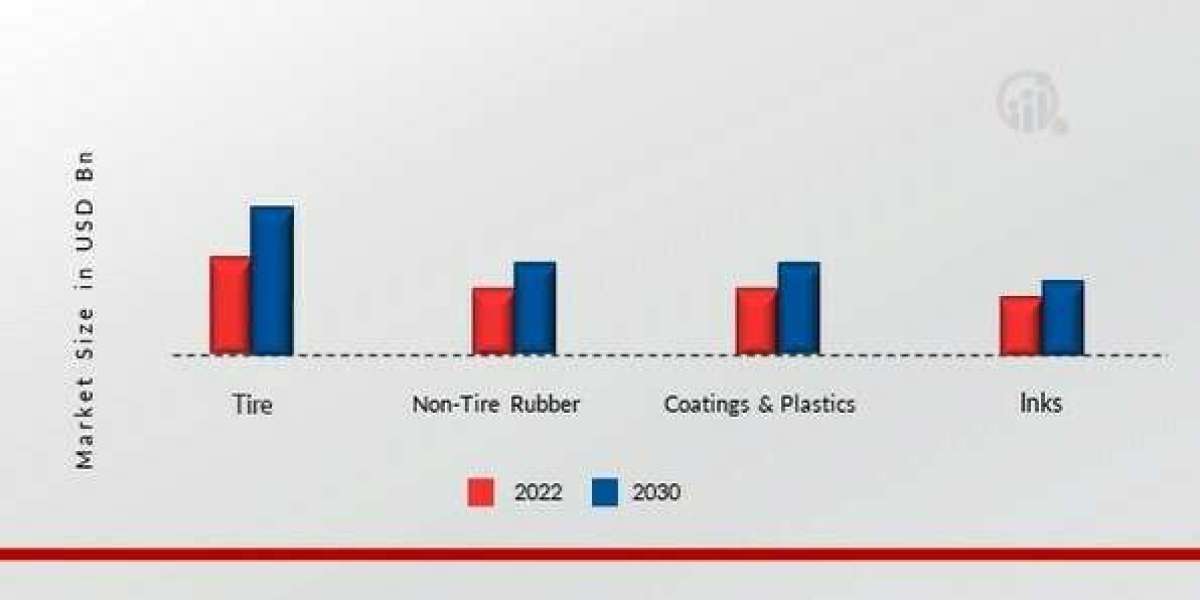

Recovered carbon black is widely used in tyre tread, sidewalls, inner liners, industrial rubber products, hoses, belts, plastic masterbatches, and even in pigment applications for inks and coatings. Its usage in these applications not only provides environmental benefits by reducing reliance on virgin fossil-based carbon black but also delivers significant cost savings to manufacturers, particularly in price-sensitive markets. Leading companies in the recovered carbon black market are focusing on strategic partnerships with tyre manufacturers, investing in research and development for quality enhancement, and scaling up production capacities to achieve economies of scale.

The competitive landscape of the recovered carbon black market is shaped by numerous emerging players and established pyrolysis technology companies that are expanding their footprint through acquisitions, mergers, and joint ventures. Many companies are actively exploring vertical integration models to control feedstock supply, optimize operations, and ensure a steady supply of high-quality rCB to their customers. Furthermore, sustainability certifications, end-user audits, and long-term supply agreements are becoming increasingly common as manufacturers seek to align their procurement strategies with their environmental, social, and governance (ESG) goals.

The market dynamics are also influenced by the global transition towards electric vehicles and renewable energy, where sustainability of raw materials is prioritised across the value chain. As tyre manufacturers innovate to produce tyres with reduced rolling resistance and enhanced fuel efficiency, recovered carbon black is being positioned as a viable reinforcement agent in tyre formulations to reduce the environmental footprint of the product. Additionally, recovered carbon black producers are expanding their portfolios by introducing customised grades with specific surface area, structure, and particle size distribution to cater to specialised applications in plastics and coatings.