I’ve spent years working with payment operations teams, and one pattern always emerges: by the time a chargeback hits your merchant account, you’ve already lost. Not just the transaction amount, but also the product, shipping costs, and a $25–$100 chargeback fee. The damage compounds when you factor in dispute ratios that can trigger monitoring programs like the Visa Acquirer Monitoring Program.

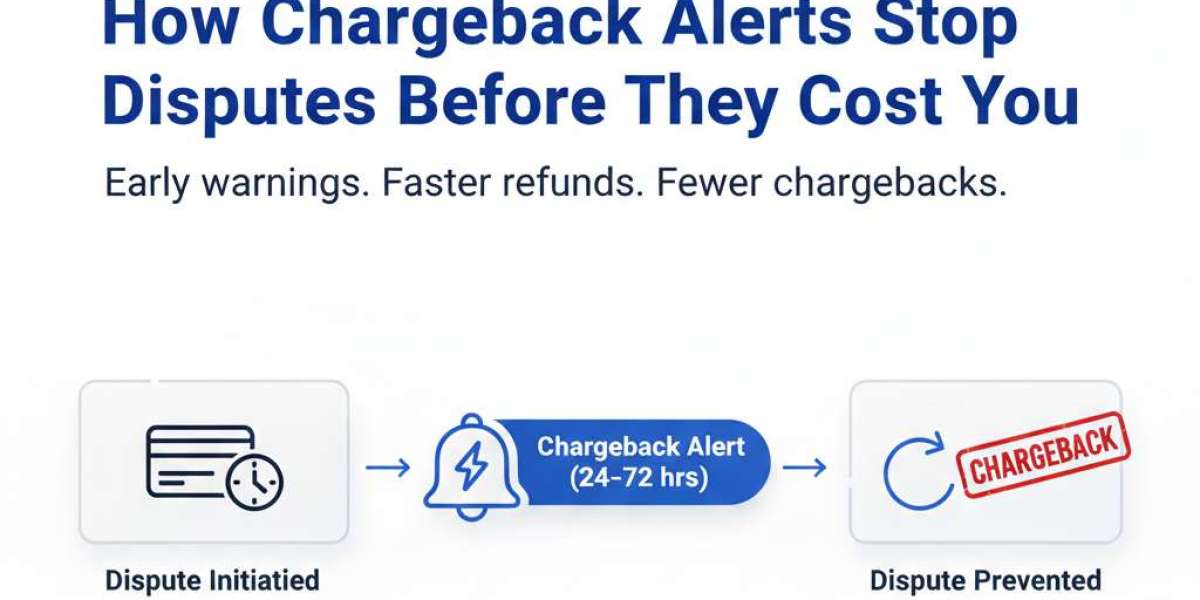

Chargeback alerts changed how we approach dispute prevention. Instead of reacting to chargebacks after they’re filed, these systems notify merchants the moment a customer initiates a dispute with their bank, giving you 24–72 hours to issue a refund and prevent the chargeback from ever appearing on your record.

Here’s what I’ve learned about making them work.

What Exactly Is a Chargeback Alert?

A chargeback alert is a real-time notification sent to merchants when a cardholder disputes a transaction with their issuing bank, before that dispute becomes an official chargeback. The alert gives you a short window, typically 24 to 72 hours, to refund the transaction voluntarily and stop the chargeback from being filed.

Think of it as an early warning system. The customer contacts their bank. The bank signals the dispute through a network like Verifi’s CDRN or Ethoca. You receive the alert, review the transaction, and decide whether to refund immediately or let it proceed to a formal chargeback.

The key advantage: refunding through an alert doesn’t count toward your chargeback ratio. It’s classified as a merchant-initiated refund, not a dispute.

How Do Chargeback Alert Networks Like CDRN and Ethoca Actually Work?

Chargeback alerts operate through two primary networks: Verifi’s Cardholder Dispute Resolution Network (CDRN) and Ethoca Alerts (now owned by Mastercard). Both serve the same core function but operate on different card networks.

When a cardholder files a dispute, the issuing bank checks whether the merchant is enrolled in an alert program. If enrolled, the bank sends a notification to the network (CDRN or Ethoca), which then routes the alert to the merchant, usually through a payment processor or chargeback management platform.

You receive transaction details: order ID, amount, cardholder name, dispute reason. You have a decision window to refund or decline. If you refund within the timeframe, the dispute is resolved. The chargeback never posts to your account.

Merchants using Visa’s Rapid Dispute Resolution can reduce chargebacks significantly (e.g., up to 70%), according to industry analyses, depending on rules and transaction volume.

What’s the Difference Between Visa RDR and Traditional Chargeback Alerts?

Visa Rapid Dispute Resolution (Visa RDR) is Visa’s proprietary alert system, but it works differently than CDRN or Ethoca. Instead of sending individual alerts for merchant review, Visa RDR uses pre-configured rules to automatically refund transactions that match specific criteria you define.

For example, you might set a rule: “Auto-refund all disputes under $50 from US cardholders.” When a dispute matching that rule comes in, Visa processes the refund automatically without manual intervention.

Traditional chargeback alerts (CDRN/Ethoca) send notifications you must respond to individually. RDR automates the decision based on your ruleset. I’ve seen ecommerce companies use RDR to handle low-value disputes while manually reviewing high-ticket alerts through CDRN.

Running a high-volume payment operation? Contact us to optimize your chargeback alert strategy and reduce dispute ratios by up to 50%.

Why Do Chargeback Alerts Matter for Your Dispute Ratio?

