Introduction

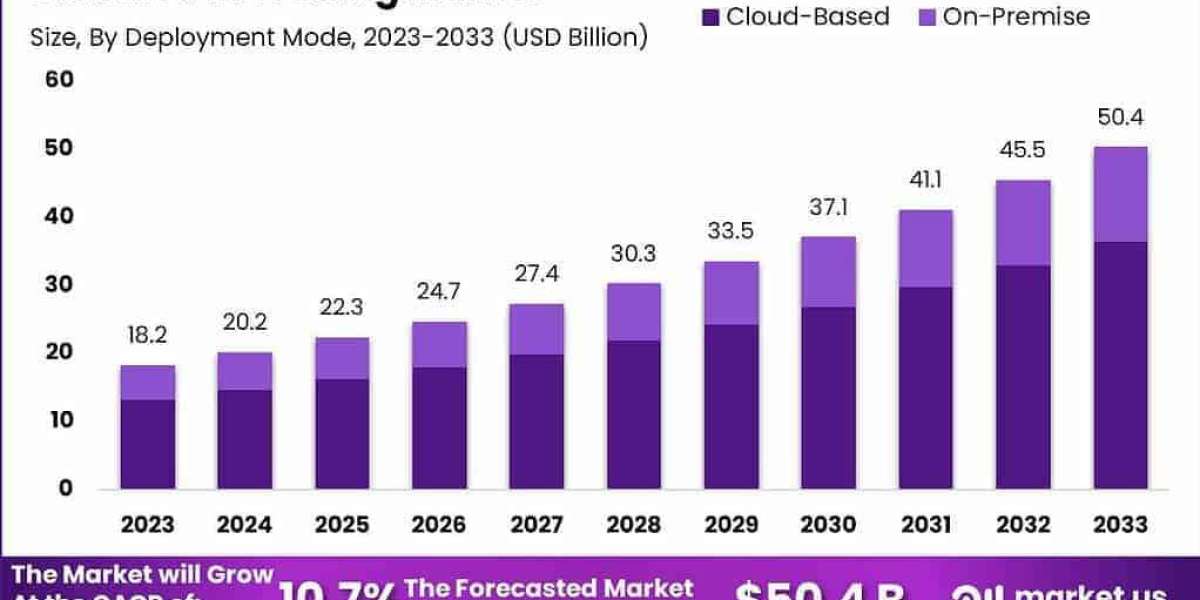

The Global AI in Trading Market is projected to grow from USD 18.2 billion in 2023 to USD 50.4 billion by 2033, with a CAGR of 10.7%. AI transforms trading by enhancing decision-making, risk management, and efficiency through predictive analytics and algorithmic trading. Driven by machine learning, big data, and demand for high-speed trading, the market serves financial institutions, hedge funds, and retail traders. AI’s ability to analyze vast datasets and optimize strategies positions it as a transformative force in trading, fostering smarter, faster, and more profitable financial markets globally.

Key Takeaways

Market Growth: USD 18.2 billion in 2023 to USD 50.4 billion by 2033, at a 10.7% CAGR.

Growth Drivers: Machine learning, big data, and high-speed trading demand.

Leading Segments: Cloud deployment and algorithmic trading dominate.

Challenges: High costs, regulatory complexities, and data security concerns.

Outlook: North America leads; Asia-Pacific grows rapidly.

Deployment Mode Analysis

Deployment modes include cloud-based and on-premises. Cloud-based deployment held a 69% share in 2023, driven by scalability, cost-efficiency, and real-time data processing. On-premises deployment, growing at a 12.8% CAGR, appeals to firms prioritizing data security and compliance. Cloud dominates for flexibility, while on-premises drives growth in regulated environments.

Application Analysis

Applications include algorithmic trading, risk management, and market analysis. Algorithmic trading held a 59% share in 2023, driven by AI’s high-speed trade execution. Risk management, growing at a 14% CAGR, enhances portfolio protection. Market analysis supports forecasting. Algorithmic trading dominates, while risk management drives growth through precision.

Market Segmentation

By Deployment Mode: Cloud-Based, On-Premises

By Application: Algorithmic Trading, Risk Management, Market Analysis, Others

By End-User: Financial Institutions, Hedge Funds, Retail Traders, Others

By Region: North America, Asia-Pacific, Europe, Latin America, Middle East & Africa

Restraints

High implementation costs and complex regulatory frameworks hinder adoption. Data security concerns, particularly with sensitive financial data, pose risks. Skill shortages in AI and trading expertise limit scalability. Addressing these requires cost-effective solutions, standardized regulations, and robust cybersecurity measures to ensure broader market adoption.

SWOT Analysis

Strengths: Enhanced decision-making, speed, and scalability in trading.

Weaknesses: High costs, regulatory hurdles, and data security risks.

Opportunities: Growing AI adoption, real-time analytics, and emerging markets.

Threats: Cybersecurity risks and regulatory uncertainties. This analysis highlights AI’s potential while addressing implementation challenges.

Trends and Developments

Trends include AI-driven algorithmic trading, predictive analytics, and blockchain integration. In 2023, Goldman Sachs invested $400 million in AI trading tools, while Two Sigma partnered for data-driven solutions. Regulatory sandboxes, like Singapore’s $90 million AI initiative, drive innovation. These trends enhance trading efficiency and transparency.

Key Player Analysis

Key players include IBM, TradeStation, QuantConnect, Citadel, and Two Sigma. IBM leads in AI analytics, TradeStation in retail trading platforms. QuantConnect excels in open-source solutions, Citadel in high-frequency trading, and Two Sigma in data-driven strategies. R&D and partnerships strengthen their market leadership.

Conclusion

The Global AI in Trading Market, growing from USD 18.2 billion in 2023 to USD 50.4 billion by 2033 at a 10.7% CAGR, transforms financial markets. Despite cost and regulatory challenges, AI drives efficiency and precision. Innovation and partnerships will ensure sustained growth.