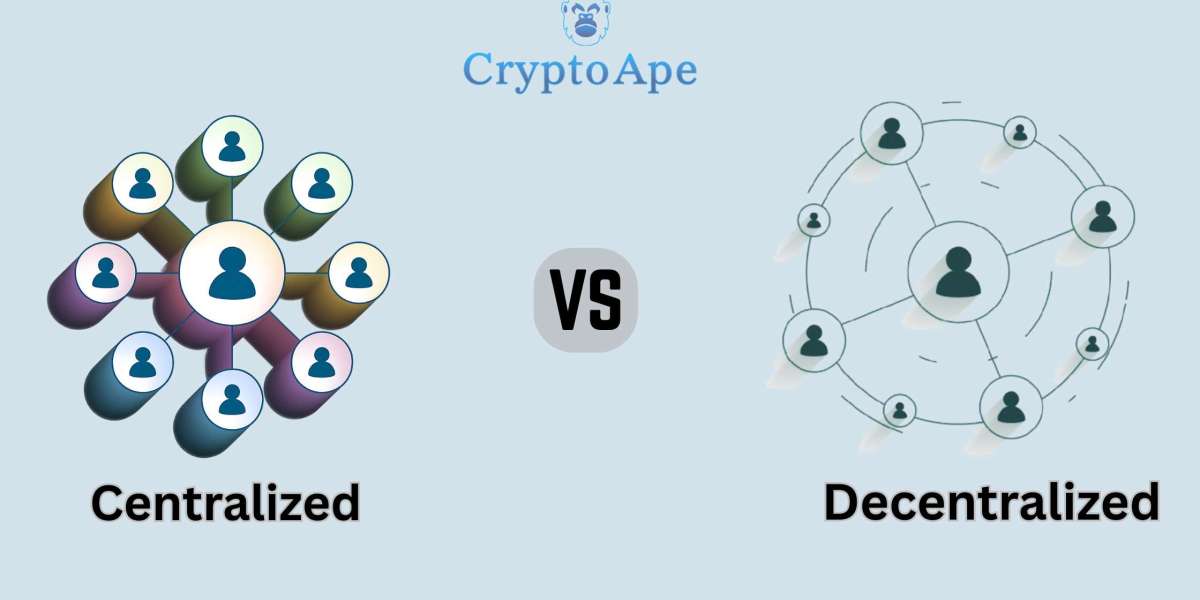

In the world of cryptocurrency exchange development, choosing between a centralized and a decentralized exchange is a major decision. Each model serves a different purpose, comes with its own strengths and challenges, and appeals to a specific audience. So, what really sets them apart?

Let’s break it down in a way that’s useful for anyone considering exchange development — from Web3 entrepreneurs to blockchain product managers.

What Is a Centralized Crypto Exchange (CEX)?

A centralized crypto exchange is a platform managed by a single organization or company that facilitates the buying, selling, and trading of digital assets.

Popular examples include Binance, Coinbase, and Kraken.

Key Features of CEXs:

Custodial services: the platform holds user funds on their behalf.

KYC/AML compliance: centralized exchanges usually require identity verification.

Fast transaction speeds with internal order matching.

Fiat integration, allowing users to deposit and withdraw in local currencies.

Example Use Case:

A Cryptocurrency Exchange Development Company might help a financial institution build a secure, fully regulated CEX that supports fiat-to-crypto trading for retail investors in India.

What Is a Decentralized Crypto Exchange (DEX)?

A decentralized exchange is a blockchain-based platform that allows peer-to-peer trading without intermediaries.

Examples include Uniswap, SushiSwap, and PancakeSwap.

Key Features of DEXs:

Non-custodial: users retain full control over their funds at all times.

Typically no KYC: offers greater privacy.

Smart contract-based transaction execution.

Uses automated market makers (AMMs) and liquidity pools instead of order books.

Example Use Case:

A Crypto Exchange Development Company might help a DAO launch a cross-chain DEX using Ethereum Layer 2 for gas efficiency, targeting privacy-focused traders.

Key Differences Between CEX and DEX

Here’s how centralized and decentralized exchanges differ across key areas:

Control

CEX: Managed by a central authority or company.

DEX: Operates via smart contracts or community governance.

Security

CEX: Vulnerable to hacks due to centralized fund storage.

DEX: Generally safer from custodial attacks but depends on smart contract security.

User Experience

CEX: User-friendly, ideal for beginners.

DEX: Requires technical knowledge and experience with crypto wallets.

Transaction Speed

CEX: Fast internal processing.

DEX: Dependent on blockchain confirmations, so slower.

Privacy

CEX: Requires user verification (KYC).

DEX: Often allows anonymous trading.

Liquidity

CEX: Typically has deeper liquidity pools.

DEX: Liquidity varies based on user-provided funds.

Fiat Integration

CEX: Supports fiat currencies.

DEX: Primarily crypto-to-crypto trading only.

Which Model Is Best for You?

If You’re Building for Retail Investors:

Choose a CEX. It's beginner-friendly and offers full compliance, fiat on-ramps, and customer support. A Cryptocurrency Exchange Development Company can help you integrate all essential features.

If You’re Building for Web3 Natives:

A DEX might be your ideal model. Partner with a team offering Cryptocurrency Exchange Development Services to launch a secure, scalable DEX with DeFi compatibility.

Benefits of Centralized Crypto Exchanges

Easy onboarding for beginners

Strong customer support systems

High liquidity for popular trading pairs

Access to fiat currencies and bank integrations

Better alignment with regulatory bodies

Practical Tip:

When selecting a Crypto Exchange Development Company, ensure they offer compliance modules, fiat gateways, and multi-device app development.

Benefits of Decentralized Crypto Exchanges

Users maintain full control of their assets

No central point of failure or custody risk

Globally accessible and censorship-resistant

Better alignment with the ethos of Web3 and DeFi

Lower barriers to entry for projects launching tokens

Practical Tip:

Smart contract security is key. Look for a Cryptocurrency Exchange Development team experienced in auditing and maintaining DeFi protocols.

Use Case Scenarios

1. Web3 Startup Launching a Token

A Web3 startup planning an IDO may prefer a DEX to offer token trading without regulatory hurdles. Tools like Uniswap forks can be deployed quickly with a Cryptocurrency Exchange Development Services provider.

2. Fintech Firm Launching a Local Exchange

A traditional fintech firm in Southeast Asia may opt for a compliant CEX with full fiat integration, wallet management, and mobile apps. In this case, collaborating with a Crypto Exchange Development Company experienced in regional licensing makes a big difference.

Conclusion

Choosing between a centralized or decentralized crypto exchange depends entirely on your goals, users, and regulatory environment.

A centralized exchange is better suited for businesses targeting mass adoption and traditional markets.

A decentralized exchange is ideal for Web3-native projects, DAO ecosystems, or privacy-driven communities.

Regardless of the path, partnering with a reliable Cryptocurrency Exchange Development Company ensures your product is not only functional and secure but also future-ready.

Make sure your chosen partner offers full-stack Cryptocurrency Exchange Development Services, including smart contract development, liquidity solutions, fiat integrations, and post-launch support.