Your chargeback-to-transaction ratio determines whether you land in card network monitoring programs like Visa’s VAMP, Mastercard’s ECMP, or high-risk merchant territory. These programs impose fines, require remediation plans, and can lead to account termination if ratios exceed thresholds.

Here’s the critical point: chargeback alerts don’t count toward your ratio. When you refund a transaction via an alert, it’s recorded as a merchant refund, not a chargeback. The dispute was never officially filed.

This is especially important if you’re operating near the 0.9% threshold for monitoring programs. According to a 2024 report by the Merchant Risk Council, chargeback alert systems can significantly lower dispute ratios — for instance, some merchant analyses report reductions up to 40% — helping avoid penalties and account risks.”

Which Chargeback Prevention Tools Should You Actually Use?

Not all merchants need the same alert setup. I’ve worked with subscription businesses, digital goods sellers, and physical product retailers. Each requires different coverage.

For Visa transactions: Enroll in Visa RDR. It covers the majority of US card volume and offers the fastest resolution times. Configure rules based on transaction amount, dispute reason code, and customer geography.

For Mastercard transactions: Use Ethoca Alerts. Mastercard owns Ethoca, and coverage is extensive across issuing banks globally.

For comprehensive coverage: Combine CDRN (which covers multiple card networks) with RDR for Visa. Many chargeback management platforms bundle both.

Integration matters. Alerts are most effective when integrated with your payment retry strategies and order management system. I also recommend pairing alerts with 3D Secure authentication for high-risk transactions. Authentication prevents disputes from starting; alerts catch the ones that slip through.

What Happens When You Receive a Chargeback Alert?

When an alert arrives, you have 24–72 hours to act. Here’s the decision framework I use:

Review the transaction. Pull order details, shipping status, communication history. Check for signs of legitimate confusion (wrong item shipped, subscription cancellation not processed) versus clear fraud.

Evaluate refund cost versus chargeback cost. If the transaction is $50, the product shipped, and the dispute reason is “product not received” but tracking shows delivery, you might fight it. If it’s $30 and the dispute reason is ambiguous, refund immediately.

Refund or decline through your platform. Most alert systems integrate with Shopify, WooCommerce, or custom payment stacks. You click “refund,” the system processes it, and the dispute closes.

According to research from Javelin Strategy & Research, Merchants using chargeback prevention alerts (24–72 hour windows via Ethoca/Verifi) can prevent 30–40% of disputes from becoming chargebacks by responding quickly.

How Do You Know If Chargeback Alerts Are Working?

Track three metrics:

Alert coverage rate: What percentage of your chargebacks are preceded by alerts? If you’re only getting alerts on 40% of disputes, you’re missing coverage on certain issuers or card types.

Prevention rate: Of the alerts you receive, how many do you successfully prevent? If you’re refunding 90% but your chargeback ratio hasn’t dropped, investigate where disputes are bypassing alerts.

Cost per prevented chargeback: Divide total alert fees by total chargebacks prevented. If you’re paying $3,000 in alert fees to prevent $15,000 in chargeback costs, that’s a 5x return.

I also compare dispute trends month-over-month using profitability analysis frameworks. A sudden spike in “fraud” chargebacks might signal that customers are learning to bypass alerts by claiming unauthorized use.

What’s the Biggest Mistake Merchants Make with Chargeback Alerts?

Treating every alert like a chargeback, you must fight. I’ve seen merchants decline 70% of alerts because they “have evidence.” Then they spend hours on representation, lose 60% of cases, and rack up fees anyway.

Alerts aren’t about being right. They’re about being strategic. If refunding costs less than fighting, refund. If the dispute reason is subjective (“product not as described”), you’ll probably lose representation anyway.

The second mistake: enrolling in alerts without integrating them into operations. If your customer service team doesn’t know alerts exist, they’ll process chargebacks manually while alerts expire unused. Connect alerts to your CRM, order management, and payment workflows.

Not sure if your current chargeback prevention setup is optimized? Get a free dispute ratio assessment from our payment operations team.

How Do Chargeback Alerts Fit into a Broader Dispute Prevention Strategy?

Alerts are one layer. A complete strategy includes:

- Pre-authorization fraud screening (velocity checks, device fingerprinting, 3D Secure)

- Clear product descriptions and return policies (reduces “not as described” disputes)

- Proactive customer communication (shipping updates, subscription reminders)

- Chargeback alerts (catch disputes before they file)

- Representment optimization (fight winnable cases with strong evidence)

Understanding chargeback reason codes helps you identify patterns and adjust your prevention strategy accordingly.

Conclusion: Turn Chargebacks into Preventable Events

Chargeback alerts transformed dispute management from reactive damage control to proactive prevention. By receiving real-time notifications before disputes become official chargebacks, you can protect your dispute ratio, avoid monitoring program penalties, and save thousands in fees and lost merchandise.

The key is strategic implementation. Enroll in the right networks (CDRN for multi-network coverage, Visa RDR for automation, Ethoca for Mastercard). Integrate alerts with your order management and customer service systems. Build decision rules that balance refund costs against chargeback expenses. Track coverage rates, prevention rates, and ROI metrics to optimize continuously.

Remember: every alert you act on is a chargeback that never hits your account. In a payment landscape where dispute ratios can make or break your merchant status, that’s not just cost savings. It’s survival.

Ready to implement a chargeback alert system that actually works? Contact our payment optimization team for a customized strategy based on your transaction volume, dispute patterns, and business model.